by Conrad Meertins | Jun 24, 2024 | Uncategorized

Ever wondered how appraising a charming Victorian mansion differs from a modern suburban home? Historical properties offer unique challenges and opportunities in the appraisal process.

The allure of these properties lies in their rich history and architectural beauty, making them more than just real estate—they’re pieces of history.

This article delves into the intricacies of appraising historical properties, highlighting the unique factors that affect their value.

From understanding their historical significance to navigating regulatory hurdles, we’ll guide you through the essential aspects of this specialized field.

By mastering the art of appraising historical properties, you’ll be better equipped to preserve their legacy while ensuring accurate valuations. Join me as we uncover the fascinating world of historical property appraisals and equip yourself with the knowledge to navigate this rewarding yet challenging domain.

Understanding Historical Properties

Understanding historical properties begins with recognizing what qualifies them as historical. These properties, often at least 100 years old, possess architectural, cultural, or historical significance.

For instance, a Victorian mansion built in the 19th century may feature intricate woodwork and original stained glass, representing the craftsmanship of its era.

Historical properties are often listed on registers like the National Register of Historic Places, which not only acknowledges their significance but can also provide tax incentives for preservation.

The historical significance can elevate a property’s value, but it also demands careful maintenance and adherence to preservation standards.

Consider the Conrad-Caldwell House in Louisville, KY, an exquisite Richardsonian Romanesque mansion. It stands as a testament to meticulous preservation and historical integrity.

For appraisers, understanding these elements is crucial. It involves assessing not just the physical attributes but also the historical context, making it essential to approach these appraisals with a blend of historical knowledge and technical expertise.

Unique Factors Influencing Appraisal Values

Appraising historical properties involves unique factors that significantly influence their values. Historical significance is a primary factor, as properties associated with notable events or figures can command higher appraisals.

Imagine the birthplace of a famous author or a building pivotal in a historic event—its unique story can greatly increase its value.

Architectural integrity also plays a crucial role. Properties retaining original features like period-specific woodwork, stained glass, or original facades often appraise higher.

Take the Brennan House in Louisville, KY, for example. It’s a prime illustration of preserved Victorian architecture and original furnishings, adding significant value.

Location and context further impact value. Properties situated in well-preserved historical districts or near other landmarks tend to appraise higher. A historic home in Old Louisville, with its prestigious location and historical surroundings, is a perfect example of this.

These unique factors require appraisers to combine historical insight with market analysis to accurately determine the value of historical properties.

Challenges in Appraising Historical Properties

Appraising historical properties presents several challenges. One major hurdle is the lack of comparable properties. Unlike modern homes, historical properties are unique, making it difficult to find similar sales for accurate comparisons.

Imagine trying to find recent sales of an 18th-century Georgian mansion—it’s not easy, and this complicates value estimation.

Condition and restoration needs are also significant challenges. Historical properties often require extensive maintenance and preservation, impacting their appraised value.

The cost of restoring original features, such as hand-carved woodwork or vintage stained glass, can be substantial. Restoring the woodwork in a Victorian home, for example, can cost tens of thousands of dollars.

Regulatory and zoning issues further complicate appraisals. Properties in historical districts may face strict preservation laws limiting alterations. These restrictions can deter potential buyers, affecting market value.

Understanding these challenges is crucial for accurate appraisals, requiring appraisers to blend historical knowledge with practical considerations of maintenance and legal constraints.

Appraisal Methods for Historical Properties

Appraising historical properties necessitates specialized methods to capture their unique value. The Sales Comparison Approach involves comparing the historical property to similar ones that have recently sold, but finding adequate comparables can be challenging.

Adjustments must be made for unique historical features. For example, a Civil War-era house in Louisville might be compared with other historic homes in the area, factoring in its age, condition, and historical significance.

The Cost Approach estimates the value based on the cost to replicate the property, accounting for depreciation. This method is beneficial for properties with significant restorations.

Estimating the cost to restore a Victorian mansion in Old Louisville to its original state helps determine its value by considering both the replacement cost and depreciation.

The Income Capitalization Approach is useful for historical properties generating income, like converted bed-and-breakfasts (if zoning permits). This method assesses the property’s value based on its income potential, factoring in operating expenses and expected returns.

Understanding these appraisal methods allows for accurate valuations, ensuring historical properties are appraised with their unique characteristics in mind.

Best Practices for Realtors Working with Historical Properties

Realtors working with historical properties should follow best practices to ensure accurate appraisals and successful transactions. First, gathering comprehensive documentation is essential. This includes historical records, previous appraisals, and architectural plans. Collaborating with local historical societies can provide invaluable insights and data.

Preparing the property for appraisal involves highlighting its unique features. Ensure that original elements like period-specific woodwork or stained glass are showcased. Addressing necessary repairs while preserving historical integrity can positively impact the appraisal.

Effective communication with appraisers is crucial. Providing detailed information about the property’s historical significance and any relevant restorations can aid the appraiser’s understanding.

For example, detailing the preservation efforts of a restored Victorian home in Old Louisville helps convey its value.

Networking with preservationists and historical experts can also provide support and additional resources. By following these best practices, realtors can better navigate the complexities of historical property transactions, ensuring accurate appraisals and client satisfaction.

Conclusion

In summary, appraising historical properties requires a nuanced approach that blends historical insight with technical appraisal methods. Key factors influencing value include historical significance, architectural integrity, and location context.

These unique aspects, coupled with challenges like limited comparables, restoration needs, and regulatory constraints, make appraisals complex. Employing methods such as the Sales Comparison, Cost, and Income Capitalization approaches ensures accurate valuations.

For realtors, best practices include gathering thorough documentation, highlighting unique features, effective communication with appraisers, and collaboration with historical experts.

By mastering these practices, realtors can provide precise valuations and expert guidance, navigating the complexities of historical property appraisals.

This not only preserves the legacy of historical properties but also enhances professional credibility and client trust. Understanding and applying these principles is essential for success in appraising and selling historical properties.

by Conrad Meertins | Jun 20, 2024 | Uncategorized

Have you ever wondered how your privacy is protected during a real estate appraisal? Confidentiality isn’t just a courtesy—it’s a critical necessity in the real estate industry. Imagine the peace of mind knowing every detail about your property is handled with the utmost care and discretion. Confidentiality ensures that sensitive information remains secure, fostering a trustworthy relationship between appraisers and clients.

This article will explore why confidentiality is paramount, the standards appraisers adhere to, and how safeguarding your personal data protects your interests. Understanding these aspects will help you appreciate the professionalism behind the scenes and the importance of protecting your information for a smooth and secure real estate transaction.

Importance of Confidentiality

Confidentiality is crucial in real estate appraisals for building trust between clients and appraisers. According to the Uniform Standards of Professional Appraisal Practice (USPAP), appraisers are required to maintain confidentiality, reinforcing the importance of privacy in the appraisal process.

People often ask me if the report will be shared with the county assessor, thus causing their taxes to go up, or if it will go to the IRS. The report is prepared for the client and is only shared with those identified by the client as intended users or when required to do so by law.

For example, if an appraiser discloses a client’s financial details or property specifics without permission, it could lead to identity theft or financial fraud. A breach of confidentiality can also damage an appraiser’s reputation and result in legal consequences. Moreover, confidentiality is essential for maintaining market integrity. If confidential information is leaked, it could influence property values and distort the market.

By prioritizing confidentiality, appraisers not only comply with ethical standards but also uphold the integrity and trust necessary for fair and accurate real estate transactions.

Standards and Practices

The Uniform Standards of Professional Appraisal Practice (USPAP) outlines strict guidelines that appraisers must follow to ensure client information remains secure. These guidelines mandate that appraisers keep all information about the property, the client, and the appraisal itself confidential, unless legally obligated to disclose it.

Fortunately, major technology providers like Microsoft and Google incorporate robust security features into their products to help maintain confidentiality. For instance, Microsoft 365 offers built-in security measures, and Gmail uses technology to keep your emails secure. Even WhatsApp now has encrypted communication to protect your messages. In this world of data breaches, it’s reassuring to know that the big players are taking serious measures. However, it is still important to use good judgment and be careful when using these tools.

Appraisers can also use password management tools like LastPass to create and store complex passwords securely. This minimizes the risk of unauthorized access to sensitive information.

By adhering to these standards and using these tools, appraisers demonstrate their commitment to ethical practices and protect the integrity of the real estate market.

Breach of Confidentiality

A breach of confidentiality in real estate appraisals can have significant repercussions. When an appraiser fails to protect sensitive information, it can lead to severe legal, financial, and reputational damage. For example, if an appraiser discloses a client’s financial status or property details without consent, it could result in identity theft or financial fraud. Such breaches can undermine client trust and the appraiser’s professional credibility.

Hypothetically, imagine a case where a leaked appraisal report reveals private details about a high-profile client. This could lead to a lawsuit and substantial financial penalties for the appraiser involved. Beyond legal consequences, such breaches could distort the real estate market. Confidential information, if exposed, could unfairly influence property values and disrupt fair market assessments.

Preventing breaches requires stringent adherence to the Uniform Standards of Professional Appraisal Practice (USPAP) and utilizing secure tools and practices. Upholding confidentiality safeguards clients’ interests and maintains the integrity of the real estate industry.

Best Practices for Ensuring Confidentiality

Ensuring confidentiality in real estate appraisals requires adherence to several best practices. Clear and secure communication channels are vital. Appraisers should use encrypted emails and secure file-sharing platforms to transmit sensitive information, minimizing the risk of unauthorized access.

Documentation and data handling are equally important. Appraisers must securely store physical documents and employ secure measures for digital data. For example, using password management tools like LastPass can help in maintaining strong, unique passwords for all accounts.

Professional conduct is also crucial. Continuous education and training on confidentiality standards, such as those outlined by the Uniform Standards of Professional Appraisal Practice (USPAP), ensure appraisers stay informed about the latest privacy protocols. Additionally, appraisers should avoid discussing confidential information in public or unsecured environments.

By implementing these practices, appraisers demonstrate their commitment to protecting client information, fostering trust, and upholding industry standards.

Conclusion

In conclusion, confidentiality in real estate appraisals is paramount for maintaining trust, ethical compliance, and market integrity. Adhering to stringent standards and practices, such as those outlined by the Uniform Standards of Professional Appraisal Practice (USPAP), is essential for protecting sensitive client information. Breaches of confidentiality can lead to severe legal, financial, and reputational consequences, underscoring the importance of secure communication and data handling protocols.

By following best practices—such as using encrypted communication channels provided by major technology providers, implementing secure storage solutions, and engaging in continuous education—appraisers can safeguard client information and maintain the trust and credibility crucial to their profession. Ultimately, upholding confidentiality not only protects clients but also ensures the integrity and fairness of the real estate market, benefiting all parties involved in the transaction. Remember, confidentiality is not just a requirement; it’s a cornerstone of ethical and professional real estate practice.

by Conrad Meertins | May 15, 2024 | Uncategorized

Why does a seemingly similar property in one neighborhood appraise for significantly more than in another? It’s all about location adjustments.

In real estate, location is everything. But why do two identical houses have drastically different appraised values just because one is across town? The answer lies in location adjustments—the subtle yet crucial differences that shape property values and ultimately impact your transactions.

Whether you’re a seasoned realtor or a curious homeowner, understanding how location influences property values can empower you to navigate the real estate market confidently. This article explores the hidden mechanics behind location adjustments in property appraisals and offers practical insights into their rationale.

We’ll uncover how proximity to schools, future developments, and other influences can affect valuations. Let’s shed the light on location adjustments and equip you to harness their power in your next transaction.

Importance of Location in Property Valuation

Location adjustments account for the differences in neighborhood desirability, accessibility, and local amenities, making them crucial in determining property value. For instance, a study by the National Association of Realtors found that homes near highly rated schools command up to 10% higher prices than comparable properties elsewhere.

Similarly, proximity to transportation hubs, shopping centers, parks, and employment opportunities enhances a property’s appeal. For example, homes within a 10-minute walk of public transit often see a 4-24% premium in value.

However, negative factors like proximity to industrial areas can decrease property values. A home near an active rail line or busy highway may be worth 5-15% less than a similar property in a quieter neighborhood.

Therefore, understanding location adjustments is essential to accurate property valuation, allowing appraisers to quantify these differences and help realtors navigate transactions confidently.

The Rationale Behind Location Adjustments

Location adjustments ensure appraisals accurately reflect how a property’s location influences its value. This rationale is particularly evident in the Sales Comparison Approach, where appraisers compare the subject property to similar ones in the same market area. For instance, two identical homes may have vastly different values due to neighborhood differences: a house near a top-rated school can yield up to 10% more than one adjacent to an industrial site.

Ultimately, this adjustment provides a comprehensive view of a property’s worth, ensuring fair market valuations.

Implementing Location Adjustments in Appraisals

Implementing location adjustments in appraisals requires careful research, accurate data, and systematic comparisons. The process begins with thorough market research and data collection, focusing on neighborhood trends, amenities, and comparable sales. Appraisers must identify comparables with similar location attributes; for instance, recent sales that share neighborhood features.

Adjustments are then made based on quantifiable differences. If a comparable property is closer to a top-rated school, a positive adjustment may be warranted. Similarly, proximity to a busy highway or industrial area could necessitate a negative adjustment.

The adjustments process involves quantifying these differences systematically. Paired sales analysis, where two similar properties are compared directly, is one effective approach. Statistical modeling, such as regression analysis, can also be used to identify trends.

Ultimately, implementing location adjustments accurately helps appraisers deliver fair and consistent valuations, ensuring that location nuances are fairly reflected in the final appraisal report.

Common Challenges in Location Adjustments

Location adjustments can be challenging due to inconsistent data, market volatility, and the subjective nature of locational factors. One significant challenge is finding accurate, up-to-date market data. For instance, rapidly changing neighborhoods may lack recent comparable sales, making it difficult to identify reliable benchmarks. In a volatile market, property values can fluctuate drastically within months, complicating the appraisal process.

Subjective interpretation of locational factors also poses issues. For example, noise pollution from highways or industrial areas affects individuals differently, and appraisers must quantify these effects objectively. A study by the National Bureau of Economic Research found that homes within 500 feet of highways could experience a 5-10% reduction in value.

Another challenge is finding appropriate comparables in niche markets or unique neighborhoods.

Addressing these challenges requires thorough research, professional judgment, and collaboration between realtors and appraisers to ensure fair and accurate location adjustments.

Best Practices for Realtors and Appraisers

Realtors and appraisers can streamline the appraisal process and enhance the accuracy of location adjustments by adhering to best practices.

- Proactive Market Research: Realtors should stay informed about local market trends, school district ratings, upcoming infrastructure projects, and neighborhood developments. For example, properties near a new transit hub can see values increase due to improved accessibility.

- Collaboration with Appraisers: Maintaining strong communication lines between realtors and appraisers ensures accurate data sharing. Realtors can provide appraisers with recent comparable sales data, pending listings, and neighborhood insights.

- Transparent Communication with Clients: Realtors should educate clients on location adjustments, explaining how factors like proximity to amenities can affect valuations.

- Objective Adjustments: Appraisers should use paired sales analysis and statistical modeling to ensure systematic and unbiased location adjustments.

By implementing these practices, realtors and appraisers can deliver fair, comprehensive valuations that accurately reflect location nuances and empower informed real estate transactions.

Conclusion

In real estate, location adjustments are key to accurately valuing properties and ensuring fair transactions. We’ve explored the critical role of location in property valuation, revealing that factors like proximity to top-rated schools, transportation hubs, and future developments can significantly influence property values.

Understanding the rationale behind location adjustments helps demystify why two seemingly identical properties in different neighborhoods can have drastically different appraised values. Appraisers use approaches like Sales Comparison to systematically quantify these differences, providing clarity and fairness in their valuations.

Implementing location adjustments requires thorough market research, accurate data collection, and unbiased analysis. Despite challenges like inconsistent data and market volatility, best practices such as proactive collaboration between realtors and appraisers, transparent communication with clients, and objective adjustments can significantly improve accuracy.

By mastering location adjustments, realtors and appraisers can deliver consistent, comprehensive valuations that empower clients to navigate the real estate market with confidence.

by Conrad Meertins | Feb 14, 2024 | Uncategorized

Unlocking the Power of Data in Real Estate

In the competitive world of real estate, the savvy individual knows that success is not just about what you say, but how deeply you understand the market before you speak. Stephen Covey’s fifth principle, “Seek first to understand, then to be understood,” rings especially true in this context. For Louisville homeowners and real estate agents alike, a profound comprehension of local market trends is not a mere advantage—it is an absolute necessity. This article is your lens into the Louisville market, providing the clarity needed to harness its full potential.

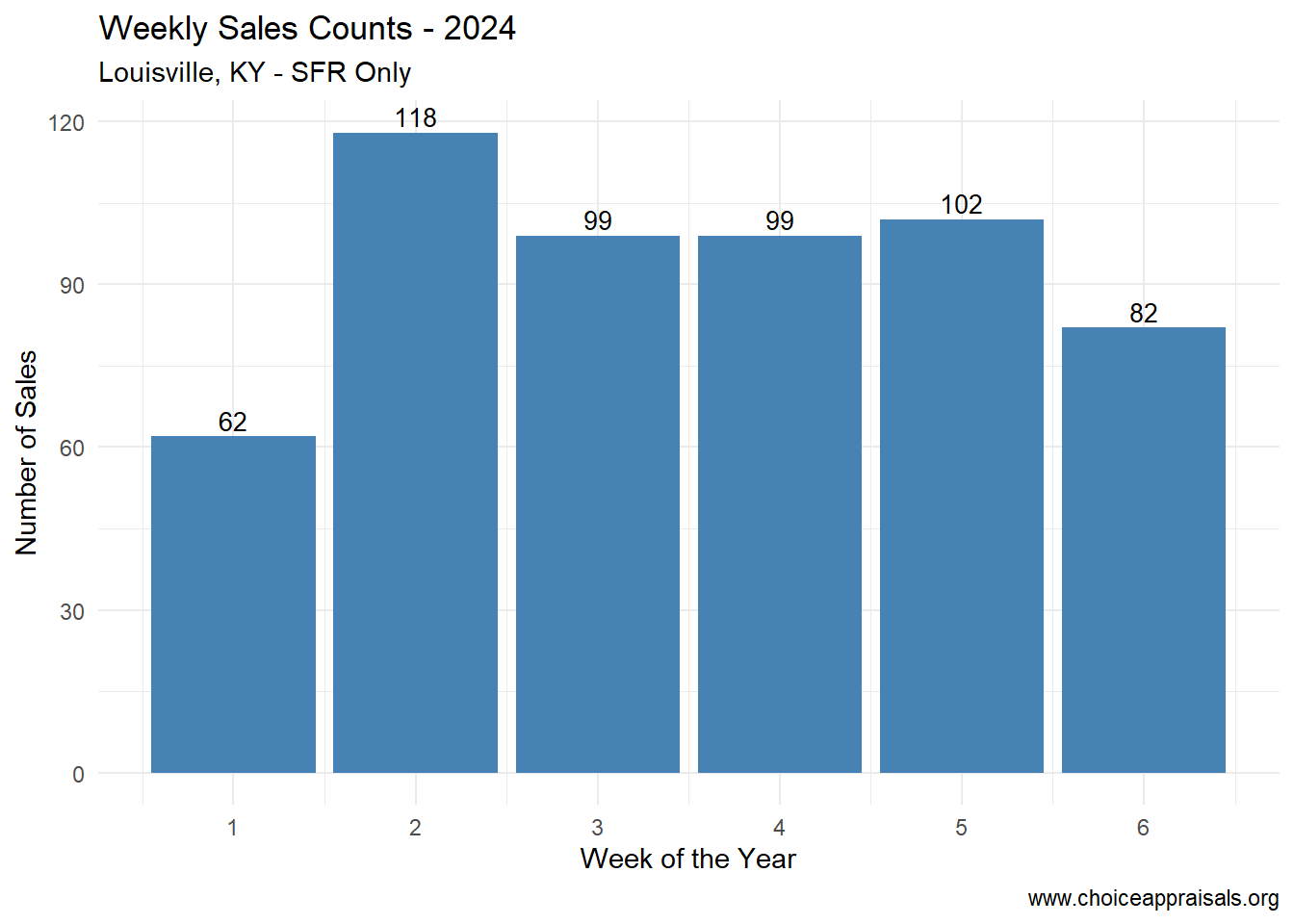

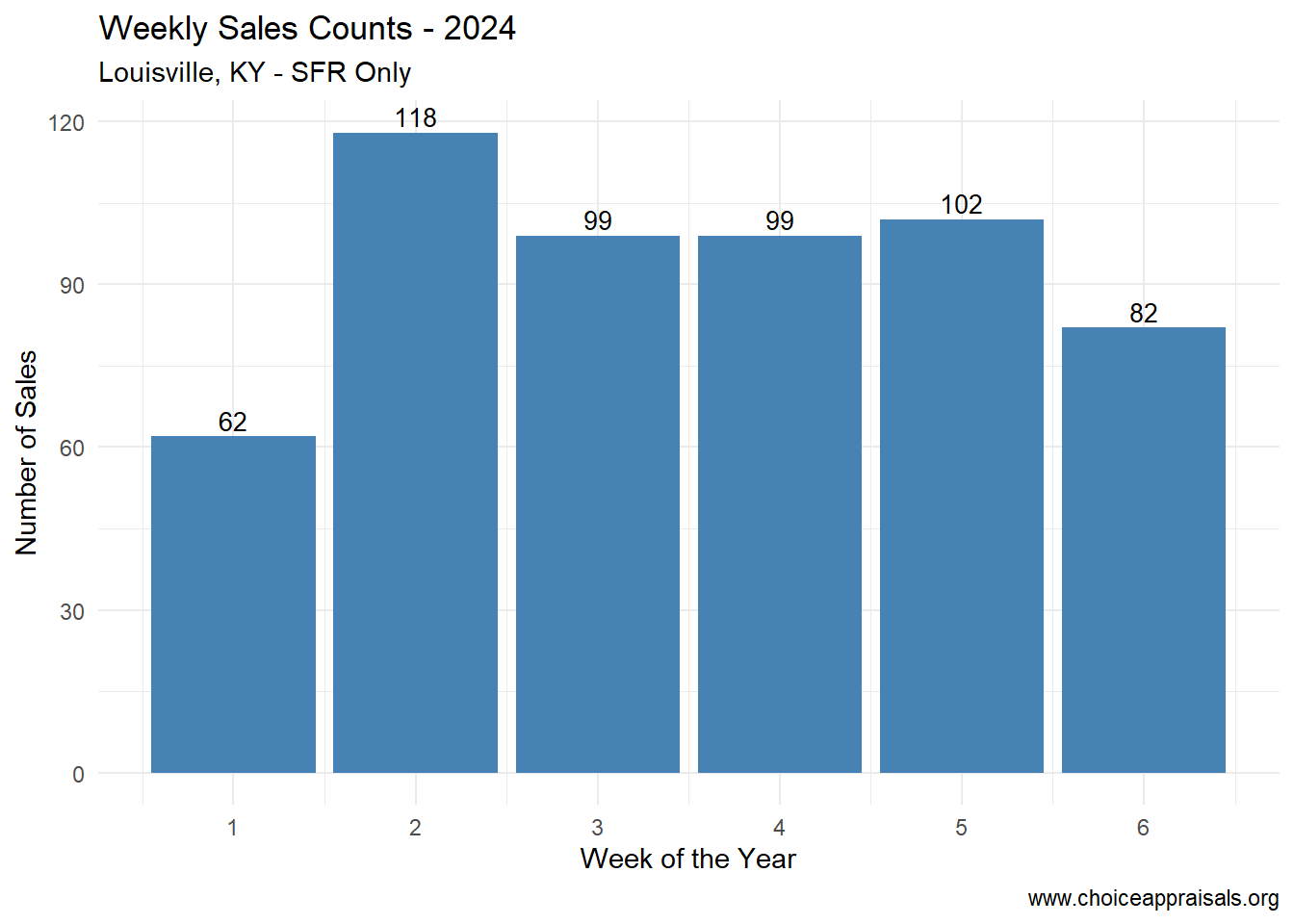

The Heartbeat of the Market: Weekly Sales Counts

Ups and Downs

The weekly pulse of Louisville’s real estate market beats clearly through the data provided by the MLS. Observing the initial six weeks of 2024, we witness a fluctuating pattern of sales, with peaks that speak to healthy buyer interest and dips that suggest market hesitations. Understanding this rhythm is crucial for anyone looking to enter the market, be it for listing a home or preparing for an appraisal. The key is not just to observe but to act on these insights and to let them help to manage your expectations.

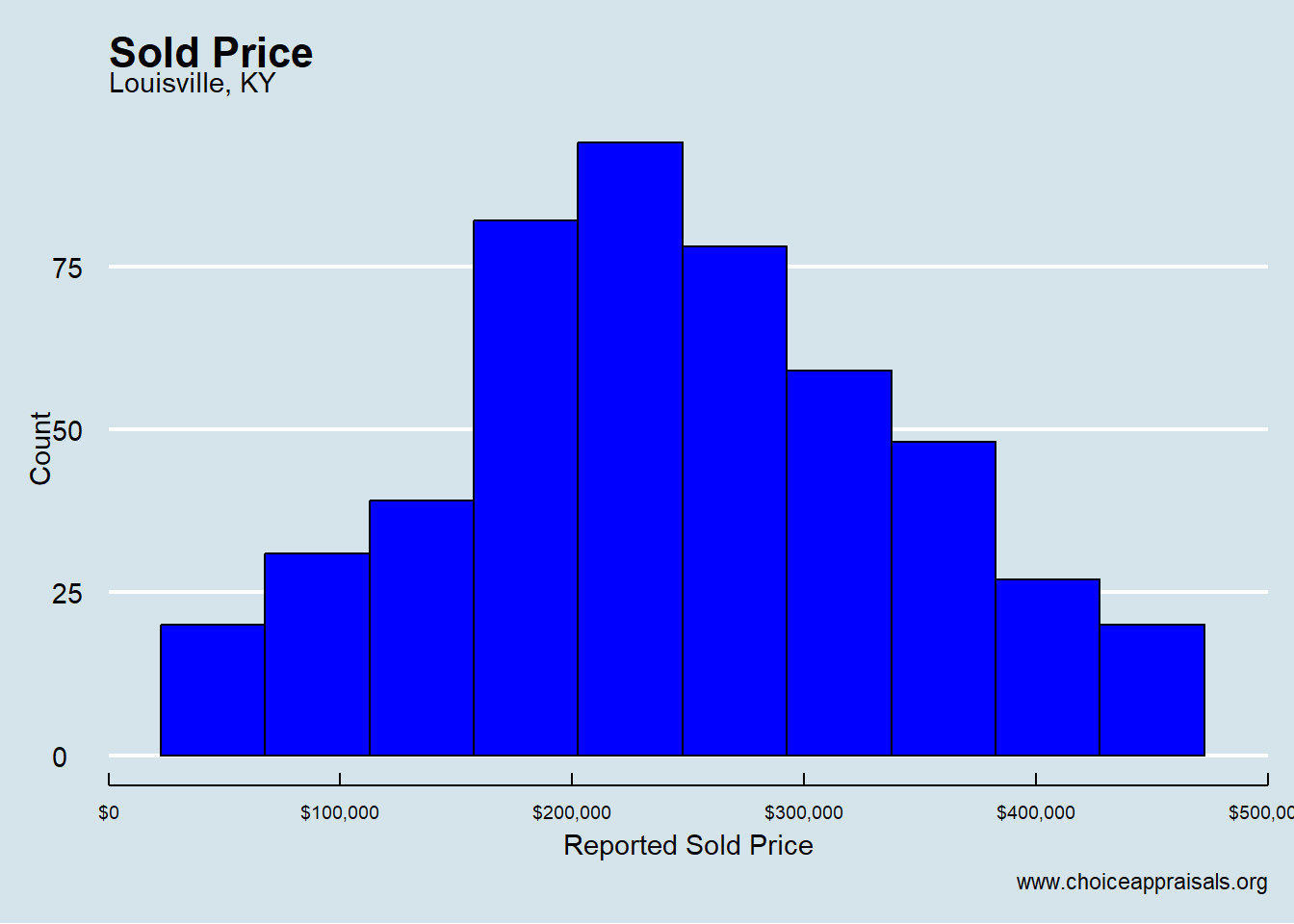

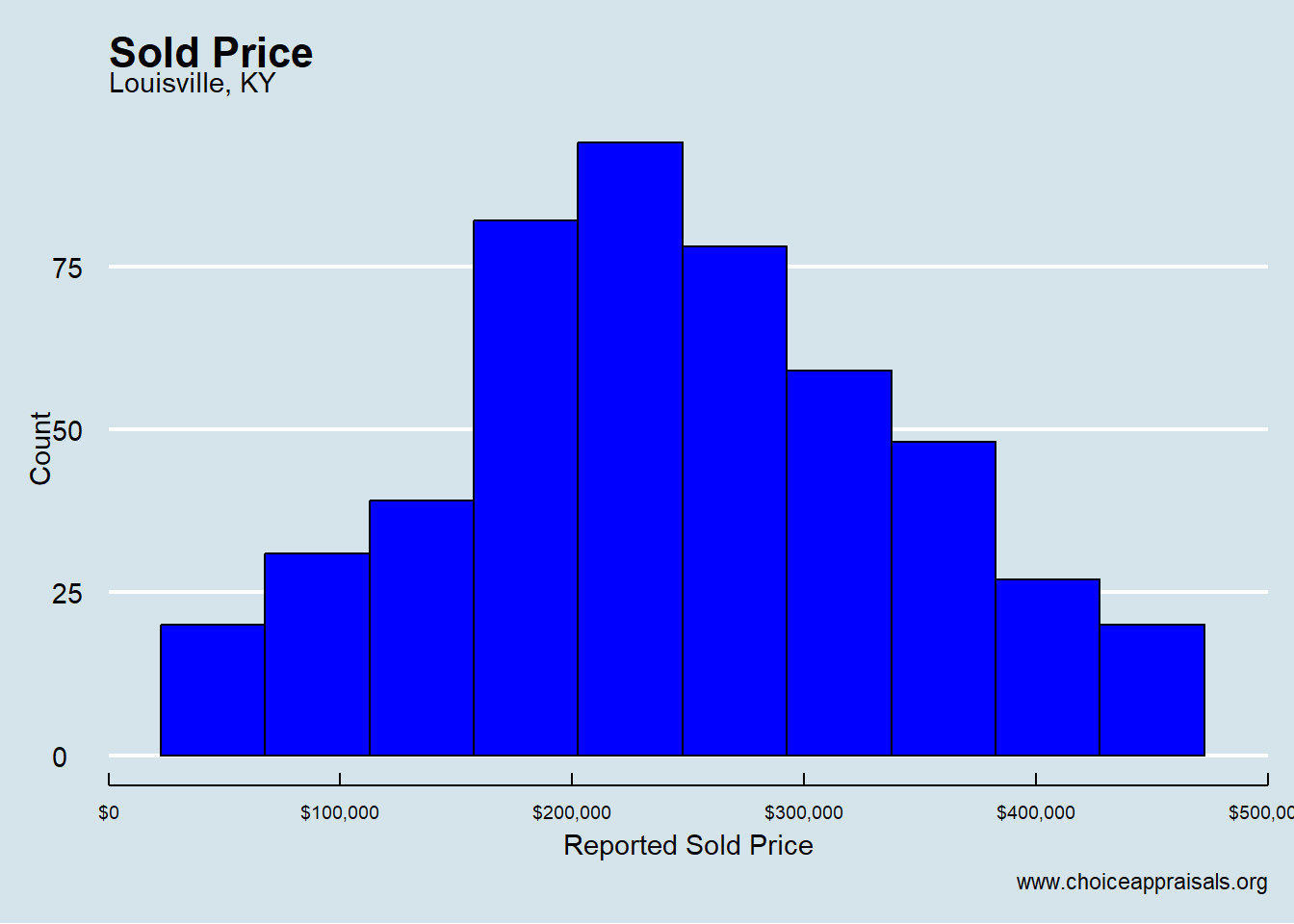

Price Point Precision: Navigating the Sold Price Distribution

Finding the Sweet Spot

The distribution of sold prices in Louisville (for 1/1/24 – 2/11/24) reveals where the action truly is. Most homes changing hands fall within the $200,000 to $300,000 range, providing a clear target zone for sellers aiming to price their homes competitively. But the market is not one-size-fits-all. Neighborhood-specific trends could shift your home’s position on this spectrum, highlighting the importance of tailoring your strategy to the nuances of your locale.

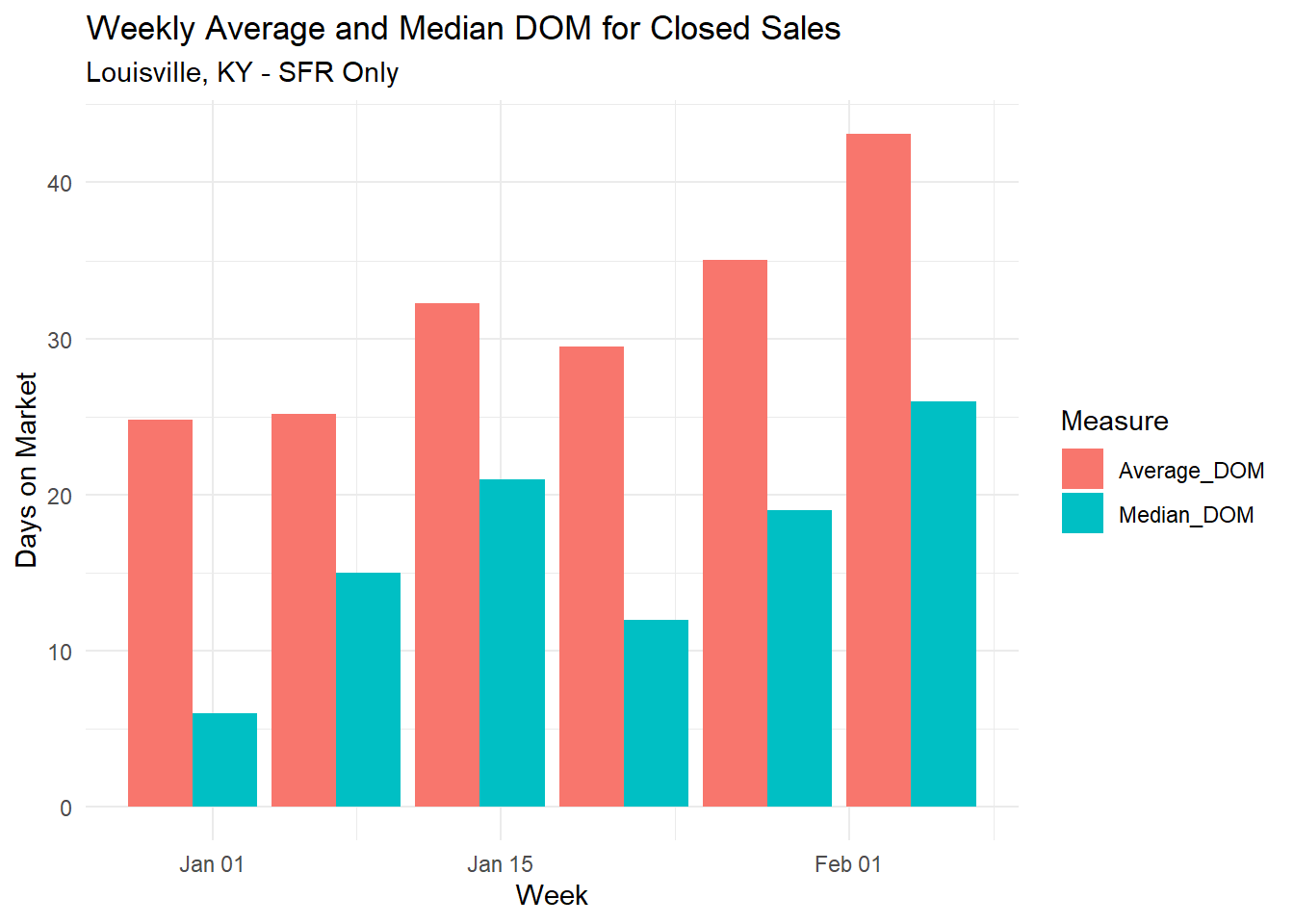

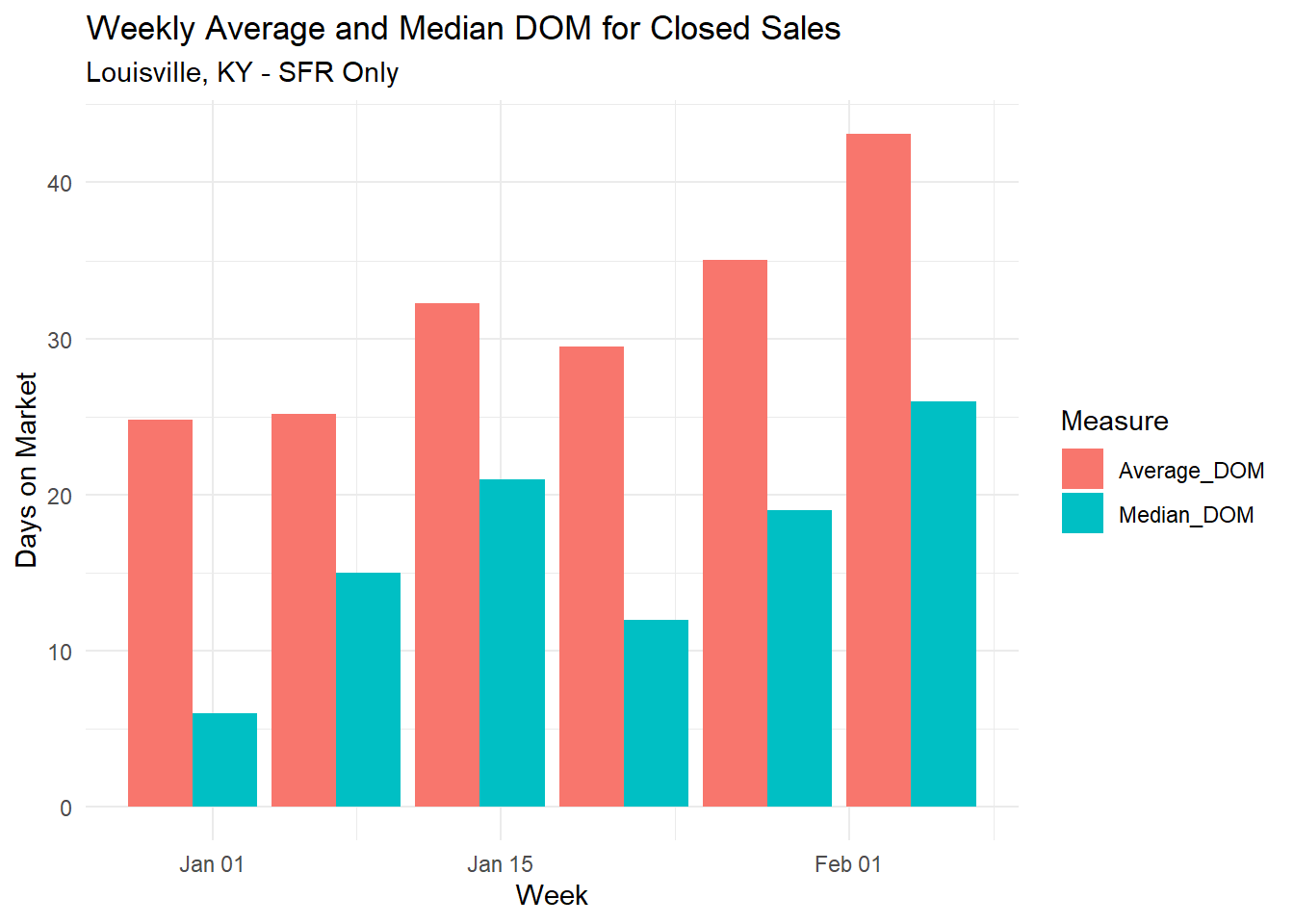

The Timing of the Sale: Days on Market Analysis

Median vs. Average: A More Accurate Market Tempo

The Days on Market (DOM) chart is a crucial indicator of how swiftly homes are moving in Louisville. Unlike the average DOM, which can be distorted by outliers, the median DOM offers a more faithful representation of what sellers can expect. This distinction is pivotal, as it can shape both the pricing strategy and the marketing approach for your home listing.

Understanding the complex layers of the market goes beyond the surface numbers. By dissecting data, real estate professionals can detect micro-trends that influence broader market movements. For example, a sudden increase in the DOM may indicate a shift towards a buyer’s market, necessitating a more aggressive marketing approach or a reassessment of pricing strategies.

The Art of Negotiation

A deep understanding of market data not only empowers realtors to provide exceptional service but also equips homeowners to engage in informed negotiations. Knowledge of the median sold prices and DOM empowers homeowner to enter negotiations with realistic expectations and the confidence to make or accept offers that are in line with market dynamics.

Real-Life Success Stories: Data-Driven Decisions in Action

When appraising a home in Louisville, a family learned firsthand the power of market knowledge. They needed to sell their mother’s home and got a low offer. With my help, they saw that homes in her area were selling fast, often in less than a month. So, they didn’t have to take the first offer that came along. By setting a competitive price that matched what other homes were selling for, they were in a strong position to sell quickly and for a better price. This real-world example shows why it’s smart to understand the local real estate scene before setting a price or accepting an offer.

Adapting to Market Shifts: Staying Ahead of the Curve

The ability to adapt to market shifts is what sets apart successful real estate professionals and savvy homeowners. Regular analysis of sales counts, price distributions, and DOM trends helps anticipate market changes, allowing for proactive rather than reactive strategies.

In wrapping up our comprehensive analysis of Louisville’s real estate market, we’ve uncovered the profound impact of data on every facet of real estate transactions. By adhering to Stephen Covey’s timeless principle and applying it to the interpretation of market data, we’ve demonstrated how it can lead to more strategic and successful real estate decisions. From the valuation of a property to the intricacies of listing and negotiating, a data-driven, seek first to understand approach is not just advantageous—it’s indispensable. The market speaks a language of numbers and trends; fluency in this language is what leads to confident, informed, and successful outcomes.

by Conrad Meertins | Sep 11, 2023 | Uncategorized

The Tale of the “Larger” Home

Let me take you back to a property I once appraised. The MLS Listing advertised the home as a cozy 1,300 square feet. However, upon measurement, it was only a 1,000-square-foot dwelling. Sure, the market was on an upswing, and the list price fortunately equated to the market value, but what if the market had been stagnant or declining?

The discrepancy could have had serious repercussions. The potential buyers were under the illusion that they were getting a larger home. Realtors, let this be a cautionary tale. Accurate measurements are not just optional; they are critical. Let’s dive in.

The ANSI Standard: A New Measure of Accountability

As of 2022, appraisers are mandated to follow the ANSI® Z765-2021 standard, also known as the ANSI standard, for measuring homes. This standard covers everything from the gross living area to non-gross living areas like basements and additional structures. Fannie Mae’s selling guidelines are crystal clear: if your appraisals require interior and exterior inspections, you must adhere to this standard. Failure to do so renders the appraisal unacceptable.

Why is this important for realtors? Because it sets a standardized framework that you should also be following. If appraisers have to be this meticulous, why shouldn’t you? This leads me to my next point.

Taking Action: Measure Twice, List Once

If you find yourself in doubt, don’t hesitate to get your listing measured. I offer this service and am more than happy to assist. However, it’s not just about outsourcing; you can also take matters into your own hands. Measuring a home isn’t rocket science, but it does require careful attention to detail.

Here are some tools you might consider to ensure accurate measurements:

– Laser Distance Measurer: For quick and precise measurements.

– CubiCasa – a digital resource to create floor plans

– A Clipboard and Graph Paper: The old-fashioned but effective way to jot down measurements as you go.

Conclusion: The True Value of Accuracy

Remember, when a buyer or seller is looking at a home, they are envisioning a future, a lifestyle. Your listing sets the stage for that vision. An inaccurate listing not only disrupts that vision but could potentially lead to legal complications. In this ever-evolving industry, staying ahead means adapting to changes and upholding high standards of accuracy and integrity.

As the old adage goes, “Measure twice, cut once.” In our world, it’s more like, “Measure twice, list once.” May we all strive for this level of diligence in our practice.

by Conrad Meertins | Aug 28, 2023 | Uncategorized

Welcome to the fascinating world of real estate! Ever wondered how a property’s worth is decided? There’s a method called the Sales Comparison Approach (SCA). This short article will help you understand what it is and how it’s used. Plus, we’ll discuss the steps involved, and its advantages and limitations. So, let’s jump in!

Understanding the Sales Comparison Approach

The Sales Comparison Approach is a way to determine a property’s value. It’s widely used in real estate because it compares the property to similar ones that have recently been sold. This way, the value is based on what buyers are actually willing to pay.

Steps Involved in the Sales Comparison Approach

Now, how does it work? A major key for the appraiser is to determine the pool of similar properties, called “comparables.” In an ideal world, these homes would have sold within the past 3 to 6 months. However, appraisers can go back in time as far as necessary. After selecting 3 to 6 comparables to serve as representatives, they make adjustments where appropriate.

For example, if your house has a new roof but the comparable doesn’t, they’ll add the “contributory value” of a new roof to the comparable’s price. Contributory value is essentially “how much more the average person will pay because of that feature.” By making this adjustment to the comparable sale, the price reflects what it would be if it had a new roof, like your house!

The Use of the Sales Comparison Approach in Various Property Types

SCA can be used for different types of properties. Whether it’s a condo in the city, a house in the suburbs, or a farmhouse in the country, SCA can be helpful. However, each type of property has its own considerations. For instance, a farmhouse’s value might be influenced more by its land size than a city condo, which has no land.

Advantages and Limitations of the Sales Comparison Approach

The best thing about SCA is that it’s based on real sales, giving a realistic value. But it’s not perfect. Sometimes it’s hard to find comparables, and no two properties are the same, so making adjustments isn’t always straightforward. But don’t worry! Skilled appraisers know how to handle these challenges.

Conclusion

So, there you have it! The Sales Comparison Approach is a key part of real estate appraisals. It’s useful but also has its challenges. By understanding it, you’re now better equipped to deal with property valuations. For more insights into real estate, consider joining our Facebook group. It’s a great place to learn and ask questions. Happy appraising!