by Conrad Meertins | Jan 20, 2025 | Valuation

My first experience with an ADU was about a decade ago in Old Louisville. It was a four-story single-family residence (a beautiful brownstone). Just as I thought I had finished the appraisal, the owner asked, “Would you like to see the carriage house?”

I didn’t know there was more to see, but I confidently said, “Of course!” I was looking forward to it, not realizing at the time how ADUs would eventually become a significant trend in real estate.

As a Louisville appraiser, I’ve witnessed firsthand how Accessory Dwelling Units (ADUs) are reshaping our local real estate market. From the historic carriage houses in Old Louisville to newly constructed garden suites in St. Matthews, these versatile spaces are becoming increasingly valuable additions to Kentucky properties.

Let’s explore how ADUs impact market value, both positively and negatively, and what homeowners and buyers need to know about Fannie Mae’s guidelines.

The Upside: Positive Impacts of ADUs on Market Value

1. Increased Property Value in Our Market

Here in Louisville, where housing demand continues to grow, particularly in areas like the Highlands and Crescent Hill, ADUs often significantly increase a property’s value. The charm of our historic neighborhoods makes these additions especially appealing when they complement the architectural character of the main residence.

2. Rental Income Potential in Derby City

With the Kentucky Derby, Louisville’s growing tourism industry, and our expanding medical district, ADUs offer unique rental opportunities. From short-term rentals during major events to long-term leases for medical residents and students, ADUs can provide substantial income streams that help offset mortgage costs or generate additional cash flow.

3. Enhanced Market Appeal in Our Community

Louisville’s multi-generational families and young professionals are increasingly seeking properties with ADUs. Whether it’s housing aging parents in Cherokee Gardens or creating a home office in Clifton, these spaces offer the flexibility and versatility that our local market demands.

4. Flexibility in Use

ADUs can adapt to the changing needs of homeowners. Today, they might serve as a rental unit or guest house; tomorrow, they could be a home office, a space for aging relatives, or even a short-term rental during Derby week.

Challenges to Consider: The Downsides of ADUs

While ADUs offer incredible benefits, there are challenges to keep in mind:

1. High Construction Costs

Building an ADU can be a significant upfront investment, ranging from $100,000 to over $400,000 depending on size, design, and location.

2. Zoning and Regulatory Hurdles

Local zoning laws and permitting requirements can be complicated. Noncompliant or illegal ADUs may impact insurance claims, property marketability, or financing options.

3. Increased Property Taxes

Adding an ADU typically increases a property’s assessed value, which means higher property taxes.

4. Maintenance and Management

For those renting out their ADU, property management and maintenance become ongoing responsibilities.

5. Type of ADU Impacts Value Differently

- Detached ADUs generally add the most value.

- Attached ADUs come next.

- Internal ADUs (like basement apartments) add the least value but can still be significant depending on the market.

What Does Fannie Mae Say About ADUs?

As a key player in the mortgage market, Fannie Mae provides specific guidelines for properties with ADUs:

- Appraisal Requirements: Appraisers must evaluate how the ADU contributes to market value by analyzing comparable sales or, if none are available, using a cost-based approach.

- Gross Living Area (GLA): ADUs are appraised separately from the main dwelling unless they are within it and have interior access.

- Legal Compliance: ADUs must meet local zoning laws and regulations to be included in the property’s valuation.

- Financing and Underwriting: Lenders must follow specific loan-to-value (LTV) and debt-to-income (DTI) guidelines while factoring in potential rental income from the ADU.

Real-Life Insights: ADUs in Louisville

My most recent experience with an ADU involved a proposed construction project—a $1.3 million build featuring a 3,500-square-foot main residence with an attached garage and a 1,500-square-foot ADU on the other side of the garage.

The design was not only stunning but also supported by the local market, demonstrating a positive correlation between construction costs and property value in this case.

Looking Forward: What ADUs Mean for Louisville

As Louisville continues to grow and evolve, ADUs represent a significant opportunity for property owners. Whether you’re in the Highlands, Butchertown, or the expanding East End, understanding how these units impact property values is crucial for making informed real estate decisions.

Adding an ADU can increase property value, generate income, and provide flexibility, but it also requires careful planning, compliance with local regulations, and a clear understanding of market trends.

Fannie Mae’s guidelines play a vital role in shaping how ADUs are appraised and financed, so it’s important to factor these into your decision-making process.

If you’re considering adding an ADU to your property—or buying a home with one—consulting with a professional appraiser who understands the local market can make all the difference.

Need professional guidance on ADU appraisal in Louisville? Contact me for a thorough valuation of your property’s potential!

by Conrad Meertins | Dec 30, 2024 | Valuation

So, you’re a real estate professional, right? You’re no stranger to appraisal reports. They’re part of your daily grind. But let’s be real, these documents can sometimes feel like they’re written in a different language. How can you crack the code to understanding them better? That’s what this article is all about.

An appraisal report, in its simplest form, is an unbiased estimate of the value of a property. It’s an essential tool for lenders, buyers, and yes, agents like you. Why? Because it provides a defensible opinion of market value of a property, which is crucial in any real estate transaction.

Understanding appraisal reports isn’t just a nice-to-have skill. It’s a must. When you know your way around these reports, you’re in a better position to advise your clients, negotiate deals, and close sales. It’s about leveling up your game in the competitive world of real estate. So, are you ready to dive in? Let’s do this.

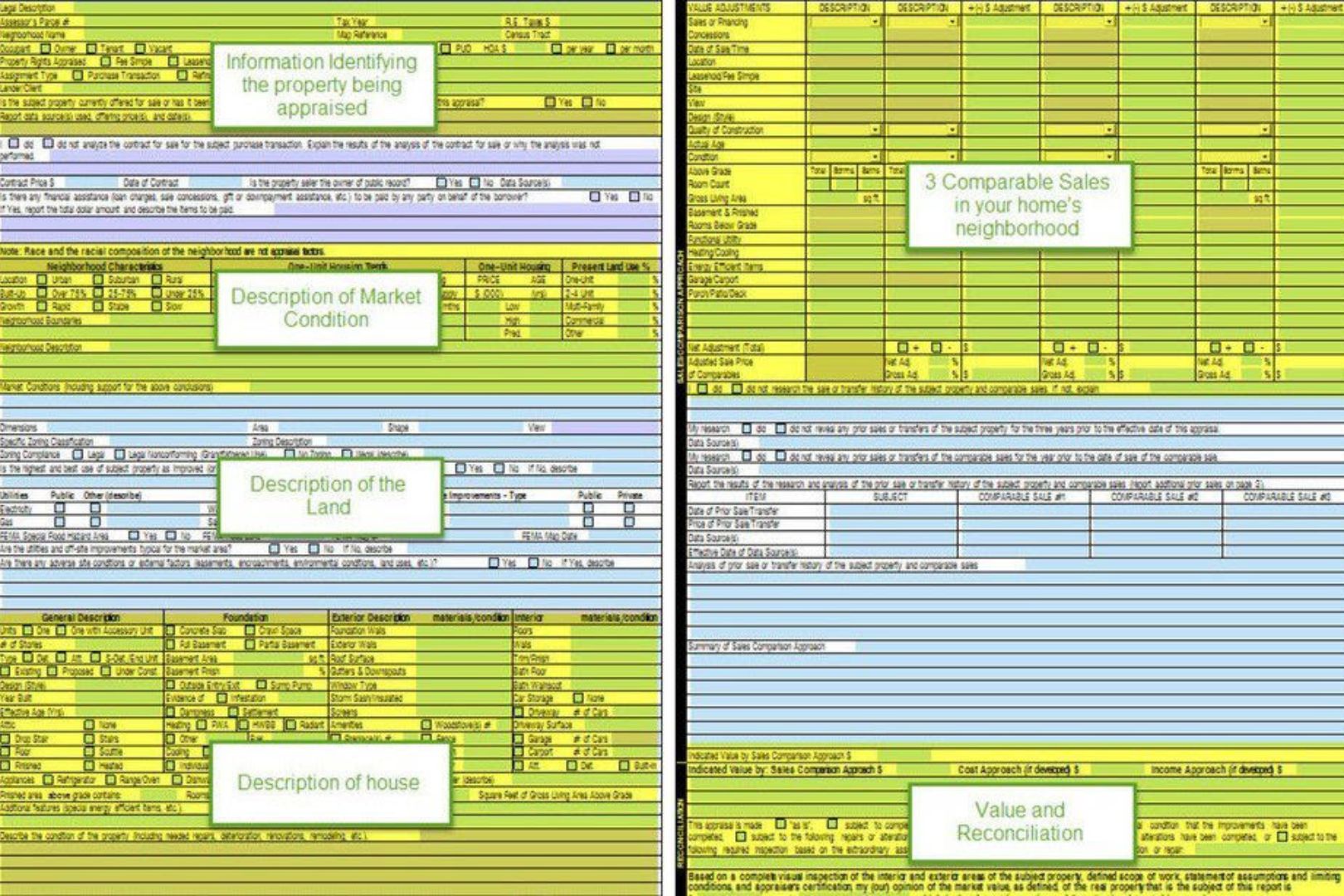

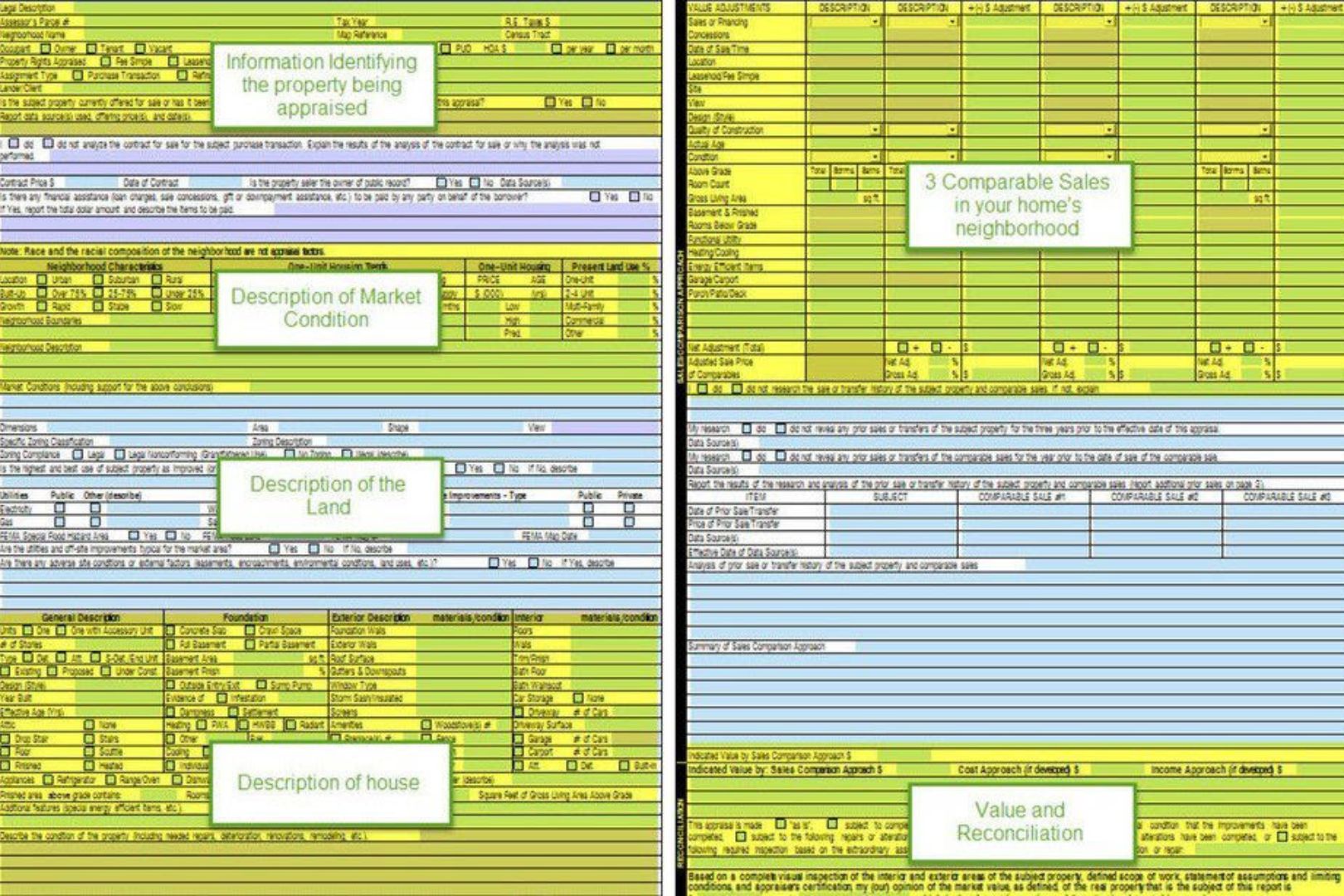

Tip 1: Know the Basics

First, you’ve got the ‘Subject’ section. This is where you’ll find information about the property in question. It’s the ‘who’ and ‘where’ of the report. Details like the property address, legal description, and owner’s name are all nestled in here.

Next up is the ‘Contract’ section. If there’s a sale going on, this is where you’ll find the details. Think purchase price, contract date, and the like. It’s the ‘what’ and ‘when’ of the report.

Then we’ve got the ‘Neighborhood’ section. This is where the appraiser paints a picture of the area surrounding the property. It’s the ‘context’ of the report, giving you a snapshot of the local real estate market and the broader forces at play.

The ‘Improvements’ section is next in line. This is where the property itself comes under the microscope. Everything from the home’s condition to its unique features is laid out here. It’s the ‘how’ of the report, showing you what the property has (or doesn’t have) going for it.

Finally, we have the ‘Valuation’ and ‘Reconciliation’ sections. This is where the rubber meets the road. After considering all the data, the appraiser provides an estimated market value for the property and explains how they arrived at that figure. It’s the ‘why’ and ‘so what’ of the report, tying everything together.

FYI the Valuation sections encompasses the Sales Comparison Approach, the Income Approach and the Cost Approach.

Now, let’s talk key terms. ‘Subject’, ‘Contract’, ‘Neighborhood’, ‘Improvements’, ‘Valuation’, ‘Reconciliation’ – these are your new best friends. Get to know them, understand them, and you’ll be well on your way to mastering the art of reading appraisal reports.

Remember, knowledge is power. The more you understand the basics, the better equipped you’ll be to navigate the complex world of real estate appraisals. It’s not rocket science, but it does require a bit of dedication. Are you up for the challenge?

Tip 2: Understand the Purpose of the Appraisal

So, you’ve got the basics down. Great! But let’s not stop there. Why is the appraisal being done in the first place? Knowing the ‘why’ can provide a whole new perspective on the ‘what’.

There are several reasons an appraisal might be ordered. Maybe it’s for a home sale, or a refinancing deal. Maybe it’s for an estate settlement or a divorce settlement. Each purpose has its own unique considerations that can impact the final appraisal report.

Let’s say the appraisal is for a home sale. The main objective here is to determine if the contract price is in line with market realities.

On the other hand, an appraisal for a estate settlement may focus more on the market value as of “date of death”, which might not necessarily align with the current market value.

Why does this matter? Because the purpose of the appraisal can directly influence the report. It can affect the approach the appraiser takes, the comparables they select, and the adjustments they make.

In essence, understanding the ‘why’ behind the appraisal can help you better understand the ‘what’ in the report. It’s not just about reading the numbers, it’s about comprehending the story those numbers are telling.

So next time you’re handed an appraisal report, take a moment to ask – why was this appraisal done? The answer might just change the way you read the report.

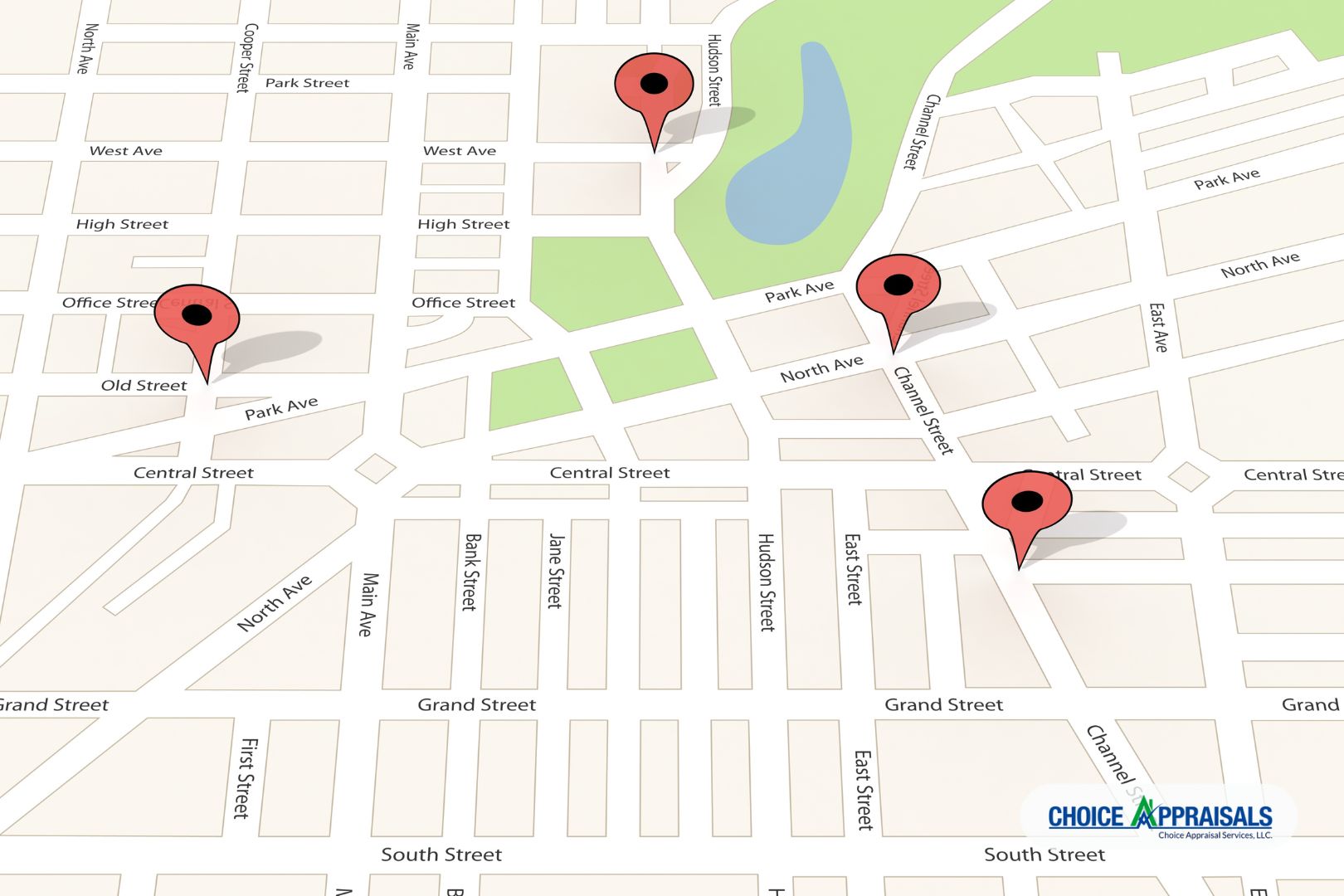

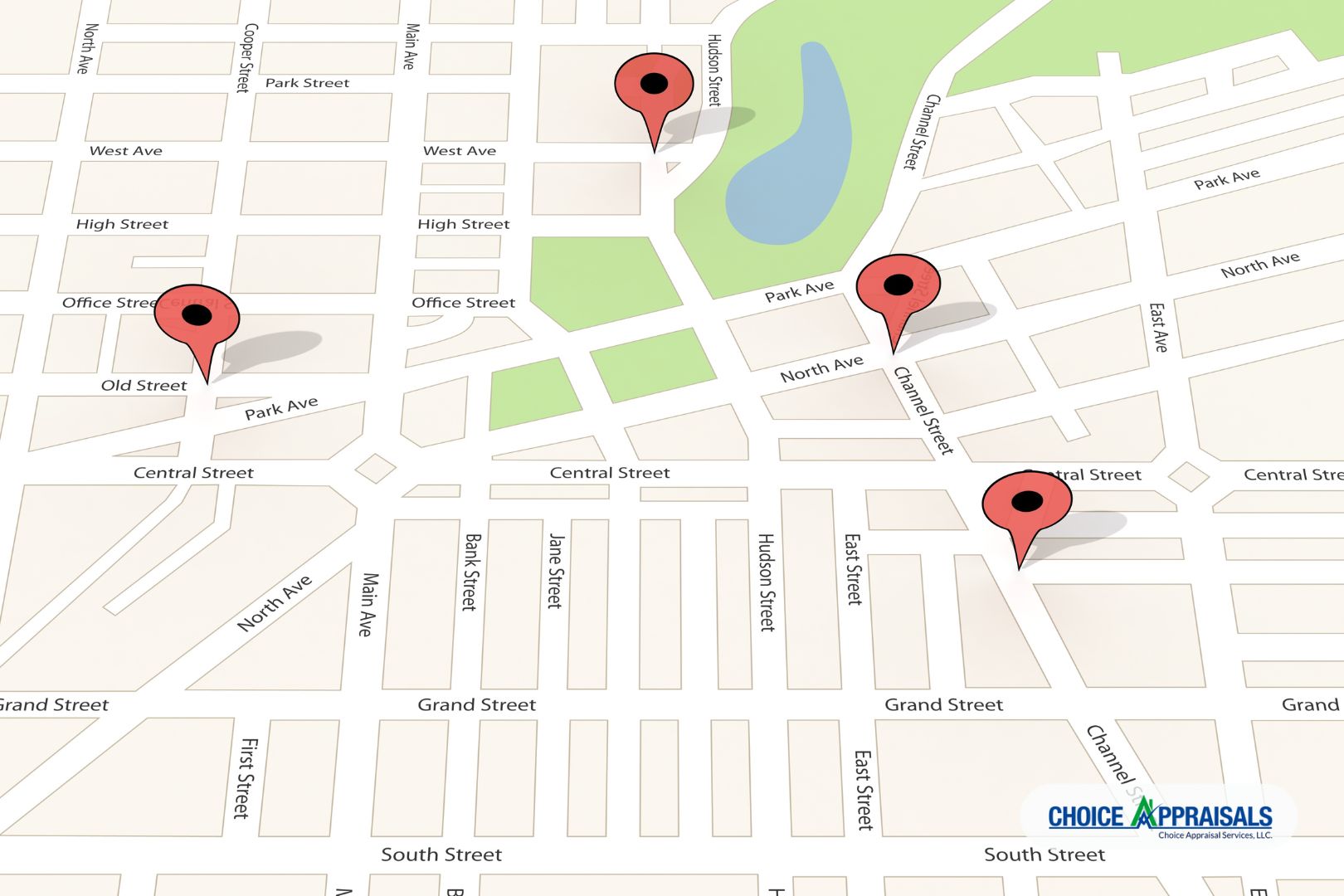

Tip 3: Pay Attention to the Comparables

Alright, let’s chat about comparables, or “comps” as they’re often called in the biz. These are properties similar to the one being appraised that have recently sold or are currently on the market. They play a key role in determining the appraised value of a property. Think of them as the yardstick by which your property is measured.

The comparables are analyzed in the Sales Comparison Analysis section of an appraisal report. This section can seem like a jumble of numbers and terms, but it’s not as daunting as it looks.

Here’s the lowdown: each comp is listed with its selling price, and various features such as location, size, age, condition, and amenities. These features are compared to those of the property being appraised, and adjustments are made to the comp’s selling price based on the differences.

So, how do you make sense of this section? Here’s a tip: don’t get too caught up in the individual adjustments. Instead, look at the big picture. Are the comps similar to your property? Are they in the same neighborhood? Do they have similar features? If the answer is yes, then the appraised value is likely on point.

But if the comps seem off – maybe they’re in a different neighborhood, or they’re significantly larger or smaller – that could be a red flag. Remember, comps are a major factor in determining the appraised value. If they’re not truly comparable, the value could be skewed.

So, keep a keen eye on the comparables. They’re more than just numbers on a page – they’re a crucial piece of the appraisal puzzle.

Tip 4: Review the Adjustments

So, you’ve got your hands on an appraisal report and you’re cruising through the comparables. You’re feeling good, feeling confident. But then, you hit the adjustments section and suddenly, it’s like you’ve run into a brick wall. Don’t worry, it’s not as daunting as it seems. Let’s break it down.

Adjustments, in the simplest terms, are like the tweaks on a stereo equalizer. They’re used to level the playing field between the subject property and the comparables.

For instance, if a comparable property has a swimming pool and the subject property doesn’t, an adjustment is made to account for this difference. This ensures that you’re comparing apples to apples, not apples to oranges.

But how do you interpret this section? Well, it’s not about just looking at the numbers. It’s about understanding the story those numbers tell.

When you see a negative adjustment, it means the comparable is superior to the subject property in that aspect. A positive adjustment, on the other hand, indicates the subject property is superior.

Pro Tip

CBS – Comparable Better? – Subtract!

CIA – Comparable Inferior? – Add!

The key here is to not get lost in the figures. Instead, try to understand the rationale behind each adjustment. Why was it made? How does it affect the overall value? Remember, each adjustment is a piece of the puzzle that forms the final appraisal value.

Now, you might be wondering, “What if I disagree with an adjustment?” That’s a valid concern. The key questions is: “Is the adjustment market based? – Is it supported by evidence?

The appraisers support for his or her adjustments should be noted in the comments or addenda. Understand their perspective and use that knowledge to better serve your clients.

So next time you’re faced with the adjustments section, don’t panic. Take a deep breath, review each adjustment carefully, and try to see the story behind the numbers. It might take some practice, but once you get the hang of it, you’ll be able to navigate this section like a pro.

Tip 5: Don’t Ignore the Conditions and Assumptions

This section isn’t just small print. It’s the equivalent of the secret sauce in a gourmet recipe. Ignore it at your peril. The conditions and assumptions section of an appraisal report often gets sidelined, but it’s a crucial part of the whole narrative. It’s like the director’s commentary on a movie. You get to understand the ‘why’ behind the ‘what’.

Why is it so important? It’s because this section outlines the terms under which the appraisal was made. It’s a list of all the factors that the appraiser assumed to be true when determining the value of the property.

This could include anything from zoning laws to the physical condition of the property. It’s the lens through which the appraiser viewed the property, and it can significantly impact the final appraisal value.

Think of it like this: you’re a detective, and this section is a vital clue that helps you piece together the full picture. If you don’t consider these conditions and assumptions, you might end up with a distorted understanding of the property’s value.

So, how do you navigate this section? Start by reading it carefully. Don’t skim. Each assumption or condition is a piece of the puzzle. If something seems off or doesn’t make sense, flag it. Ask questions. Challenge assumptions.

Remember, your job is to get a complete and accurate understanding of the property’s value. You can’t do that if you’re working with incomplete or inaccurate information.

The conditions and assumptions are not just a footnote. It’s a crucial part of the appraisal report that deserves your full attention. Ignore it at your own risk.

Unfortunately, assumptions can be written anywhere in the report, but they are required to be prominent wherever they are placed.

Tip 6: Look for Errors

It’s a little-known secret that even appraisal reports, as official as they may seem, can be prone to human error. And while it’s not exactly like hunting for Waldo, spotting these mistakes requires a keen eye and a solid understanding of the appraisal process.

Common errors can range from minor typos to major miscalculations. They might be as simple as misspelled names and incorrect property addresses, or as significant as erroneous square footage calculations and inaccurate comparable sales data. These mistakes, while they might seem trivial, can have a profound impact on the final appraisal value.

So, how do you play detective with an appraisal report? First, don’t rush. Take your time to thoroughly review each section of the report.

Pay special attention to the property description and the comparable sales used. Ensure the information aligns with what you know about the property and the local market.

Second, question everything. Does the reported square footage match your records? Do the comparable sales seem appropriate? If something seems off, it probably is.

Lastly, don’t hesitate to reach out to the appraiser for clarification. Remember, it’s not about challenging their expertise but about ensuring accuracy. After all, we’re all human and mistakes do happen.

Looking for errors isn’t about being nitpicky—it’s about safeguarding your client’s interests and maintaining the integrity of the transaction. So, put on your detective hat and start scrutinizing those appraisal reports.

Tip 7: Consult with the Appraiser

Ever heard the saying, “two heads are better than one?” It rings true in the world of real estate appraisals as well. The final, and arguably one of the most important, tips is to establish an open line of communication with the appraiser.

Why? Because appraisers are the masters of their craft, they hold a wealth of knowledge that can provide you with invaluable insights into the appraisal report.

Now, you might be thinking, “Great, but how do I approach this conversation without sounding like I’m questioning their expertise?” Good question. Here’s how.

Firstly, approach the conversation with genuine curiosity. You’re not there to challenge their appraisal, but to understand it. Ask them to explain the reasoning behind their choices, particularly if something isn’t clear to you.

A phrase like “Could you help me understand why this particular comparable was chosen?” comes across as much more collaborative than confrontational.

Secondly, make it a two-way street. Share your knowledge about the property and its neighborhood. You might have information that the appraiser wasn’t aware of, like upcoming developments in the area or recent sales that weren’t listed publicly. This can be incredibly beneficial to both parties.

Finally, remember to respect their time and expertise. Appraisers are busy professionals, so keep your questions concise and to the point.

And remember, while it’s okay to ask for clarification, it’s not okay to pressure an appraiser to change their valuation. Their independence and objectivity are crucial aspects of their role.

In a nutshell, don’t be a stranger to the appraiser. A little bit of communication can go a long way in helping you understand an appraisal report. Plus, it can strengthen your professional relationships, making future appraisals a smoother process.

Conclusion

Alright, so we’ve covered a fair bit of ground here. Let’s take a moment to circle back and recap the seven pointers that can make reading appraisal reports less of a headache and more of a breeze for you.

First off, get your head around the basics. Know the structure, understand the key terms. Next, grasp the purpose of the appraisal. It’s not just numbers and figures; there’s a story behind it all. Then, give due attention to the comparables and adjustments. They’re not just fillers; they play a significant role in the valuation.

Also, don’t let your eyes glaze over the conditions and assumptions section. It’s not just fine print; it can seriously impact the appraisal value. And while you’re at it, be on the lookout for errors. They’re not just typos; they can skew the entire report.

Lastly, don’t hesitate to reach out to the appraiser. They’re not just report generators; they can provide valuable insights and clarifications.

Well, we’ve come to the end. I really hope this guide has helped you to understand appraisal reports better. If I can be of service to you as you navigate the world of appraisals, please reach out. I am always happy to help.

Keep learning, keep growing, and keep rocking the real estate world!

by Conrad Meertins | Dec 23, 2024 | Valuation

When it comes to real estate transactions, appraisals are crucial. They determine the value of a property and can significantly impact the outcome of a deal. But what if the appraisal seems off? Here are five red flags you should look out for in your appraisal report.

Introduction

Ever wondered what makes an appraisal report a cornerstone of real estate transactions? Well, an appraisal report is a comprehensive analysis that provides an expert opinion of the market value of a property. It’s like the GPS of a real estate transaction, guiding all parties involved on the right value path.

Picture this: You’re about to buy a house. It’s charming, it’s cozy, it’s perfect. But is it worth the price tag? That’s where an appraisal comes in. It ensures that the property’s price aligns with its actual worth, protecting buyers from overpaying and sellers from underselling.

But here’s the kicker: not all appraisals are created equal. Accuracy is the name of the game. An inaccurate appraisal can be like a faulty GPS, leading you down a winding path to a destination that doesn’t match your expectations. It can throw off the balance of a transaction, causing headaches for buyers, sellers, and lenders alike.

That’s why it’s crucial to keep an eagle eye on your appraisal report, to ensure it’s as accurate as a Swiss watch. In the following sections, we’ll examine five red flags that could indicate your appraisal needs a second look. So buckle up, and let’s get started.

Red Flag 1: Inaccurate Property Details

Picture this: you’re excited about a property you’re considering for purchase. You’ve walked the rooms, admired the square footage, counted the bathrooms. But then you receive the appraisal report and something seems off.

The report states the property has one less bathroom than you’ve physically counted, and the square footage seems underreported. This, my friend, is a red flag waving right at you.

Inaccurate property details in an appraisal report, such as incorrect square footage or number of rooms, can significantly skew the appraisal value.

It’s like trying to compare apples to oranges; you’re not getting a true value comparison. This could lead to a lower appraisal than what the property might actually be worth, and you could be on the losing end of the deal.

So, how do you spot these errors? It’s simple. Compare the property details in the appraisal report with the actual property specifications. This could be from your own observations during a property visit or from the property listing details. If there’s a discrepancy, it’s time to raise an eyebrow.

And what do you do if you find these errors? Reach out to the lender or appraiser for clarification. It could be a simple oversight that can be easily corrected. If the appraiser stands by the inaccurate details, consider getting a second opinion.

Remember, when it comes to real estate transactions, knowledge is power and accuracy is key. Stay vigilant and don’t be afraid to question the details.

Red Flag 2: Ignoring Comparable Sales

Ever heard the saying, “You’re only as good as the company you keep?” Well, in the world of real estate appraisals, it’s more like, “Your property’s value is only as accurate as the comps it’s compared to.” Comparable sales, or “comps,” are the lifeblood of a solid appraisal. They’re the benchmark against which your property’s value is measured.

Imagine you’re selling a three-bedroom house with a spacious backyard and a newly renovated kitchen. It would be reasonable to compare your property to a similar one that recently sold in your neighborhood.

But what if the appraiser compares it to a smaller, outdated property or one in a less desirable location? The result could be a skewed appraisal that undervalues your property.

So, how do you spot this red flag? It’s all about doing your homework. Research recent sales of similar properties in your area. If the comps used in your appraisal don’t match up, that’s a red flag.

But don’t stop there. If you find discrepancies, bring them to the attention of the appraiser or lender. Provide them with the accurate comps and ask for a review of the appraisal. Remember, it’s not about challenging the expertise of the appraiser, but ensuring the accuracy of your appraisal. After all, your property’s worth is on the line.

Red Flag 3: Inexperienced Appraiser

Imagine walking into a restaurant, and the chef tells you it’s his first day cooking. You’d probably be a bit apprehensive, right? The same goes for appraisals. An inexperienced appraiser is like a rookie chef – they might know the basics, but they lack the finesse and insight that come with years of experience.

An inexperienced appraiser might miss subtle details or nuances that a seasoned pro would catch. This could lead to a less accurate valuation of your property, which could impact your transaction significantly. Picture this – an appraiser underestimates the value of your property by 10%. That could mean thousands of dollars left on the table. Ouch!

So, how do you know if your appraiser is a rookie or a seasoned pro? Again, it’s all about doing your homework. Check their credentials and ask about their experience. How long have they been in the business? How many appraisals have they done? Have they worked in your area before? These questions can give you a sense of their level of expertise.

Also, remember that experience isn’t just about quantity; it’s about quality too. Has the appraiser continued their education and stayed up-to-date with industry trends? Have they received positive feedback from clients? These factors can indicate whether an appraiser has the experience and knowledge necessary to provide an accurate, fair valuation.

In the end, if something doesn’t feel right, don’t be afraid to speak up or seek a second opinion. After all, it’s your property and your transaction on the line. Don’t settle for less than the best.

Red Flag 4: Geographic Incompetence

“Geographic incompetence” sounds like an insult you’d throw at a lost tourist, doesn’t it? Well, in the realm of real estate appraisals, it’s a real issue that can make or break a property’s valuation. Let’s break it down.

Geographic incompetence refers to an appraiser’s lack of familiarity with the area where the property is located. It’s like asking a New Yorker for the best bourbon tasting here in Louisville– they might have an opinion, but it’s unlikely to be as informed as a local’s.

When an appraiser doesn’t know the local market well, they can miss crucial details that impact a property’s value. This could include anything from overlooking local amenities to failing to account for the area’s growth potential or unique real estate trends.

So, how do you spot this red flag? You might notice a lack of local comparable sales in the report or a disregard for location-specific factors that could affect the property’s value. The appraiser might also make assumptions or generalizations that don’t quite fit with what you know about the area.

If you suspect geographic incompetence, don’t panic. Instead, take action. Ask the appraiser about their experience with your area. If they’re not forthcoming or their answers don’t inspire confidence, consider informing your lender or getting a second opinion. As I said before, it’s your property, your deal, and you have the right to an accurate appraisal.

Remember, even seasoned appraisers can falter when they step out of their geographic comfort zone. It’s up to you to ensure your property is evaluated by someone who knows the lay of the land.

Red Flag 5: Bias or Prejudice

Let’s take a moment to think about the last time you had to make a decision. Did you rely solely on facts and figures, or did your personal feelings or preconceived notions come into play? Now, imagine that same scenario, but in the context of an appraisal. Bias or prejudice, whether intentional or subconscious, can significantly skew an appraisal, leading to a less-than-accurate property valuation.

Bias in an appraisal can manifest in various ways. It might show up as favoritism towards a certain type of property or neighborhood, or it could be a negative bias against properties in less affluent areas. Prejudice, on the other hand, could stem from personal beliefs or experiences, and can equally distort an appraiser’s judgment.

Spotting signs of bias or prejudice in an appraisal can be tricky, as they often hide behind the veil of professional discretion. However, a few telltale signs might include a lack of comparable sales in the report, or a repeated pattern of undervaluing certain types of properties or locations.

If you suspect bias or prejudice in your appraisal, it’s essential to address it head-on. Start by discussing your concerns with the appraiser. Remember, it’s entirely possible for bias to be unintentional, and a professional appraiser should be open to reassessing their work.

If the appraiser dismisses your concerns, consider seeking a second opinion. It’s crucial to ensure your property is evaluated objectively and accurately, free from any bias or prejudice.

In the end, the goal is to ensure fairness and accuracy in the appraisal process. By being vigilant and knowledgeable, you can play an active role in achieving this.

Navigating Property Value Disputes

When you’ve spotted a red flag in your appraisal report, what’s the next step? How do you navigate the choppy waters of property value disputes? Don’t worry, it’s not as daunting as it sounds. You’re not the first to face this, and certainly won’t be the last. Let’s walk through this together.

First things first, keep calm. A dispute doesn’t mean you’re at a dead-end. It’s simply a bump in the road that calls for some negotiation and, possibly, a little professional intervention.

Your first option is to request a second opinion. Just like in medicine, a second opinion in real estate can provide a fresh perspective, a different angle. It’s not about questioning the first appraiser’s competence (although sometimes, that might be the case), but about ensuring you have the most accurate and fair evaluation.

Remember, every appraiser brings their own experience and expertise to the table, and a second opinion might just bring you closer to the true value of your property.

But what if a second opinion isn’t enough? What if the dispute persists? This is where challenging the appraisal comes into play. To do this, you’ll need to gather solid evidence to support your claim. This might include recent comparable sales that were overlooked, or specific, factual errors in the report. It’s not about discrediting the appraiser, but about ensuring the report reflects the true value of your property.

In the end, navigating property value disputes requires a balanced blend of patience, assertiveness, and a good understanding of the appraisal process. It’s not about winning or losing, but about ensuring fairness and accuracy. After all, your property isn’t just a number on a report, it’s a significant investment. And it deserves a fair and accurate appraisal.

Conclusion

In the bustling realm of real estate, the appraisal report is your compass. It’s what guides you through the terrain of transactions, pointing out the true value of the property in question. But just like any compass, it needs to be accurate to be of any use. This is why it’s crucial to keep an eye out for those red flags we’ve talked about.

Remember, the devil is often in the details. Inaccurate property details can skew the appraisal, leading to a value that’s either too high or too low. Comparable sales, when overlooked or misused, can also throw off the appraisal.

The competency and impartiality of the appraiser are equally vital. An inexperienced appraiser or one with a geographic incompetence can easily miss the mark. And let’s not forget the role of bias or prejudice, subtle as it may be, in influencing the appraisal.

So, what’s the takeaway from all this? Vigilance and knowledge are your best allies in ensuring a fair and accurate appraisal. In the end, it’s all about ensuring that the real estate transaction is fair for all parties involved. And armed with the information we’ve discussed, you’re well on your way to doing just that.

So, go forth and conquer the world of real estate, one accurate appraisal at a time.

If you need an appraisal ally, give me a call. I am always here to help!

by Conrad Meertins | Nov 11, 2024 | Valuation

Here is a shocking truth – When it comes to appraising a property, not all homes are created equal.

This article aims to shed light on the specific factors that differ when appraising a condo versus a single-family home, and why it’s crucial for real estate agents, buyers, and sellers to understand these nuances.

How the Type of Property Affects the Appraisal Process and Final Valuation

On the surface, the difference between a condo and a single-family home might seem like a matter of maintenance. However, from an appraisal standpoint, various factors affect the process and final valuation. Let’s delve into what goes into appraising each type of property.

What Goes Into Appraising a Single-Family Home?

The general process for a single-family home appraisal includes collecting property data, such as land, square footage, home condition, and improvements. Then comes the all-important market analysis and comparable sales analysis.

These factors help the appraiser to have a comprehensive view of the property’s worth, setting the stage for its market value.

What Goes Into Appraising a Condo?

In contrast, condo appraisals focus on different aspects. Here, property data collection includes common areas and amenities, Homeowners Association (HOA) fees, the percentage of owner-occupied units, and information about the subject project. Comparable sales within the same building or complex are always preferred if possible.

For instance, I once appraised a stand-alone condo that looked like a single-family home with land. However, the owner only owned the interior of the unit, not the land, making comps from typical single-family homes not suitable. Understanding these subtleties is vital for an accurate appraisal.

Key Differences Between Condo and Single-Family Home Appraisals

Ownership Elements: Single-family homes include land, while condos focus on common areas.

Comparative Sales: Condos require comps from other condo units (in the same building or complex whenever possible)

Appreciation Rate: Condos typically appreciate at a slower rate compared to single-family homes.

How Realtors Can Help

Real estate agents play a pivotal role in guiding their clients through the appraisal process. It’s not uncommon for people to look at the percentage increase in home values and assume their condo is appreciating at the same rate.

However, this is usually not the case. Moreover, choosing an appraiser experienced with the specific type of property is crucial for an accurate valuation.

The Importance of Expertise in Appraisals

Expertise comes into play when gathering information about a condo project. An unaware appraiser may state that certain info is unavailable, but an expert knows where to look.

For example, the county clerk’s office can provide a wealth of information about the condo project, from the legal description to the number of units in the project. Mastery of this small learning curve can make a significant difference in the appraisal process.

In summary, understanding the nuances between condo and single-family home appraisals can make all the difference in a successful real estate transaction. Choose your appraiser wisely and arm yourself with the right information for a seamless appraisal experience.

Contact us today for a free consultation and learn how our appraisal services can help you achieve your real estate goals.

by Conrad Meertins | Sep 2, 2024 | Valuation

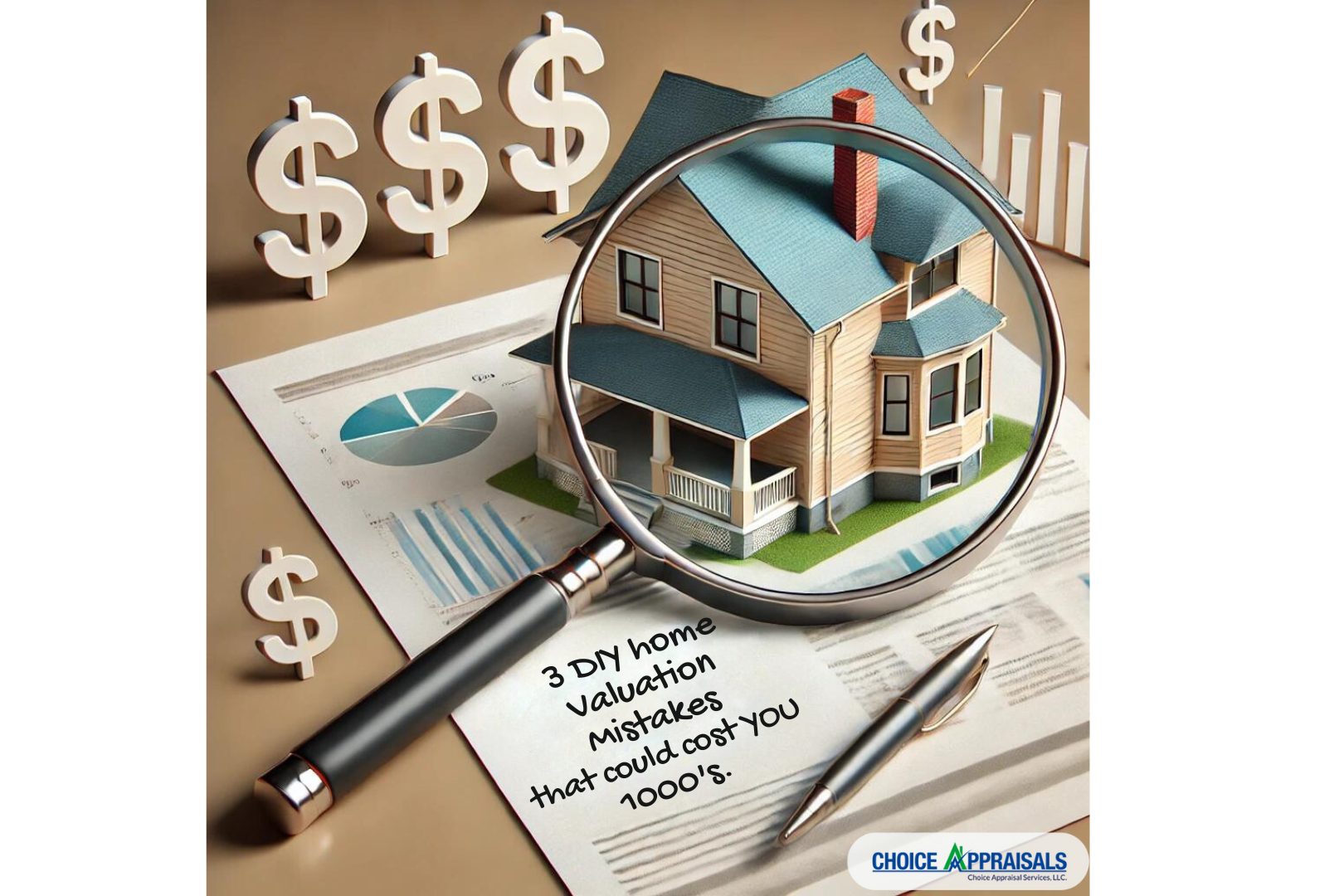

In our fast-paced world, everyone craves value—and we want it instantly. But when it comes to your home’s value, quick fixes aren’t always the best solution.

I’ve previously discussed the pros and cons of online calculators, but today, let’s explore three critical reasons why DIY valuations can be risky:

- Failing to Identify the Underlying Problem

- Lack of Access to Comprehensive Data

- Insufficient Analytical Skills and Tools

These three pitfalls are interconnected—missing the underlying problem leads to misinterpreting the data, which then compounds the errors in your valuation. Let’s delve into each of these in more detail.

1. Missing the Underlying Problem

This might sound surprising, but every house has a “problem” that impacts its value—even brand new ones. By “problem,” I’m referring to a valuation question that must be uncovered to determine the true worth of the property.

For instance, I was once asked to appraise a new construction home in a mature neighborhood where no new homes had been built within a half-mile radius for three years. The key question—or problem—was, “How does the lack of recent new construction sales in the area affect this home’s value?”

Identifying the underlying problem is crucial because it shapes the entire valuation approach. Questions like, “When was the last new construction sale in this area?” or “Are there similar new constructions nearby?” become central.

Without pinpointing the problem, a DIY valuation will likely miss the mark, leading to a flawed estimate.

2. Lack of Access to Comprehensive Data

Where do most people turn for home sale data? Sites like Zillow are common, but they often provide incomplete information.

Realtors have access to gold mines like the Multiple Listing Service (MLS) and Property Valuation Administrator (PVA) websites, which offer more extensive data, especially for unique properties like new constructions.

However, simply accessing data isn’t enough; knowing how to extract and interpret it is key. Early in my career, I made the mistake many DIYers make today—relying on a few neighborhood sales to determine value.

But it’s vital to understand the highs and lows of the market area before drawing conclusions. A DIY valuation might overestimate a property’s value, missing critical market trends that indicate the area can only support 80% of the DIY estimated price.

3. Insufficient Analytical Skills and Tools

Data analysis is where many DIY valuations fall short. Imagine trying to assess a neighborhood with 200 recent sales—how do you determine which ones are relevant? Should some sales be excluded? What are the quarterly price trends?

These questions may significantly influence the final value and answering them requires more than just raw data—it requires the right tools and expertise.

Online resources might offer broad figures, like the median sales price for homes in Louisville, but Louisville has over 100 neighborhoods, each with its own unique market. Without the ability to analyze data specific to your home’s market area, a DIY valuation is bound to be inaccurate.

Wrap-up

In summary, DIY home valuations often fall short because they miss critical steps that professional appraisers never overlook. First, they fail to identify the underlying problem that drives the property’s true value. Without pinpointing this, the entire valuation process is compromised from the start.

Second, they lack access to comprehensive data that realtors and appraisers use to make informed decisions.

Lastly, even when data is available, DIYers often don’t have the tools or expertise needed to analyze it properly, leading to inaccurate and potentially costly errors.

As an appraiser, I approach each property with a well-honed process that starts with identifying the key valuation question, gathering and analyzing data from multiple trusted sources, and using advanced tools to ensure every factor is considered.

My 20+ years of experience, coupled with continuous learning and adaptation, allows me to deliver precise, reliable valuations that help you make informed decisions and maximize your property’s value.

If you’re serious about understanding your property’s true worth and making the most informed decisions possible, skip the DIY route. Let me provide you with a comprehensive appraisal that gives you the confidence to move forward without leaving money on the table.

Ready to get started? Contact me today to schedule a professional appraisal and ensure you’re making the best decisions for your property. Your home is one of your most significant investments—let’s make sure you treat it as such.

by Conrad Meertins | Aug 12, 2024 | Valuation

We all obsess over condition—whether it’s the state of our bodies, our cars, or our homes. But when it comes to our homes, does obsession really matter? Sometimes, we get so fixated on the imperfections that we forget the bigger picture, especially when the market conditions take the driver’s seat.

Today, I want to share some observations on how a home’s condition influences its ability to sell, particularly in different market scenarios. By the end, you’ll see how I, as an appraiser, account for condition when preparing reports.

Condition in a Seller’s Market

In a seller’s market, where inventory is low and demand is high, condition still matters, but it’s not always the deal-breaker you might think. Buyers are often so eager to secure a home that they’re willing to overlook flaws and even pay a premium for properties that wouldn’t ordinarily justify such prices.

Why? It all comes down to competition. Think of an auction—when everyone wants the same item, the bidding war pushes prices up, even if the item isn’t perfect. Similarly, in a hot market, buyers are more likely to bid on a home, even if it’s not in pristine condition.

This is where knowing the market environment becomes crucial. If you’re a seller, having a trusted appraiser or realtor who understands the market dynamics can give you a significant edge.

Pro Tip for Realtors: While the market may allow for higher asking prices, be careful not to overestimate. The appraiser still needs to justify the price based on comparable sales, so ensure there are similar homes in the area that have sold for similar prices despite their condition.

Condition in a Buyer’s Market

Now, let’s flip the script. In a buyer’s market—high inventory, low demand—buyers can afford to be picky. This is when condition becomes a critical factor in a home’s saleability. Just to clarify, we’re not in a buyer’s market right now, so don’t get too excited. But if we were, the scenario would be quite different.

Imagine walking into a burger joint where a cheeseburger and a sirloin steak are the same price. Which would you choose? Most would opt for the steak, of course!

In this analogy, the steak represents a home in great condition, while the cheeseburger is a home that needs some work. Both are listed at similar prices, but with no competition, buyers will naturally gravitate toward the better option.

For Sellers: In such a market, if your home is in less-than-perfect condition, be prepared to adjust your asking price to make it more appealing. Remember, when buyers have options, they’re likely to go with the one that offers the best value.

Accounting for Condition in an Appraisal Report

So, how do I, as an appraiser, adjust for condition? Let me walk you through one of my methods. When appraising a property, I start by defining criteria that help me find comparable homes on the market.

For instance, if I’m appraising a 1,000-square-foot, 3-bedroom, 1-bathroom ranch-style home, I’ll look for similar homes that sold within the past year, within a mile of the subject property.

In a densely populated area, this approach should yield around 30 comparable homes. Next, I analyze their condition via the local MLS, assigning each a condition rating (Fair, Average, Avg/Good, Good). Once I have this data, I create a pivot table that gives me the median sale price for each condition category.

Here’s an example of what the data might look like:

|

Condition

|

Median Sale Price

|

| Fair |

$160,000 |

| Average |

$190,000 |

| Avg/Good |

$210,000 |

| Good |

$250,000 |

This table tells me that in this market, buyers are willing to pay $20,000 more for a home in Avg/Good condition compared to one in Average condition, and $60,000 more for a home in Good condition. This is a defensible, market-driven approach to account for condition when setting a list price or producing an appraisal report.

Conclusion

As you can see, condition is important, but the type of market you’re in dictates how important it is. In a seller’s market, it’s less of a factor; in a buyer’s market, it’s crucial. By analyzing similar homes, you can quantify just how much more (or less) someone might pay based on condition.

The bigger the sample size, the more reliable the analysis. I aim to gather at least 30 homes to ensure that my clients receive market-based evidence on how condition affects sales price.

So, the next time you think about a home’s condition, consider the market first. Act with knowledge, consult with a trusted appraiser, and set your price accordingly—don’t let condition become an obstacle to selling your home.