by Conrad Meertins | Aug 12, 2024 | Valuation

We all obsess over condition—whether it’s the state of our bodies, our cars, or our homes. But when it comes to our homes, does obsession really matter? Sometimes, we get so fixated on the imperfections that we forget the bigger picture, especially when the market conditions take the driver’s seat.

Today, I want to share some observations on how a home’s condition influences its ability to sell, particularly in different market scenarios. By the end, you’ll see how I, as an appraiser, account for condition when preparing reports.

Condition in a Seller’s Market

In a seller’s market, where inventory is low and demand is high, condition still matters, but it’s not always the deal-breaker you might think. Buyers are often so eager to secure a home that they’re willing to overlook flaws and even pay a premium for properties that wouldn’t ordinarily justify such prices.

Why? It all comes down to competition. Think of an auction—when everyone wants the same item, the bidding war pushes prices up, even if the item isn’t perfect. Similarly, in a hot market, buyers are more likely to bid on a home, even if it’s not in pristine condition.

This is where knowing the market environment becomes crucial. If you’re a seller, having a trusted appraiser or realtor who understands the market dynamics can give you a significant edge.

Pro Tip for Realtors: While the market may allow for higher asking prices, be careful not to overestimate. The appraiser still needs to justify the price based on comparable sales, so ensure there are similar homes in the area that have sold for similar prices despite their condition.

Condition in a Buyer’s Market

Now, let’s flip the script. In a buyer’s market—high inventory, low demand—buyers can afford to be picky. This is when condition becomes a critical factor in a home’s saleability. Just to clarify, we’re not in a buyer’s market right now, so don’t get too excited. But if we were, the scenario would be quite different.

Imagine walking into a burger joint where a cheeseburger and a sirloin steak are the same price. Which would you choose? Most would opt for the steak, of course!

In this analogy, the steak represents a home in great condition, while the cheeseburger is a home that needs some work. Both are listed at similar prices, but with no competition, buyers will naturally gravitate toward the better option.

For Sellers: In such a market, if your home is in less-than-perfect condition, be prepared to adjust your asking price to make it more appealing. Remember, when buyers have options, they’re likely to go with the one that offers the best value.

Accounting for Condition in an Appraisal Report

So, how do I, as an appraiser, adjust for condition? Let me walk you through one of my methods. When appraising a property, I start by defining criteria that help me find comparable homes on the market.

For instance, if I’m appraising a 1,000-square-foot, 3-bedroom, 1-bathroom ranch-style home, I’ll look for similar homes that sold within the past year, within a mile of the subject property.

In a densely populated area, this approach should yield around 30 comparable homes. Next, I analyze their condition via the local MLS, assigning each a condition rating (Fair, Average, Avg/Good, Good). Once I have this data, I create a pivot table that gives me the median sale price for each condition category.

Here’s an example of what the data might look like:

|

Condition

|

Median Sale Price

|

| Fair |

$160,000 |

| Average |

$190,000 |

| Avg/Good |

$210,000 |

| Good |

$250,000 |

This table tells me that in this market, buyers are willing to pay $20,000 more for a home in Avg/Good condition compared to one in Average condition, and $60,000 more for a home in Good condition. This is a defensible, market-driven approach to account for condition when setting a list price or producing an appraisal report.

Conclusion

As you can see, condition is important, but the type of market you’re in dictates how important it is. In a seller’s market, it’s less of a factor; in a buyer’s market, it’s crucial. By analyzing similar homes, you can quantify just how much more (or less) someone might pay based on condition.

The bigger the sample size, the more reliable the analysis. I aim to gather at least 30 homes to ensure that my clients receive market-based evidence on how condition affects sales price.

So, the next time you think about a home’s condition, consider the market first. Act with knowledge, consult with a trusted appraiser, and set your price accordingly—don’t let condition become an obstacle to selling your home.

by Conrad Meertins | Aug 6, 2024 | Valuation

In the fast-paced (sometimes slow-paced) world of real estate, determining your property’s value is crucial to making informed decisions. Whether you’re selling, buying, or refinancing, understanding your property’s worth can significantly impact your financial outcomes.

This leads to the question: should you rely on a Comparative Market Analysis (CMA) or a Pre-listing Appraisal Report?

Both CMAs and pre-listing appraisals offer valuable insights into property valuation, yet they serve distinct purposes and rely on different methodologies.

This post will examine the key differences between these two approaches, highlighting their unique strengths and offering guidance on when to use each tool effectively.

By the end of this read, you’ll be equipped with the knowledge to choose the best option for your real estate needs, ensuring a strategic approach to your property’s valuation.

Understanding Comparative Market Analysis (CMA)

In the world of real estate, a Comparative Market Analysis (CMA) is a vital tool for both buyers and sellers. It offers a snapshot of the local market, allowing homeowners to gauge the potential selling price of their property. But what exactly is a CMA, and how does it work?

Definition

According to Investopedia, “A comparative market analysis (CMA) estimates a home’s price based on recently sold, similar properties in the immediate area.”

Real estate agents and brokers generate CMA reports to assist sellers in setting competitive listing prices and to help buyers make informed offers. These reports rely on data from homes similar to the subject to paint a picture of the current market conditions.

Key Features

CMAs primarily focus on selecting homes comparable to the subject property. Real estate agents utilize a mix of recent sales, active listings, and expired listings to establish a competitive price range.

This analysis is rooted in real-time market data, reflecting the dynamic nature of real estate. By examining similar properties in terms of size, location, condition, and features, agents can craft a well-rounded estimate of the property’s market value.

Key Elements of a CMA:

-

- Recent Sales: Provides a baseline of what buyers are willing to pay for similar properties.

-

- Active Listings: Shows the current competition and helps position the property strategically.

-

- Expired Listings: Offers insights into price points that didn’t attract buyers, aiding in avoiding overpricing pitfalls.

Strengths

CMAs are particularly valued for their quick and cost-effective nature. They allow real estate agents to set initial listing prices efficiently, which can be crucial in fast-moving markets.

The strengths of CMAs lie in their ability to attract potential buyers by offering a competitive price right from the start. By making informed pricing decisions based on data and trends, agents can enhance the appeal of the property to potential buyers.

Ideal Scenarios for CMAs

CMAs shine in scenarios where a homeowner needs a quick assessment of their property’s market position. They are most effective in areas where properties share similarities, allowing for more accurate comparisons.

Additionally, when an agent’s local expertise can be leveraged, a CMA becomes an invaluable tool in crafting a market strategy that resonates with prospective buyers.

When to Use a CMA:

-

- Quick Assessments: Ideal for sellers needing a rapid overview of market conditions and pricing.

-

- Homogeneous Markets: Effective in neighborhoods with similar properties, providing reliable comparative data.

-

- Agent Expertise: Leveraging an agent’s knowledge of the local market nuances can refine CMA results.

Example Scenario

Imagine a homeowner in a suburban neighborhood with many similar three-bedroom houses. They decide to sell their home and need to determine a competitive asking price.

A CMA allows their real estate agent to quickly analyze recent sales and active listings in the area, providing the homeowner with a realistic price range to attract buyers. This swift analysis ensures the property is neither underpriced nor overpriced, maximizing the chance for a successful sale.

Exploring Pre-listing Appraisal Reports

While Comparative Market Analyses (CMAs) provide a quick snapshot of the real estate landscape, pre-listing appraisals offer a more detailed and structured valuation. For homeowners seeking precision, especially in complex scenarios, understanding the benefits of a pre-listing appraisal is crucial.

Definition

A pre-listing appraisal is a comprehensive valuation conducted by a licensed appraiser, designed to provide an in-depth analysis of a property’s market value before it hits the market.

Unlike CMAs, which are typically performed by real estate agents, appraisals are carried out by licensed professionals who adhere to rigorous standards of USPAP (Uniform Standards of Professional Appraisal Practice) to assess a property’s worth accurately.

Key Features

Market Analysis

Appraisal reports delve deeply into the subject’s market, evaluating trends such as increasing, stable, or declining sold home rates.

Each appraisal report includes a thorough market analysis, offering a broader perspective that accounts for economic factors, local developments, and other market influences. This comprehensive approach ensures that the property’s valuation is well-grounded in the current market context.

Adjustments

Appraisers conduct meticulous analyses to adjust for differences between the subject property and comparable sales. This involves accounting for unique features, such as extra square footage, high-end finishes, or custom-built amenities, providing a more precise valuation.

Adjustments are made to ensure the subject property is accurately compared to others, considering all aspects that may affect its value. It should be noted that appraisal reports are required to have support for how all of its adjustments were derived.

Comparable Selection Criteria

Unlike CMAs, appraisal reports are bound by stringent requirements. Financial institutions often require appraisers to “bracket” the subject’s features, ensuring a balanced and accurate comparison.

This process involves selecting comparables that have slightly more or less desirable features than the subject, thereby offering a more reliable valuation metric (this is only done when the feature in question cannot be matched exactly by a comparable sale).

This bracketing technique helps demonstrate the acceptability of certain features within the market, reinforcing the appraiser’s conclusions. For example, if the subject has a 5 car garages. If a comparable cannot be found with a 5 car garage, at least one with less than five cars and one with more than 5 cars would be included.

Strengths

Pre-listing appraisals are known for their precision and credibility. They provide a detailed property value assessment that can be crucial in setting a realistic list price, especially in unique markets or for high-value properties.

The strengths of pre-listing appraisals lie in their ability to deliver objective, third-party evaluations that homeowners and buyers can trust.

Ideal Scenarios for Pre-listing Appraisals

Pre-listing appraisals shine in scenarios requiring accuracy and detail beyond what a CMA can provide. They are ideal for:

-

- Complex Properties: When a homeowner needs an accurate valuation for properties with intricate designs or multiple unique features.

-

- Unique Features: For properties with distinctive attributes where precise valuation is critical to avoid mispricing.

-

- Objective Assessments: In cases where an unbiased third-party evaluation aids in negotiation or helps prevent disputes during sales transactions.

Example Scenario

Consider a homeowner with a custom-built estate featuring specialized architecture, high-end materials, and unique exterior amenities – let’s say a tennis court. For such a property, a pre-listing appraisal is invaluable.

It accounts for all these distinct elements, providing a precise valuation that reflects its true market value. This detailed assessment not only assists in setting the right price but also supports negotiations, ensuring the seller maximizes their property’s worth.

Having explored the intricacies of pre-listing appraisals and their critical role in accurately valuing complex properties, it becomes evident that both CMAs and appraisals offer unique advantages depending on the situation.

In the next section, we’ll conduct a detailed comparison of CMAs and pre-listing appraisals, examining when and why each method should be employed. This comparison will further illuminate the distinct roles these tools play in real estate, helping you make informed decisions tailored to your specific needs.

Detailed Comparison of CMA and Pre-listing Appraisal Report

Choosing between a Comparative Market Analysis (CMA) and a pre-listing appraisal depends on the specific needs of the property owner and the nature of the real estate market.

Both tools provide valuable insights but differ significantly in their approach, depth, and application. This section highlights these differences to help you make informed decisions on when you may use each one.

Market Analysis

Appraisal Reports:

Appraisal reports offer a detailed market analysis that goes beyond the immediate scope of similar homes. They assess broader market trends, evaluate economic indicators, and consider local and regional factors that might influence property values.

This comprehensive analysis provides insights into how a property’s value fits within the larger market context, offering a more holistic view.

CMAs:

CMAs focus primarily on comparable homes, emphasizing recent sales data, active listings, and sometimes expired listings. While this approach effectively provides a snapshot of local market conditions, it may not delve into larger market trends extensively. CMAs rely heavily on the local expertise of real estate agents to interpret this data within the neighborhood context.

Adjustments

Appraisal Reports:

Appraisal reports are renowned for their meticulous adjustments, which account for differences between the subject property and comparable sales.

These adjustments consider factors like additional bathrooms, square footage, architectural features, and more. The process involves detailed analysis and support for how each adjustment was derived, ensuring that every valuation aspect is justified and precise.

CMAs:

In contrast, CMAs often use similar homes with minimal adjustments. The adjustments are generally based on the agent’s expertise and experience rather than extensive researched data.

While effective for initial pricing strategies, this method may lack the precision of an appraisal, especially in cases where unique property features significantly impact value.

Comparable Selection Criteria

Appraisal Reports:

Appraisal reports adhere to specific rules for selecting comparables, including bracketing features. This means choosing comparables that have both fewer and more features than the subject property.

For instance, if the subject property has a three-car garage, appraisers might select one comparable with a two-car garage and another with a four-car garage. This bracketing ensures a balanced comparison and highlights any unique market features, emphasizing that the property’s traits are not anomalies.

CMAs:

CMAs typically focus on recent sales within a specific area or subdivision, sometimes limiting the scope of comparison. While this can be sufficient for standard properties, it may not fully capture the nuances needed for properties with unique features or those located in diverse markets.

When to Use Each

CMA:

-

- Quick Assessments: When a speedy evaluation of the market is needed.

-

- Competitive Pricing: Useful for setting initial list prices in standard neighborhoods in stable markets.

-

- Agent Expertise: Leverages local knowledge and market conditions.

Pre-listing Appraisal:

-

- Precise Valuations: Essential for detailed and accurate property assessments.

-

- Complex Properties: Ideal for unique or high-value properties requiring detailed analysis including market trend analysis.

-

- Objective Analysis: Necessary when an unbiased, third-party evaluation is crucial for negotiations or dispute prevention.

Example Scenario

Imagine a homeowner with a standard single-family home in a suburban neighborhood where there is abundant sales data and many of the homes are similar. In this case, a CMA can quickly establish a competitive price using recent sales data and the agent’s local expertise.

However, consider a property in a historic district with unique architectural elements and custom features. Here, a pre-listing appraisal is invaluable, providing a detailed analysis that accounts for these distinctive characteristics and ensures an accurate valuation.

Summary

Understanding the differences between a Comparative Market Analysis (CMA) and a pre-listing appraisal is essential for anyone navigating the real estate market. CMAs are valuable tools for quick market positioning, offering insights based on comparable home sales that can help set an initial listing price efficiently.

On the other hand, pre-listing appraisals provide precise valuations, especially beneficial for complex or unique properties where detailed analysis is necessary.

Both CMAs and appraisals hold significant value. As a licensed appraiser, I thoroughly respect the CMA process and appreciate when a realtor provides one.

It offers valuable insight into their valuation approach and acts as one piece of the puzzle in the overall appraisal process. Both tools should be respected for their unique strengths and purposes, and both have their rightful place in the real estate industry.

Final Thoughts

While CMAs serve as excellent starting points for setting prices, they are not a substitute for appraisal reports. Appraisers adhere to strict standards like USPAP, delivering a thorough analysis that can be more appropriate for properties with unique features or those located in diverse markets.

Some real estate agents with extensive market experience can provide valuable insights through CMAs, but if your home isn’t a cookie-cutter replica of others in the area, and if the stakes are high, consider hiring an appraiser. This decision can ensure a more precise valuation, offering peace of mind and strategic advantage in negotiations.

And hey, since CMAs are typically free, why not get both? It’s like having a dessert with your meal—just makes everything better!

What to do next…

I encourage readers to carefully evaluate their needs and consult professionals when deciding between a CMA and a pre-listing appraisal. Understanding the nuances of each tool will enable you to make informed decisions and choose the right strategy for your real estate transactions.

Whether you’re selling, buying, or simply curious about your property’s value, selecting the appropriate approach can make a significant difference. To learn more about pre-listing appraisals give me call.

by Conrad Meertins | Jul 22, 2024 | Valuation

Worried that selling your parent’s home might jeopardize their Medicaid benefits? You’re not alone. Here’s how to navigate this tricky situation with confidence and care.

As adult children, managing the care of aging parents often involves making tough decisions, especially when it comes to their homes. One of the most complex areas is understanding how selling a parent’s home intersects with Medicaid eligibility.

Whether you’re a realtor assisting clients or a homeowner facing these challenges yourself, this guide will help demystify the process and provide practical insights.

Understanding Medicaid Eligibility and Asset Limits

The confusion surrounding Medicaid eligibility and home sales can leave families feeling overwhelmed and uncertain about their next steps.

Asset and Income Limits Medicaid has strict asset and income limits. Typically, a person’s primary residence is exempt from Medicaid’s asset calculations as long as the individual or their spouse lives there.

However, once the individual enters a nursing home permanently, the home may no longer be exempt.

Exemptions and the Home

-

- Exempt While Living in the Home: If the individual or their spouse is living in the home, it’s usually considered an exempt asset.

-

- Intent to Return Home: If the individual in the nursing home declares an intent to return home, the home might still be considered exempt.

-

- Community Spouse: If a spouse continues to live in the home, it remains exempt.

Medicaid Estate Recovery

Imagine facing the loss of your family home to Medicaid estate recovery after spending years caring for a loved one.

Medicaid has the right to recover costs from the estate of the deceased Medicaid beneficiary, known as Medicaid Estate Recovery. If the home is sold after the individual’s death, Medicaid can place a lien on the home to recover the costs paid for the individual’s care.

Selling the Home Before or During Medicaid Application

Understanding the timing of selling the home is critical to maintaining Medicaid eligibility and avoiding costly penalties.

-

- Before Applying for Medicaid: Selling the home before applying for Medicaid might disqualify the individual from Medicaid for a period due to the asset transfer. Medicaid has a look-back period (typically five years) to prevent asset transfers meant to qualify for Medicaid.

-

- During Medicaid Application: If the home is sold while the individual is receiving Medicaid, the proceeds from the sale could affect their eligibility, as the funds from the sale might be considered an asset, pushing the individual above Medicaid’s asset limit.

Fair Market Value and Medicaid Compliance

Why Accurate Appraisal Matters The fair market value (FMV) of your parent’s home plays a crucial role in Medicaid. Medicaid requires an accurate appraisal to determine the value of assets.

An inaccurate appraisal—either overestimating or underestimating the home’s value—can lead to significant issues such as penalties or denial of benefits.

Example Scenario:

-

- Appraised Value: $200,000

-

- Best Offer Received: $175,000

In this scenario, Medicaid considers the appraised value of $200,000 when determining eligibility, even if the best offer received is only $175,000.

Implications of Appraised Value on Medicaid Eligibility

-

- Overestimating: If the home’s value is overestimated, it may appear that your parent has more assets, potentially disqualifying them from Medicaid or delaying eligibility.

-

- Underestimating: Underestimating the value can be seen as an attempt to reduce countable assets, which Medicaid might scrutinize, potentially leading to penalties.

Navigating the Medicaid Look-Back Period

Understanding the look-back period can save your family from unexpected penalties and ensure your loved one’s Medicaid eligibility.

Medicaid has a five-year look-back period to prevent asset transfers meant to qualify for Medicaid. If the home is sold for less than its appraised value within this period, the difference might be considered a gift, resulting in penalties.

Example: If the home is appraised at $200,000 but sold for $175,000, Medicaid may view the $25,000 difference as a gift, imposing a penalty period.

Practical Steps for Adult Children and Homeowners

-

- Get an Accurate Appraisal: Ensure the appraisal reflects the true FMV of the property to avoid complications.

-

- Document Everything: If the home sells for less than the appraised value, document the reasons thoroughly to provide to Medicaid if needed.

-

- Consult Professionals: Work with Medicaid planners or elder law attorneys to navigate the sale and its implications for Medicaid eligibility.

Navigating the complexities of home sales and Medicaid can be overwhelming, but you’re not alone. With the right information and careful planning, you can protect your parent’s benefits and make decisions that support their care and well-being.

As realtors and homeowners, staying informed about these processes not only helps in compliance with Medicaid regulations but also ensures the best outcomes for your loved ones.

by Conrad Meertins | Apr 22, 2024 | Valuation

In the ever-evolving world of real estate, “sharpening your saw”—a principle popularized by Stephen Covey in his seminal work “The 7 Habits of Highly Effective People”—isn’t just a recommendation, it’s essential.

This habit of self-renewal and continuous improvement is critical in Louisville, where market dynamics shift as quickly as the seasons. Mastering the subtleties of property valuation and market trends can catapult your results from mediocre to stellar.

Whether you’re a seasoned real estate professional or a first-time homeowner, the insights we share here will empower you to not just participate, but excel in the market.

With technological advancements and economic shifts transforming the landscape at breakneck speed, the need to continuously “sharpen your saw” in the realm of real estate has never been more critical.

Dive into this article to discover actionable tips and expert insights that will not only keep you competitive but also turn you into a market sage in Louisville’s vibrant real estate scene.

For Homeowners: Master Your Market for Better Outcomes

Imagine discovering that your home in Louisville could sell for 20% more than you expected. That’s not just good luck; it’s the power of understanding key real estate principles like market areas, comparable sales, and equity.

• Market Areas: Think of your market area in Kentucky as the neighborhood where you live, work, and play. It’s the circle around your home that includes the places you frequent. By understanding the dynamics of your market area, you can better gauge your home’s worth in relation to the local happenings.

• Comparable Sales (Comps): Comps are like your home’s competitors in the market race. They help set the stage for pricing your home accurately—ensuring you don’t overprice and linger on the market, or underprice and miss out on potential gains.

For instance, if homes with updated kitchens in your area are fetching a premium, that might inspire some strategic home improvements on your part.

• Equity: Knowing your home’s equity, which is the difference between its market value and any mortgage balance, could influence significant financial decisions. It’s especially useful if local property values in Louisville are rising, suggesting a good time to tap into that equity for home improvements.

Below is an engaging and educational quiz titled “How Well Do You Know Your Real Estate Terms?” aims to test the homeowner’s knowledge on critical real estate concepts.

For Agents: Elevate Your Services with Advanced Tools and Techniques

Being a real estate agent in Louisville’s market means staying ahead of the curve. It’s not just about selling homes; it’s about providing exceptional service that distinguishes you from the competition. Here’s how you can elevate your practice:

• Refined Comparative Market Analyses (CMAs): As an agent, your ability to conduct precise and insightful CMAs is crucial. This isn’t just about gathering data; it’s about deeply analyzing it to understand subtle market shifts and nuances.

By continuously refining your approach to CMAs, you ensure that your valuations reflect the most current market conditions in Louisville, giving your clients confidence in your pricing strategies.

• Adherence to Standards: Ensuring property measurements comply with the American National Standards Institute (ANSI) standards is not just about accuracy; it’s about trust. When clients know they can rely on your measurements, you build a foundation of credibility that is invaluable in this industry.

Enhancing Data Analysis to Serve You Better

As a real estate appraiser, to further support both homeowners and agents, I’ve advanced my expertise in data analysis through the use of R programming.

This powerful statistical tool allows me to handle, analyze, and visualize extensive datasets with precision—unveiling trends and patterns that inform more accurate market analyses and home appraisals.

Whether you’re determining the most accurate listing price or strategizing on property investments, my enhanced analytical capabilities ensure you receive the most reliable insights. This commitment to leveraging cutting-edge technology in data analysis underpins the superior service I strive to provide all my clients.

Embracing AI to Revolutionize Real Estate Transactions

The integration of AI tools into real estate is transforming the buying and selling experience for homeowners in Louisville.

By providing tailored insights and making processes smoother and more transparent, AI technologies help homeowners make informed decisions with increased confidence.

This advancement in technology ensures that each step of the real estate transaction is optimized for efficiency and clarity.

For agents, learning to utilize these advanced technologies can significantly boost your ability to manage more clients and properties simultaneously without compromising on the quality of service.

AI enables you to deliver more accurate property valuations, proactively anticipate market trends, and provide customized advice. This positions you as tech-forward professionals in a digital-first market.

The adoption of AI in real estate transcends mere technological advancement—it’s about embracing a new standard of excellence and sparking innovation across the industry. This shift not only enhances how you operate but also elevates the overall client experience, making it more efficient and informed.

Continuously Sharpen Your Saw

This post marks the conclusion of our series where we’ve applied Stephen Covey’s seminal work, “7 Habits of Highly Effective People,” to the real estate industry, specifically focusing on how these principles can transform your practice in Louisville.

It’s the continuous pursuit of knowledge and skill enhancement that sets the true leaders apart from the crowd. Whether it involves deepening your understanding of the market, embracing cutting-edge technologies, or refining your data analysis skills, each step you take is crucial.

These advancements are not just about keeping up—they’re about setting new benchmarks in service and expertise. I’d like to extend a heartfelt thank you for joining me on this insightful journey.

Let’s continue to engage with these innovative tools and concepts, commit to our professional growth, and confidently prepare to meet the future challenges of real estate head-on. Together, we will not only adapt but excel in this ever-evolving industry.

by Conrad Meertins | Jan 30, 2024 | Market Trends

In the heart of Louisville, real estate embodies a simple truth: everyone can indeed win. As an appraiser and an optimist who always looks for the silver lining, I see the essence of ‘Win-Win’ deeply ingrained in the process of buying and selling properties.

Just think of the definition of market value—a probable price struck when buyers and sellers, each acting in their own best interest without pressure, reach a harmonious agreement. This is the epitome of ‘Win-Win’ in our world.

But let’s get practical—how does this philosophy translate into the nuts and bolts of property valuation and deciding how to list your home?

It all begins with facts. A quote that I love is as follows: True victory is not in the acquisition alone but in the integrity of the transaction. Misrepresentation benefits no one.

That’s why due diligence is a cornerstone. And for us real estate professionals, our role is crucial—we must anchor our valuations in reality, not fancy. In this context, thinking ‘Win-Win’ is built on understanding the facts of our current real estate landscape in Louisville.

Let’s lay out these facts, not with complexity but with the clarity that empowers. With a clear view of how the market has fared in the first month of 2024, we pave the way for decisions that benefit all.

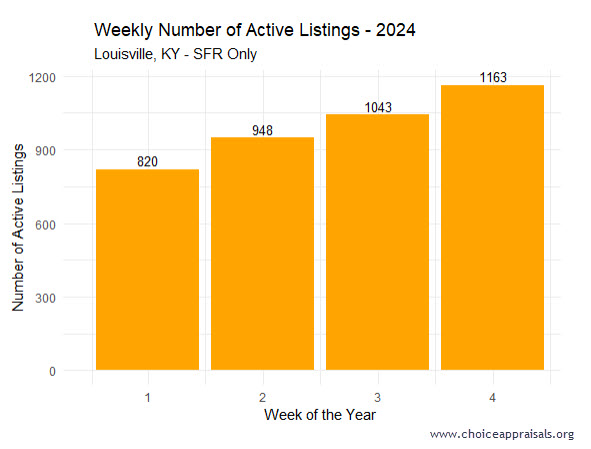

Active Listings: Climbing Towards More Opportunities

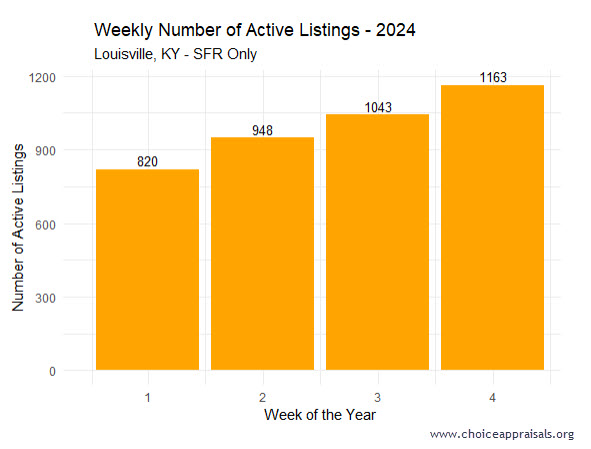

The bar graph illustrates an upward trend in the number of active listings from 820 in the first week to 1163 by the fourth week.

A growing inventory could be indicative of two trends: either sellers are entering the market to take advantage of favorable conditions, or it could suggest a slowdown where listings are staying on the market longer than in previous periods.

It’s important for agents and homeowners to watch this trend closely, as a high inventory level could lead to a more competitive market for sellers, possibly affecting prices and selling strategies.

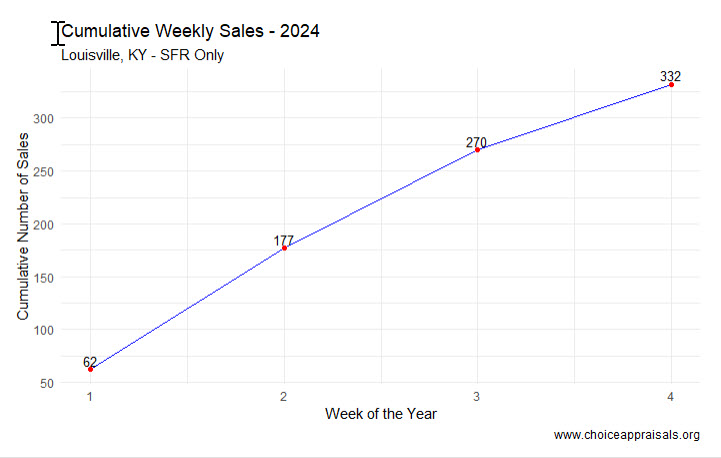

Cumulative Sales: Assessing the Market’s Lift-Off

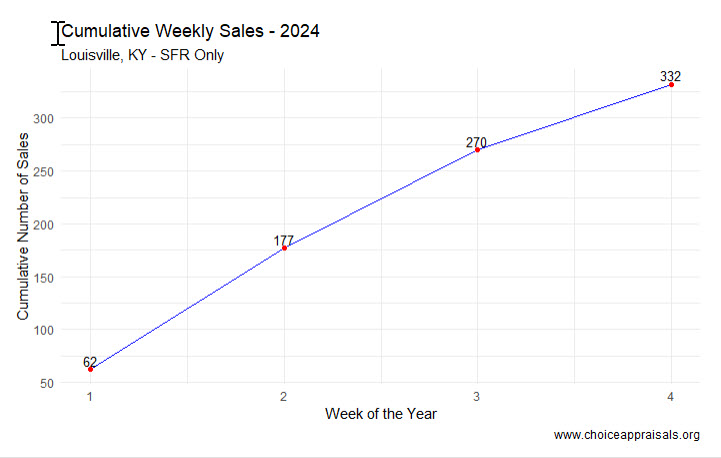

The “Cumulative Weekly Sales – 2024” graph for Louisville, KY, depicts an upward trend in property sales over the first month, with sales rising from 62 to 332. While at first glance this seems to indicate a thriving market, we have to be careful.

The trend does not necessarily signify robust growth without a benchmark. Seasonal influences also play a crucial role in real estate activity. So, it’s important to question whether this early-year sales uptick means.

Time will tell but for the sake of home buyers, realtors and appraisers, we hope it’s a sign of greater sales volume than last year.

In this context, a Win-Win scenario materializes when everyone leverages this data coupled with the information about active listings to make decisions that reflect both the present moment and the potential of the market’s future.

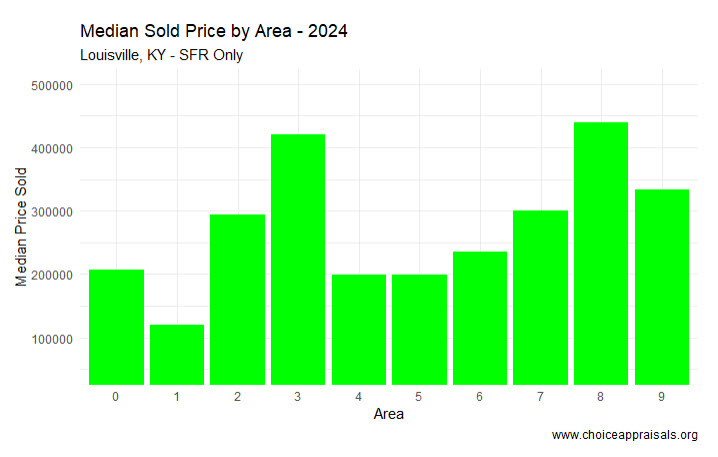

MLS Areas: Decoding the Sales Price Variance

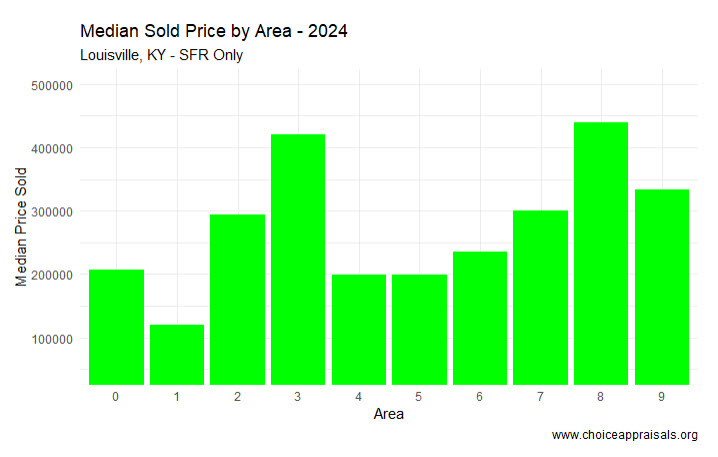

The graph showcasing the “Median Sold Price by Area – 2024” in Louisville, KY, for single-family residences reveals varied median prices across nine different areas.

This variance highlights the diverse nature of the housing market within the city, suggesting that certain areas are more in demand or possess attributes that command higher prices—factors such as school districts, proximity to amenities, and neighborhood desirability might be influencing these figures.

Notably, Area 8 stands out with a median price significantly higher than the others, which could indicate a premium neighborhood or area with larger or more luxurious homes. Conversely, Areas 1 exhibits a notably lower median sold price, which could reflect a variety of factors such as older homes, or more modest housing options.

Interesting Fact: Area 1 had the second highest amount of sales volume for the first four weeks of January 2024 with 47 sales. I personally have done more Louisville appraisals in this part of town in the past 30 days. Area 8 came in at #5 with 35 sales. It’s funny how the winner changes when we change the lens that we look through.

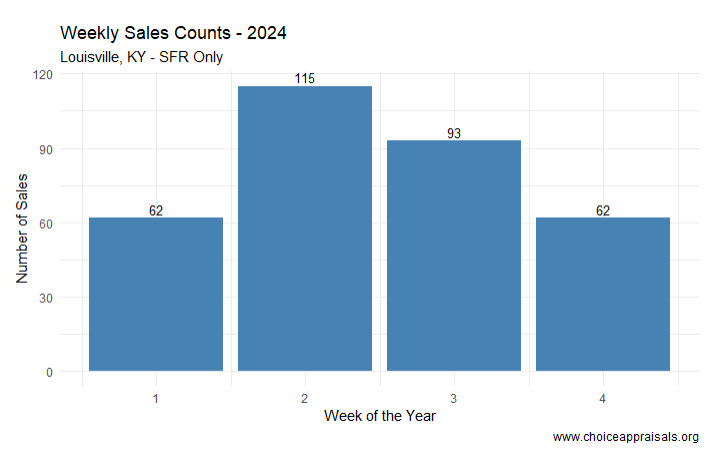

Weekly Sales: Unpacking the Market’s Pulse

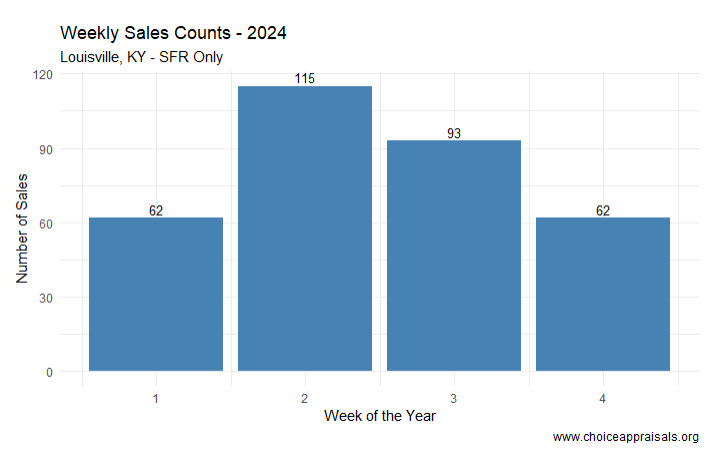

The “Weekly Sales Counts – 2024” graph for Louisville, KY, presents a roller coaster like sales pattern within the first month of the year. We begin with 62 sales in week one, surge to 115 sales in the second week, then experience a decrease to 93 in week three, before returning to the starting point of 62 sales in week four.

This ebb and flow could reflect a number of underlying market dynamics. The initial rise in sales might indicate a wave of activity often seen at the beginning of a new year, as buyers and sellers enter the market with fresh goals.

Then, week three seems to whisper, “Let’s just slow down and think about this,” possibly due to buyer hesitancy or sellers holding out for better offers. By week four, we’re back to where we started, which could be a sign of market stabilization—or maybe it’s just taking a nap after the excitement of the year end – I think/hope it’s the latter!

The subsequent fall could suggest that this initial enthusiasm is tempered by external factors, such as economic news or interest rate adjustments, which may cause market participants to act more cautiously.

Overall, this data underscores the importance of monitoring weekly market movements closely, as they can provide early indications of shifts in buyer and seller behavior that could impact strategy and decision-making.

Valuations: Crafting a Win-Win Strategy

When it comes to valuations, ‘Think Win-Win’ is about fairness and balance. For realtors and clients in Louisville, here’s how you can put this into practice:

Stay Informed and Educate: The real estate market is dynamic, and being well-informed is key. An educated homeowner is more likely to price their home accurately, and an educated buyer can make a fair offer.

Regular Market Analysis: Keep an eye on how homes are priced in different areas. Realtors should provide homeowners with a regular analysis of how the market is moving, not just in terms of price but also in how long homes stay on the market.

Set Realistic Expectations: Help clients set realistic expectations based on market data. If the market is indicating a decrease in demand, homeowners should be prepared for potentially longer selling times.

Listen and Adapt: A Win-Win situation comes from understanding what the other party values. Listen to buyers and sellers carefully and adapt your strategy to align with their goals.

Prepare for Different Scenarios: The market can shift unexpectedly. Have a plan for different scenarios, whether it’s a sudden uptick in interest rates or a change in buyer sentiment.

Conclusion

In the Louisville market, adopting a ‘Think Win-Win’ approach in real estate isn’t just idealistic, it’s practical. It’s about creating transactions where buyers and sellers walk away satisfied, where the value is fair, and where the community thrives on the integrity of its dealings.

I invite you to reflect on this philosophy and how it has shaped your experiences in real estate. Have you encountered situations where the Win-Win approach turned a negotiation around or created a surprising opportunity? Share your stories and insights. Let’s continue the conversation and learn from each other, so we can all reap the rewards of a market that works for everyone.