by Conrad Meertins | Aug 6, 2024 | Valuation

In the fast-paced (sometimes slow-paced) world of real estate, determining your property’s value is crucial to making informed decisions. Whether you’re selling, buying, or refinancing, understanding your property’s worth can significantly impact your financial outcomes.

This leads to the question: should you rely on a Comparative Market Analysis (CMA) or a Pre-listing Appraisal Report?

Both CMAs and pre-listing appraisals offer valuable insights into property valuation, yet they serve distinct purposes and rely on different methodologies.

This post will examine the key differences between these two approaches, highlighting their unique strengths and offering guidance on when to use each tool effectively.

By the end of this read, you’ll be equipped with the knowledge to choose the best option for your real estate needs, ensuring a strategic approach to your property’s valuation.

Understanding Comparative Market Analysis (CMA)

In the world of real estate, a Comparative Market Analysis (CMA) is a vital tool for both buyers and sellers. It offers a snapshot of the local market, allowing homeowners to gauge the potential selling price of their property. But what exactly is a CMA, and how does it work?

Definition

According to Investopedia, “A comparative market analysis (CMA) estimates a home’s price based on recently sold, similar properties in the immediate area.”

Real estate agents and brokers generate CMA reports to assist sellers in setting competitive listing prices and to help buyers make informed offers. These reports rely on data from homes similar to the subject to paint a picture of the current market conditions.

Key Features

CMAs primarily focus on selecting homes comparable to the subject property. Real estate agents utilize a mix of recent sales, active listings, and expired listings to establish a competitive price range.

This analysis is rooted in real-time market data, reflecting the dynamic nature of real estate. By examining similar properties in terms of size, location, condition, and features, agents can craft a well-rounded estimate of the property’s market value.

Key Elements of a CMA:

-

- Recent Sales: Provides a baseline of what buyers are willing to pay for similar properties.

-

- Active Listings: Shows the current competition and helps position the property strategically.

-

- Expired Listings: Offers insights into price points that didn’t attract buyers, aiding in avoiding overpricing pitfalls.

Strengths

CMAs are particularly valued for their quick and cost-effective nature. They allow real estate agents to set initial listing prices efficiently, which can be crucial in fast-moving markets.

The strengths of CMAs lie in their ability to attract potential buyers by offering a competitive price right from the start. By making informed pricing decisions based on data and trends, agents can enhance the appeal of the property to potential buyers.

Ideal Scenarios for CMAs

CMAs shine in scenarios where a homeowner needs a quick assessment of their property’s market position. They are most effective in areas where properties share similarities, allowing for more accurate comparisons.

Additionally, when an agent’s local expertise can be leveraged, a CMA becomes an invaluable tool in crafting a market strategy that resonates with prospective buyers.

When to Use a CMA:

-

- Quick Assessments: Ideal for sellers needing a rapid overview of market conditions and pricing.

-

- Homogeneous Markets: Effective in neighborhoods with similar properties, providing reliable comparative data.

-

- Agent Expertise: Leveraging an agent’s knowledge of the local market nuances can refine CMA results.

Example Scenario

Imagine a homeowner in a suburban neighborhood with many similar three-bedroom houses. They decide to sell their home and need to determine a competitive asking price.

A CMA allows their real estate agent to quickly analyze recent sales and active listings in the area, providing the homeowner with a realistic price range to attract buyers. This swift analysis ensures the property is neither underpriced nor overpriced, maximizing the chance for a successful sale.

Exploring Pre-listing Appraisal Reports

While Comparative Market Analyses (CMAs) provide a quick snapshot of the real estate landscape, pre-listing appraisals offer a more detailed and structured valuation. For homeowners seeking precision, especially in complex scenarios, understanding the benefits of a pre-listing appraisal is crucial.

Definition

A pre-listing appraisal is a comprehensive valuation conducted by a licensed appraiser, designed to provide an in-depth analysis of a property’s market value before it hits the market.

Unlike CMAs, which are typically performed by real estate agents, appraisals are carried out by licensed professionals who adhere to rigorous standards of USPAP (Uniform Standards of Professional Appraisal Practice) to assess a property’s worth accurately.

Key Features

Market Analysis

Appraisal reports delve deeply into the subject’s market, evaluating trends such as increasing, stable, or declining sold home rates.

Each appraisal report includes a thorough market analysis, offering a broader perspective that accounts for economic factors, local developments, and other market influences. This comprehensive approach ensures that the property’s valuation is well-grounded in the current market context.

Adjustments

Appraisers conduct meticulous analyses to adjust for differences between the subject property and comparable sales. This involves accounting for unique features, such as extra square footage, high-end finishes, or custom-built amenities, providing a more precise valuation.

Adjustments are made to ensure the subject property is accurately compared to others, considering all aspects that may affect its value. It should be noted that appraisal reports are required to have support for how all of its adjustments were derived.

Comparable Selection Criteria

Unlike CMAs, appraisal reports are bound by stringent requirements. Financial institutions often require appraisers to “bracket” the subject’s features, ensuring a balanced and accurate comparison.

This process involves selecting comparables that have slightly more or less desirable features than the subject, thereby offering a more reliable valuation metric (this is only done when the feature in question cannot be matched exactly by a comparable sale).

This bracketing technique helps demonstrate the acceptability of certain features within the market, reinforcing the appraiser’s conclusions. For example, if the subject has a 5 car garages. If a comparable cannot be found with a 5 car garage, at least one with less than five cars and one with more than 5 cars would be included.

Strengths

Pre-listing appraisals are known for their precision and credibility. They provide a detailed property value assessment that can be crucial in setting a realistic list price, especially in unique markets or for high-value properties.

The strengths of pre-listing appraisals lie in their ability to deliver objective, third-party evaluations that homeowners and buyers can trust.

Ideal Scenarios for Pre-listing Appraisals

Pre-listing appraisals shine in scenarios requiring accuracy and detail beyond what a CMA can provide. They are ideal for:

-

- Complex Properties: When a homeowner needs an accurate valuation for properties with intricate designs or multiple unique features.

-

- Unique Features: For properties with distinctive attributes where precise valuation is critical to avoid mispricing.

-

- Objective Assessments: In cases where an unbiased third-party evaluation aids in negotiation or helps prevent disputes during sales transactions.

Example Scenario

Consider a homeowner with a custom-built estate featuring specialized architecture, high-end materials, and unique exterior amenities – let’s say a tennis court. For such a property, a pre-listing appraisal is invaluable.

It accounts for all these distinct elements, providing a precise valuation that reflects its true market value. This detailed assessment not only assists in setting the right price but also supports negotiations, ensuring the seller maximizes their property’s worth.

Having explored the intricacies of pre-listing appraisals and their critical role in accurately valuing complex properties, it becomes evident that both CMAs and appraisals offer unique advantages depending on the situation.

In the next section, we’ll conduct a detailed comparison of CMAs and pre-listing appraisals, examining when and why each method should be employed. This comparison will further illuminate the distinct roles these tools play in real estate, helping you make informed decisions tailored to your specific needs.

Detailed Comparison of CMA and Pre-listing Appraisal Report

Choosing between a Comparative Market Analysis (CMA) and a pre-listing appraisal depends on the specific needs of the property owner and the nature of the real estate market.

Both tools provide valuable insights but differ significantly in their approach, depth, and application. This section highlights these differences to help you make informed decisions on when you may use each one.

Market Analysis

Appraisal Reports:

Appraisal reports offer a detailed market analysis that goes beyond the immediate scope of similar homes. They assess broader market trends, evaluate economic indicators, and consider local and regional factors that might influence property values.

This comprehensive analysis provides insights into how a property’s value fits within the larger market context, offering a more holistic view.

CMAs:

CMAs focus primarily on comparable homes, emphasizing recent sales data, active listings, and sometimes expired listings. While this approach effectively provides a snapshot of local market conditions, it may not delve into larger market trends extensively. CMAs rely heavily on the local expertise of real estate agents to interpret this data within the neighborhood context.

Adjustments

Appraisal Reports:

Appraisal reports are renowned for their meticulous adjustments, which account for differences between the subject property and comparable sales.

These adjustments consider factors like additional bathrooms, square footage, architectural features, and more. The process involves detailed analysis and support for how each adjustment was derived, ensuring that every valuation aspect is justified and precise.

CMAs:

In contrast, CMAs often use similar homes with minimal adjustments. The adjustments are generally based on the agent’s expertise and experience rather than extensive researched data.

While effective for initial pricing strategies, this method may lack the precision of an appraisal, especially in cases where unique property features significantly impact value.

Comparable Selection Criteria

Appraisal Reports:

Appraisal reports adhere to specific rules for selecting comparables, including bracketing features. This means choosing comparables that have both fewer and more features than the subject property.

For instance, if the subject property has a three-car garage, appraisers might select one comparable with a two-car garage and another with a four-car garage. This bracketing ensures a balanced comparison and highlights any unique market features, emphasizing that the property’s traits are not anomalies.

CMAs:

CMAs typically focus on recent sales within a specific area or subdivision, sometimes limiting the scope of comparison. While this can be sufficient for standard properties, it may not fully capture the nuances needed for properties with unique features or those located in diverse markets.

When to Use Each

CMA:

-

- Quick Assessments: When a speedy evaluation of the market is needed.

-

- Competitive Pricing: Useful for setting initial list prices in standard neighborhoods in stable markets.

-

- Agent Expertise: Leverages local knowledge and market conditions.

Pre-listing Appraisal:

-

- Precise Valuations: Essential for detailed and accurate property assessments.

-

- Complex Properties: Ideal for unique or high-value properties requiring detailed analysis including market trend analysis.

-

- Objective Analysis: Necessary when an unbiased, third-party evaluation is crucial for negotiations or dispute prevention.

Example Scenario

Imagine a homeowner with a standard single-family home in a suburban neighborhood where there is abundant sales data and many of the homes are similar. In this case, a CMA can quickly establish a competitive price using recent sales data and the agent’s local expertise.

However, consider a property in a historic district with unique architectural elements and custom features. Here, a pre-listing appraisal is invaluable, providing a detailed analysis that accounts for these distinctive characteristics and ensures an accurate valuation.

Summary

Understanding the differences between a Comparative Market Analysis (CMA) and a pre-listing appraisal is essential for anyone navigating the real estate market. CMAs are valuable tools for quick market positioning, offering insights based on comparable home sales that can help set an initial listing price efficiently.

On the other hand, pre-listing appraisals provide precise valuations, especially beneficial for complex or unique properties where detailed analysis is necessary.

Both CMAs and appraisals hold significant value. As a licensed appraiser, I thoroughly respect the CMA process and appreciate when a realtor provides one.

It offers valuable insight into their valuation approach and acts as one piece of the puzzle in the overall appraisal process. Both tools should be respected for their unique strengths and purposes, and both have their rightful place in the real estate industry.

Final Thoughts

While CMAs serve as excellent starting points for setting prices, they are not a substitute for appraisal reports. Appraisers adhere to strict standards like USPAP, delivering a thorough analysis that can be more appropriate for properties with unique features or those located in diverse markets.

Some real estate agents with extensive market experience can provide valuable insights through CMAs, but if your home isn’t a cookie-cutter replica of others in the area, and if the stakes are high, consider hiring an appraiser. This decision can ensure a more precise valuation, offering peace of mind and strategic advantage in negotiations.

And hey, since CMAs are typically free, why not get both? It’s like having a dessert with your meal—just makes everything better!

What to do next…

I encourage readers to carefully evaluate their needs and consult professionals when deciding between a CMA and a pre-listing appraisal. Understanding the nuances of each tool will enable you to make informed decisions and choose the right strategy for your real estate transactions.

Whether you’re selling, buying, or simply curious about your property’s value, selecting the appropriate approach can make a significant difference. To learn more about pre-listing appraisals give me call.

by Conrad Meertins | Jul 16, 2024 | Valuation

Curious why your 2-4 family property’s appraisal seems so complex? You’re not alone. Many Louisville homeowners and realtors are surprised to discover that multi-family appraisals are a whole different ballgame compared to single-family homes.

But don’t worry – we’re about to unveil the mystery behind 2-4 family home appraisals in the Derby City.

Imagine you’ve just inherited a charming duplex in the Highlands. You’re excited about the potential, but when you mention getting it appraised, your realtor friend looks at you with a mix of sympathy and amusement. “Oh honey,” she says, “you’re in for a wild ride.”

That’s the moment you realize: multi-family appraisals are not just about counting bedrooms and measuring square footage. They’re about unlocking the true potential of your property in Louisville’s dynamic real estate market.

The Multi-Family Appraisal Maze: A Louisville, KY Perspective

In the world of Louisville residential appraisers, 2-4 family properties are the ultimate puzzle. Unlike single-family homes, where appraisers mainly focus on adjusted sales prices of comparable properties, multi-family appraisals dive deeper.

They’re like peeling an onion – layer upon layer of analysis.

Here’s what makes multi-family home appraisals in Louisville unique:

Price per Bedroom: In a city where college students and young professionals are always hunting for rentals, this metric is gold. It helps compare properties with different bedroom counts, crucial in areas near the University of Louisville or Bellarmine University.

Price per Unit: Essential for investors eyeing properties in up-and-coming neighborhoods like Butchertown or NuLu. This metric helps normalize values across duplexes, triplexes, and fourplexes.

Price per Room: Crucial when comparing properties in diverse areas, from Old Louisville to the East End. It accounts for differences in layout and living spaces, which can vary widely in Louisville’s eclectic housing stock.

Price per Gross Building Area (GBA): Vital in a market where historic properties often compete with new developments. This metric helps level the playing field between a renovated Victorian in Crescent Hill and a modern fourplex in the Highlands.

But why does this matter to you? Because understanding these metrics can be the difference between a good investment and a great one in Louisville’s competitive market.

Cracking the Code: How Louisville Appraisers Use These Metrics

Louisville’s top residential appraisers don’t just crunch numbers; they tell the story of your property’s potential. They use these metrics to:

Select the most relevant comparable sales in your neighborhood. In a city as diverse as Louisville, this means finding properties that truly match yours, whether it’s a historic conversion in Old Louisville or a purpose-built multi-family in St. Matthews.

Make precise adjustments that reflect Louisville’s unique market conditions. Our city’s mix of urban, suburban, and historic districts means each area has its own nuances that impact property values.

Provide a rock-solid final valuation that stands up to scrutiny. In Louisville’s fast-moving market, accuracy is key for both buyers and sellers.

For homeowners and realtors in Louisville, this means:

Homeowners: You need to see your 2-4 family property through an investor’s eyes. Keep detailed records of your property’s specifications and rental history. In Louisville’s seasonal rental market, tracking occupancy rates and rental income throughout the year can provide valuable insights.

Realtors: Prepare to become a multi-family property detective. Your ability to analyze and present these metrics can set you apart in Louisville’s competitive real estate scene. Understanding how these metrics vary across different neighborhoods – from the Parklands to Portland – can make you an invaluable resource to your clients.

The Income Approach: A Crucial Component in Louisville’s Multi-Family Appraisals

When it comes to 2-4 family properties in Louisville, the income approach takes center stage. This method looks at your property’s potential to generate rental income – a key factor for investors in our growing city.

Here’s why it matters:

Gross Rent Multiplier (GRM): This quick calculation helps investors compare properties across different Louisville neighborhoods. A lower GRM in an up-and-coming area like Germantown might signal a good investment opportunity.

Capitalization Rate (Cap Rate): This metric is crucial for understanding the potential return on investment. In Louisville’s diverse market, cap rates can vary significantly between established areas like the Highlands and emerging neighborhoods like Schnitzelburg.

Net Operating Income (NOI): This figure accounts for Louisville-specific expenses like property taxes, insurance, and maintenance costs, which can vary widely across the city.

Understanding these income-based metrics can help you make informed decisions in Louisville’s multi-family market, whether you’re looking at a duplex in Clifton or a fourplex in Fern Creek.

Utility Considerations: A Hidden Factor in Louisville Multi-Family Appraisals

In Louisville’s varied housing stock, utility setups can significantly impact a multi-family property’s value. Here’s what you need to know:

Separate vs. Common Utilities: Properties with separate utilities for each unit often command higher valuations in Louisville. They’re particularly attractive in areas with a high concentration of young professionals, like the Highlands or NuLu.

Energy Efficiency: With Louisville’s hot summers and cold winters, energy-efficient properties can command premium rents. Upgrades like new windows or HVAC systems can significantly boost your property’s appeal and value.

Local Regulations: Be aware of Louisville Metro’s regulations regarding utility billing in multi-family properties. Compliance with local laws is crucial for maintaining your property’s value and avoiding legal issues.

Your Next Move in Louisville’s Multi-Family Market

Now that you’re armed with this insider knowledge, what’s your next step? Whether you’re considering buying a duplex in Germantown or selling a fourplex in Clifton, understanding these appraisal secrets gives you an edge.

Here are some actionable steps:

Research Your Neighborhood: Louisville’s neighborhoods each have their own character and market dynamics. Understand how your property fits into the local context.

Keep Detailed Records: Track your property’s rental history, occupancy rates, and any improvements you’ve made. This information is gold for appraisers and potential buyers.

Stay Informed: Louisville’s real estate market is always evolving. Keep an eye on local development plans and market trends that could impact your property’s value.

Consider Professional Management: In a competitive market like Louisville, professional property management can help maximize your property’s potential and value.

Plan for the Future: Whether it’s energy-efficient upgrades or unit reconfigurations, strategic improvements can significantly boost your property’s appraisal value.

Ready to navigate the exciting world of multi-family properties in Louisville? Don’t go it alone. Partner with a Louisville residential appraiser who specializes in 2-4 family home appraisals. They’ll help you unlock the true potential of your property and make informed decisions in our vibrant Louisville market.

Remember, in the world of multi-family properties, knowledge isn’t just power – it’s profit. Are you ready to see your Louisville property in a whole new light? The key to unlocking your property’s true potential is just an appraisal away.

Don’t let the complexity of multi-family appraisals hold you back from making smart investment decisions in the Derby City’s dynamic real estate market.

by Conrad Meertins | Feb 27, 2024 | Market Trends, Valuation

In the realm of real estate, the synergy between homeowners, realtors, and appraisers is not just beneficial; it’s essential.

Drawing from Stephen Covey’s 6th habit, “Synergize”, we see the immense value in collaborative efforts, especially when it comes to the precise task of home valuation. This principle underscores the strength found in teaming up, highlighting how collective inputs lead to superior outcomes.

The Unique Roles in Real Estate Transactions

Realtors are the navigators of the real estate transaction process, masters at brokering deals to ensure fairness and optimal outcomes for their clients. With an in-depth knowledge of market areas honed over years, they are pivotal in guiding homeowners through the complexities of selling or buying a home.

Appraisers, on the other hand, bring a different set of skills to the table. As valuation experts, they delve into the nitty-gritty details of property value, armed with data and trends to pinpoint the most accurate market value.

Their expertise becomes particularly crucial in fluctuating markets, where accurate valuations can make or break a deal.

The Synergy in Action: A Real-World Scenario

Consider a homeowner eager to sell their property. They believe their home is worth $350,000, while their realtor, considering current market dynamics, suggests a starting point of $300,000.

Here, the realtor could either acquiesce to the homeowner’s wishes or provide detailed market insights to align expectations. This is where an appraiser’s expertise becomes invaluable.

Data and Evidence: Understanding Louisville’s Market

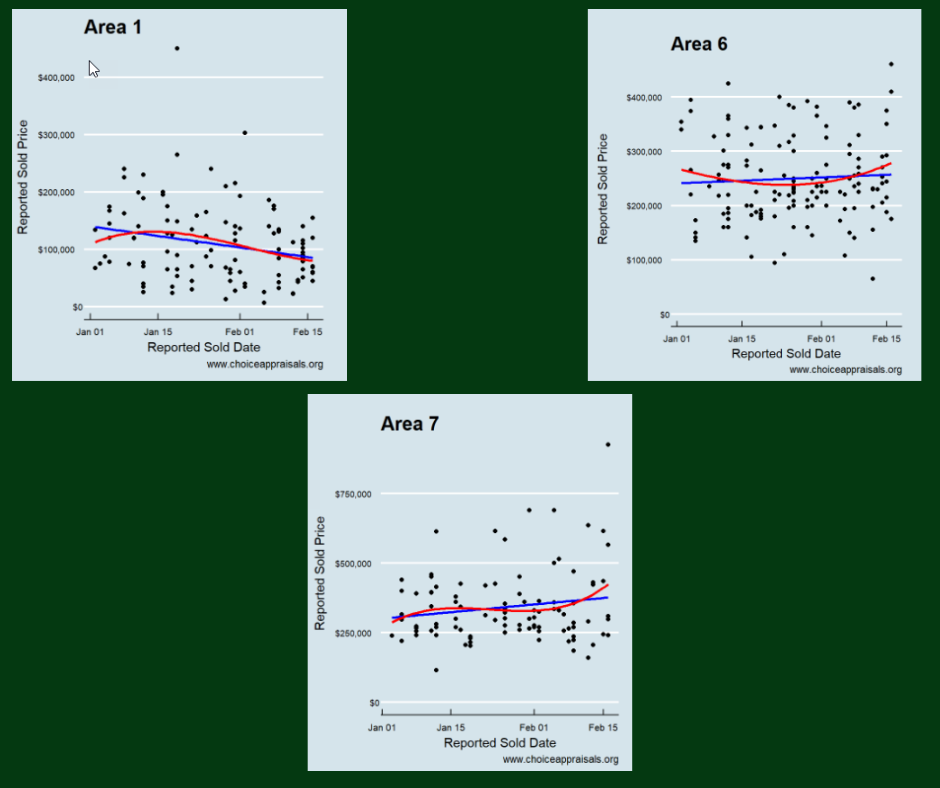

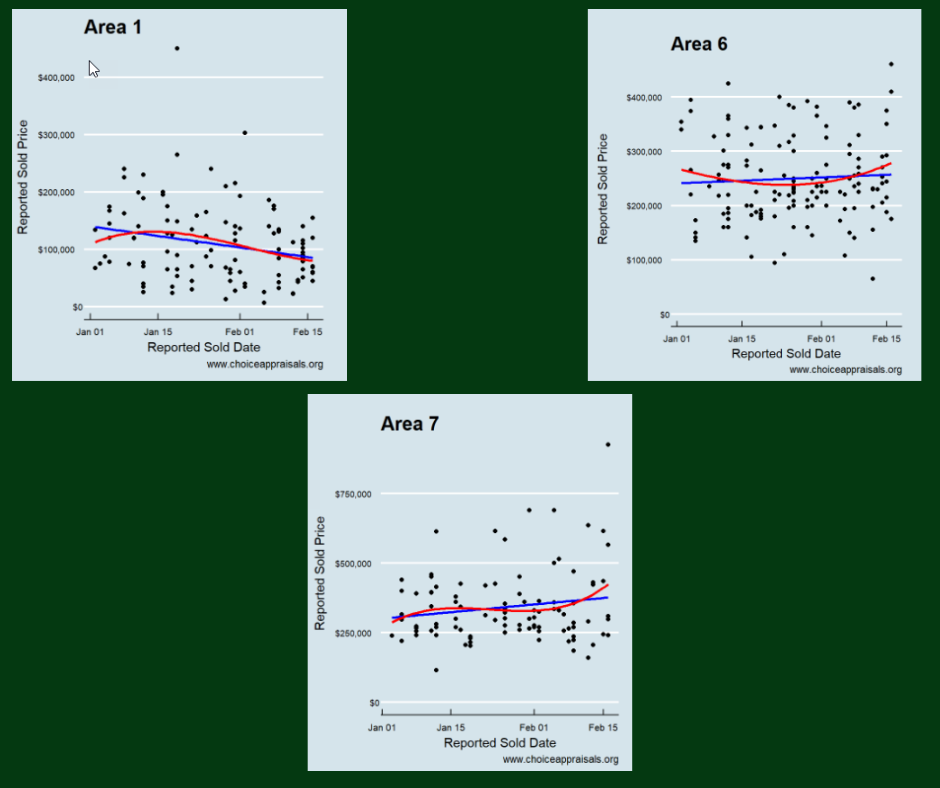

The above graph highlights the trend for homes that sold in MLS Area 1, Area 6, and Area 7. While Area 1 experienced a decline in sales prices with 114 sales, Areas 6 and 7 showed an uptick, boasting 145 and 96 sales, respectively.

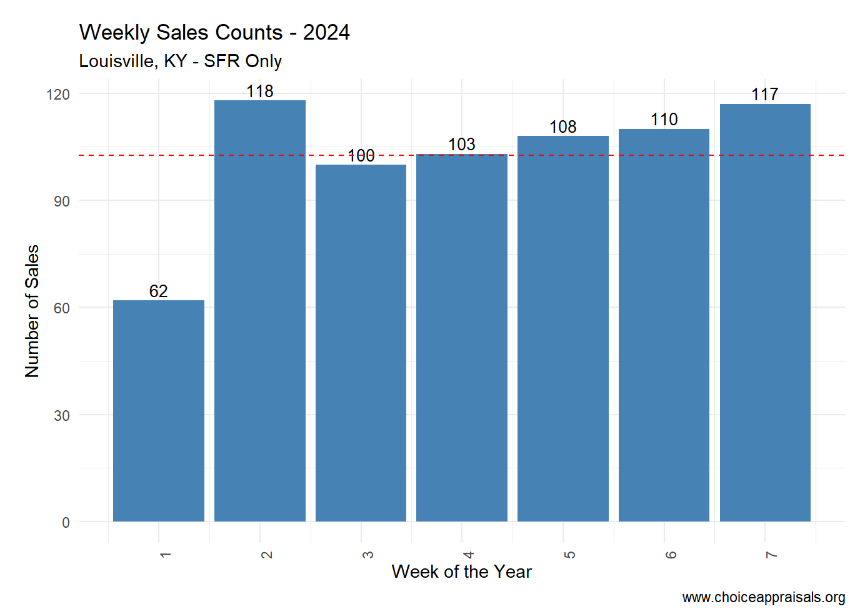

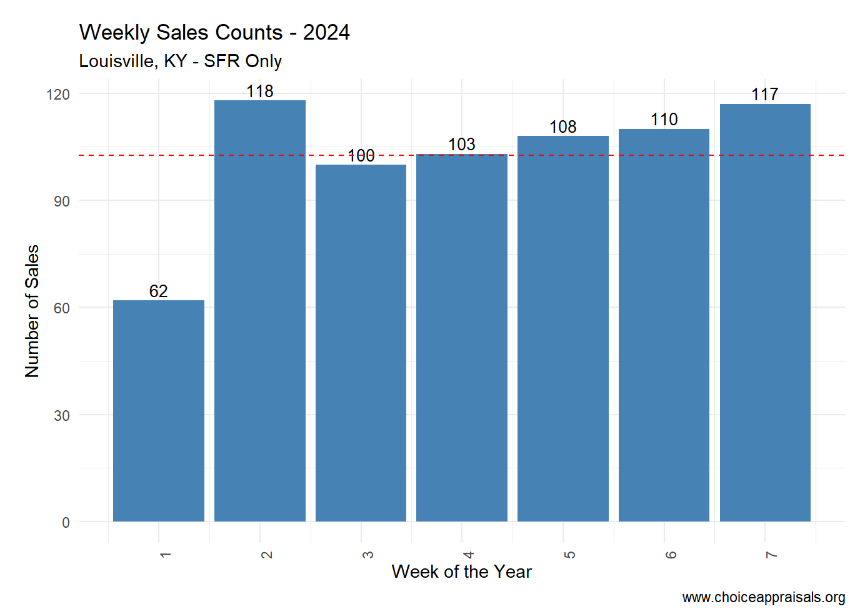

The above graph highlights the weekly volume of sales in Louisville, KY. since week one of 2024

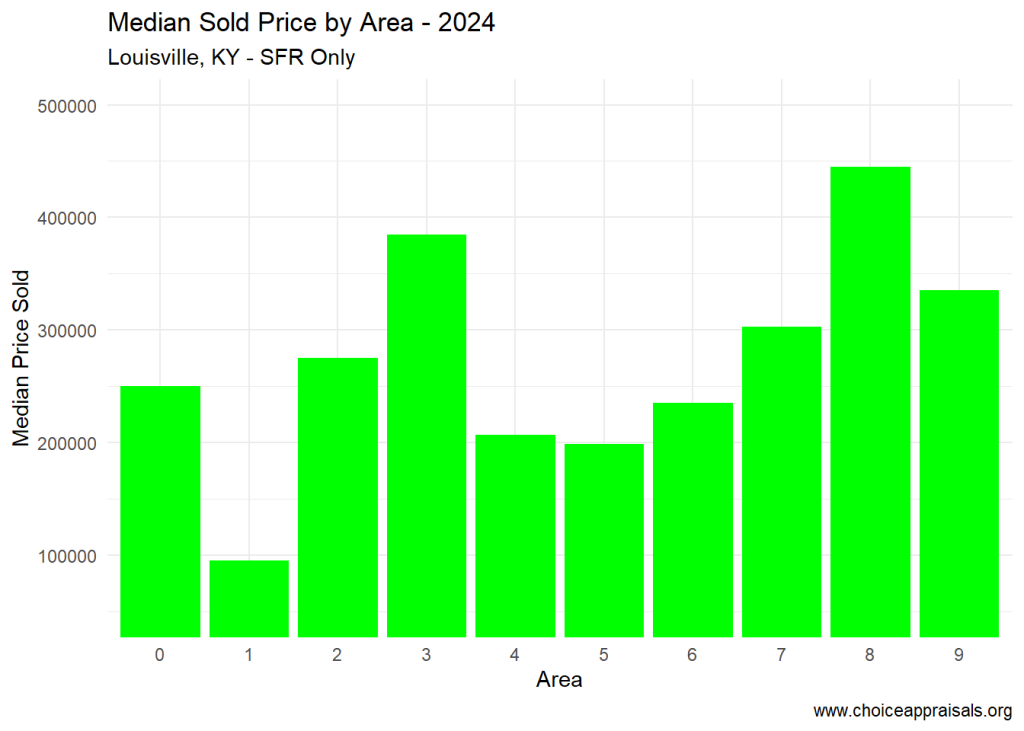

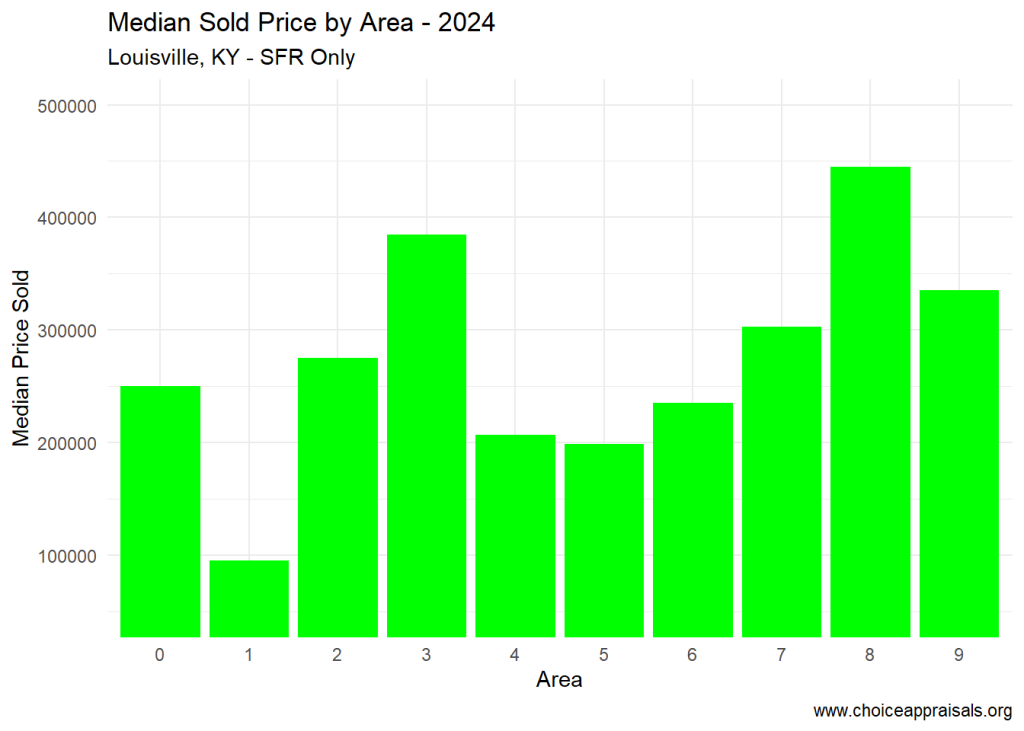

The above graph illustrates the median sale price for each MLS area in Louisville, KY over the first 7 weeks of 2024. As can be seen from the above charts, in week 7 of 2024, Louisville’s real estate market presented varied trends across its MLS areas.

The average days on market hovered between 20 and 25, with an overall median sales price of $249,000 across Louisville.

However, disparities exist, with Area 3 approaching a median of $400K and Area 8 nearing $450K. Such granular data is crucial for appraisers and realtors alike to provide homeowners with accurate, realistic valuations.

Leveraging Synergy for Success

When realtors and appraisers collaborate, sharing insights and data, they ensure homeowners receive the most accurate valuation, tailored to the nuanced dynamics of their specific MLS area.

This synergy not only enhances trust among all parties but also secures a smoother transaction process, grounded in realism and mutual understanding.

Embrace Collaboration

For homeowners, understanding the value of your home is more nuanced than it might appear. Engage both your realtor and a local Louisville appraiser in the conversation.

Realtors, don’t hesitate to bolster your market knowledge with insights from appraisers. Appraisers, your expertise is more critical than ever in today’s data-rich age—collaborate with realtors to demystify market trends for homeowners.

The Winning Formula

Synergy, as Stephen Covey highlighted, is about producing a collective outcome that surpasses what individuals could achieve alone.

In Louisville’s diverse real estate landscape, embracing this collaborative spirit ensures that homeowners, realtors, and appraisers alike can navigate the valuation process with confidence, accuracy, and success.

Let’s work together, leveraging our unique strengths for the common goal of transparent, fair, and effective real estate transactions. Go Louisville, where synergy is indeed where it’s at!

by Conrad Meertins | Jan 15, 2024 | Market Trends

Imagine uncovering a secret blueprint that could transform your approach to real estate. This blueprint merges Stephen Covey’s timeless wisdom from “Seven Habits of Highly Effective People” with the dynamic realm of real estate transactions. The focus here is on the second habit, “Begin with the End in Mind,” a principle I believe is key to navigating the ever-evolving real estate market.

In the following sections, we’ll explore recent Louisville, KY real estate trends and uncover often-overlooked insights.

As we do, we can apply the ‘Begin With the End in Mind’ approach to our 2024 Real Estate Strategy. This isn’t just about goal setting—it’s about using market analytics to guide our decisions in real estate.

Let’s dive into how this forward-thinking principle can sharpen our competitive edge.

Q1 Insights: Setting the Stage for Annual Market Trends

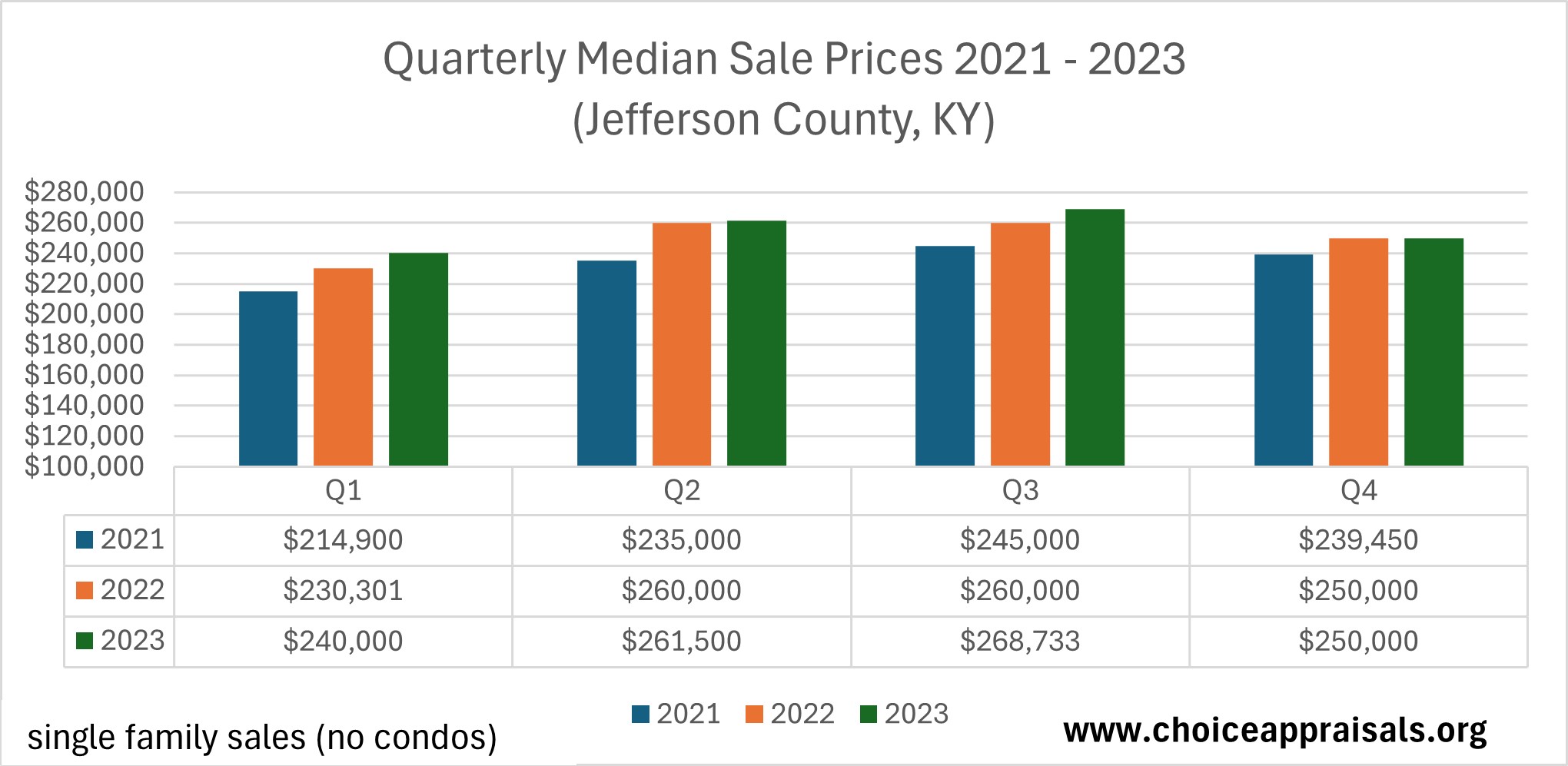

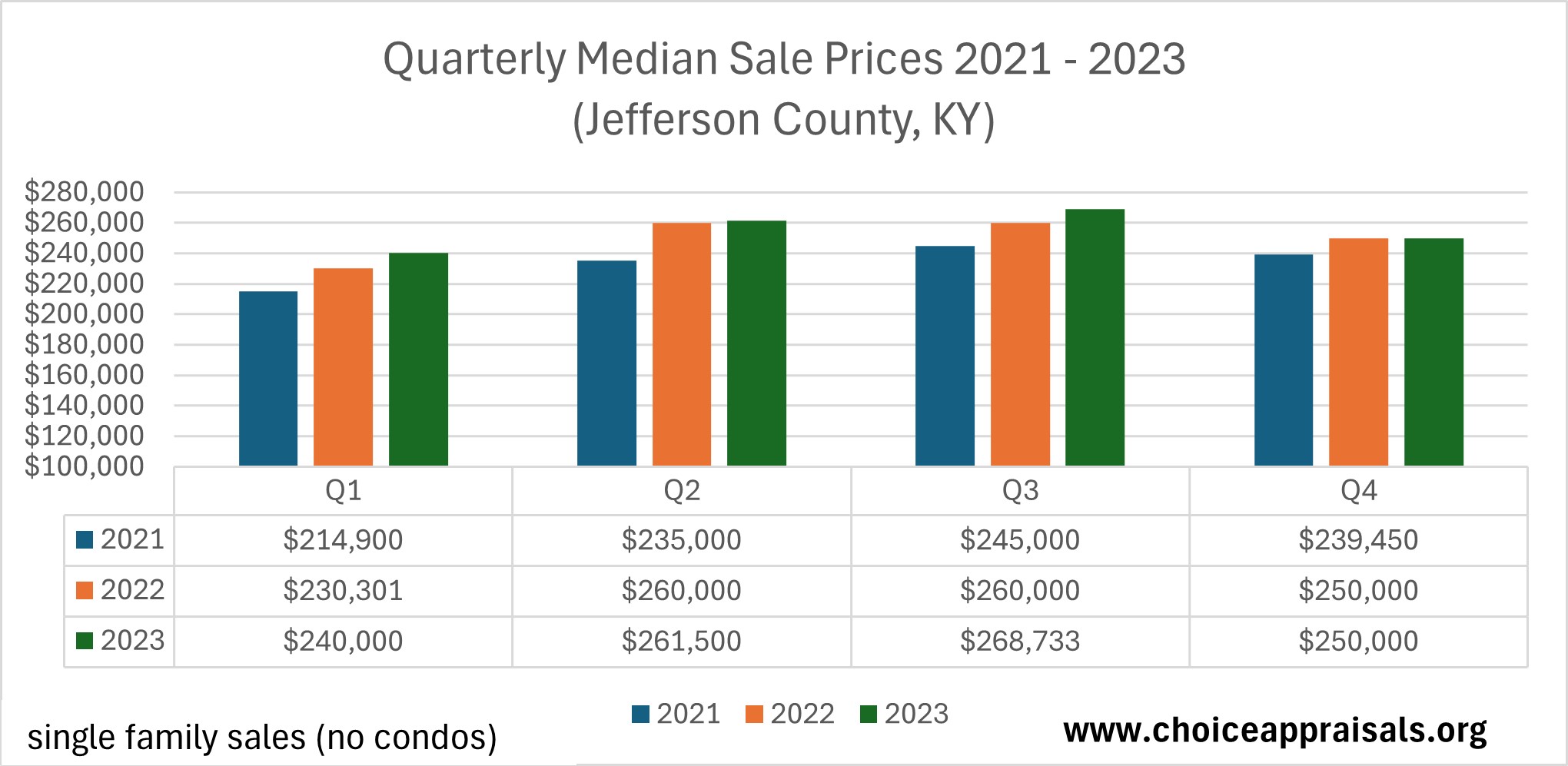

Let’s examine the market trends reflected in the quarterly median sale prices from 2021 to 2023 in Louisville, KY. Despite a reduction in the number of homes sold, which isn’t shown on this graph, there’s a clear upward trend in the prices that buyers have been willing to pay.

Starting each year with a glance at Q1, we can observe that 2023 opened with home prices that were higher than at the beginning of 2022, which also had surpassed 2021’s figures. This consistent rise in initial prices year over year is a positive indicator of growing market strength.

However, looking at the year’s end, we notice a slight deviation from this trend. While the closing prices of 2022 improved upon 2021, the same cannot be said for the transition from 2022 to 2023.

Although the prices didn’t climb higher at the end of 2023, they didn’t fall either, maintaining the gains from earlier in the year. This stability, rather than a decline, suggests that the market is holding its value well, which is reassuring for both current and prospective homeowners.

The Closing Quarter: Reflecting on Market Resilience

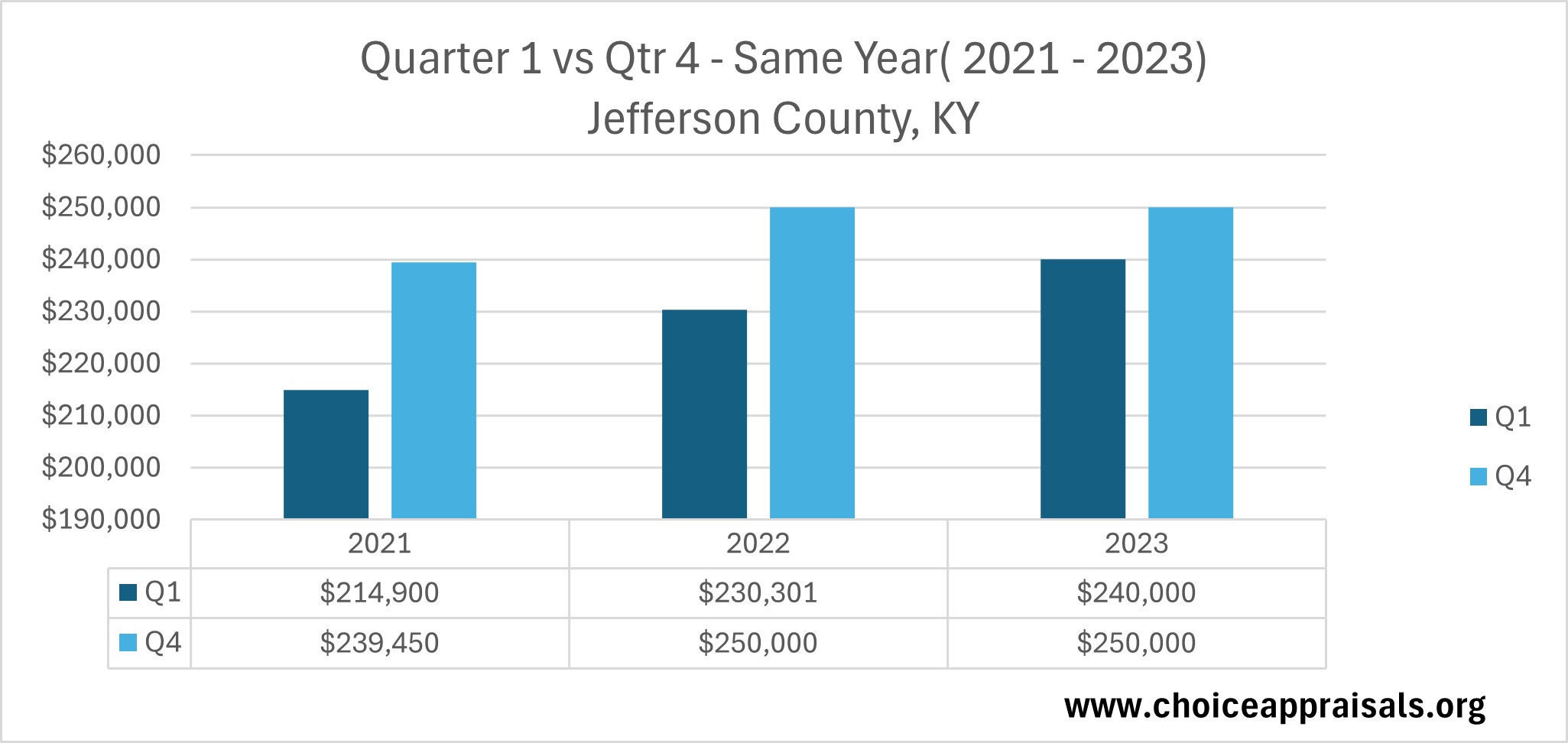

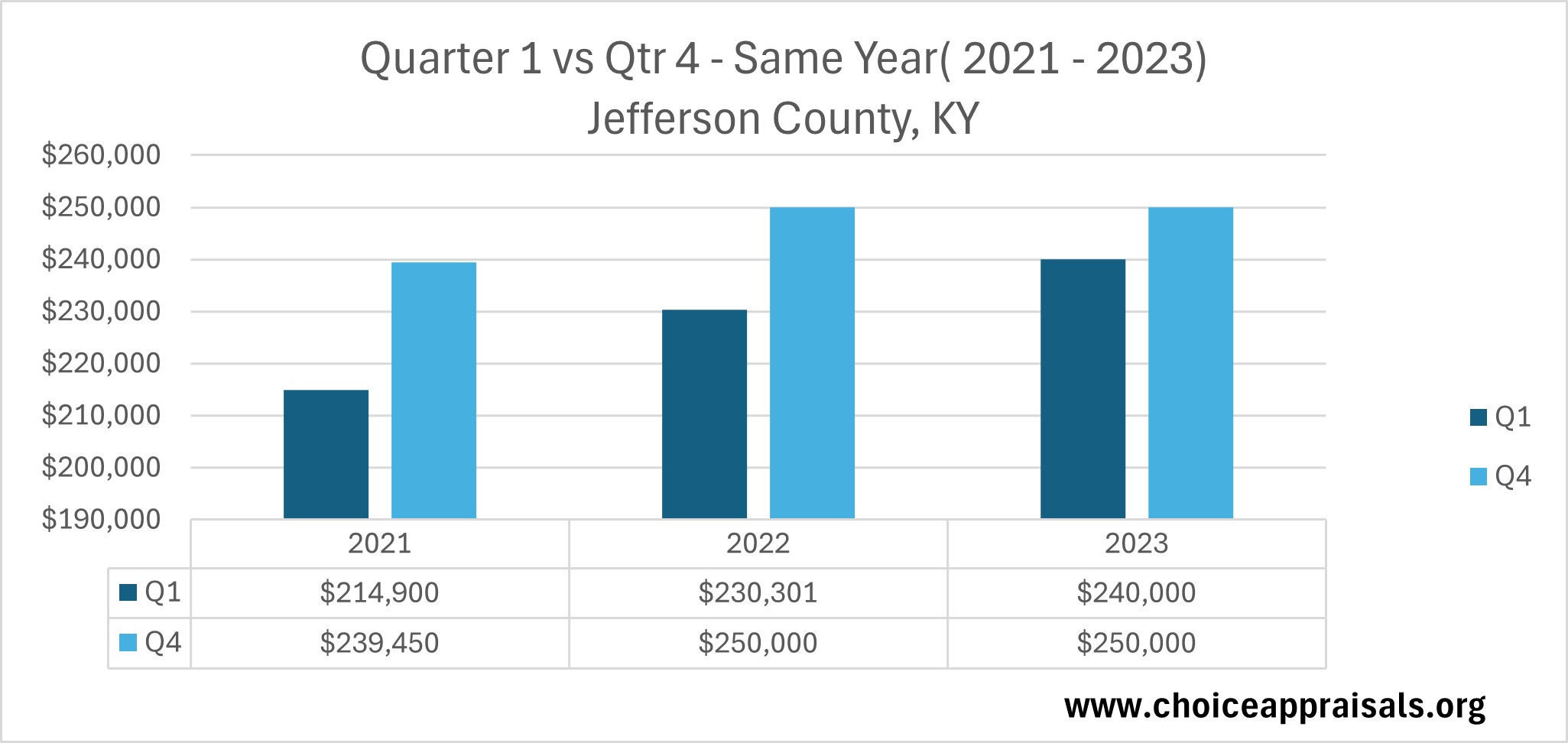

Consistency is key in the real estate market, and the trends in Jefferson County, KY, reaffirm this saying. If we take a closer look at how property prices have behaved at the start and end of each year from 2021 to 2023, we find an encouraging pattern.

Despite the expected seasonal dip towards the end of the year, the big picture is one of growth. Specifically, the comparison between Q1 and Q4 within the same year shows us that regardless of the short-term fluctuations, the overall value of homes has been on an upward trajectory.

For instance, in Louisville, KY as a whole, the opening quarter’s median sale prices have consistently been lower than those at the year’s close. This tells us that homeowners who hold onto their properties throughout the year could see a natural increase in their homes’ market value.

It’s a reassuring sign for long-term investors and a helpful metric for potential sellers planning the right time to enter the market. This trend highlights the resilience of the local real estate market.

It also demonstrates that even with the anticipated year-end slowdown, property values in Louisville, have maintained a positive momentum.

New Year’s Market Outlook: Beyond the Initial Dip

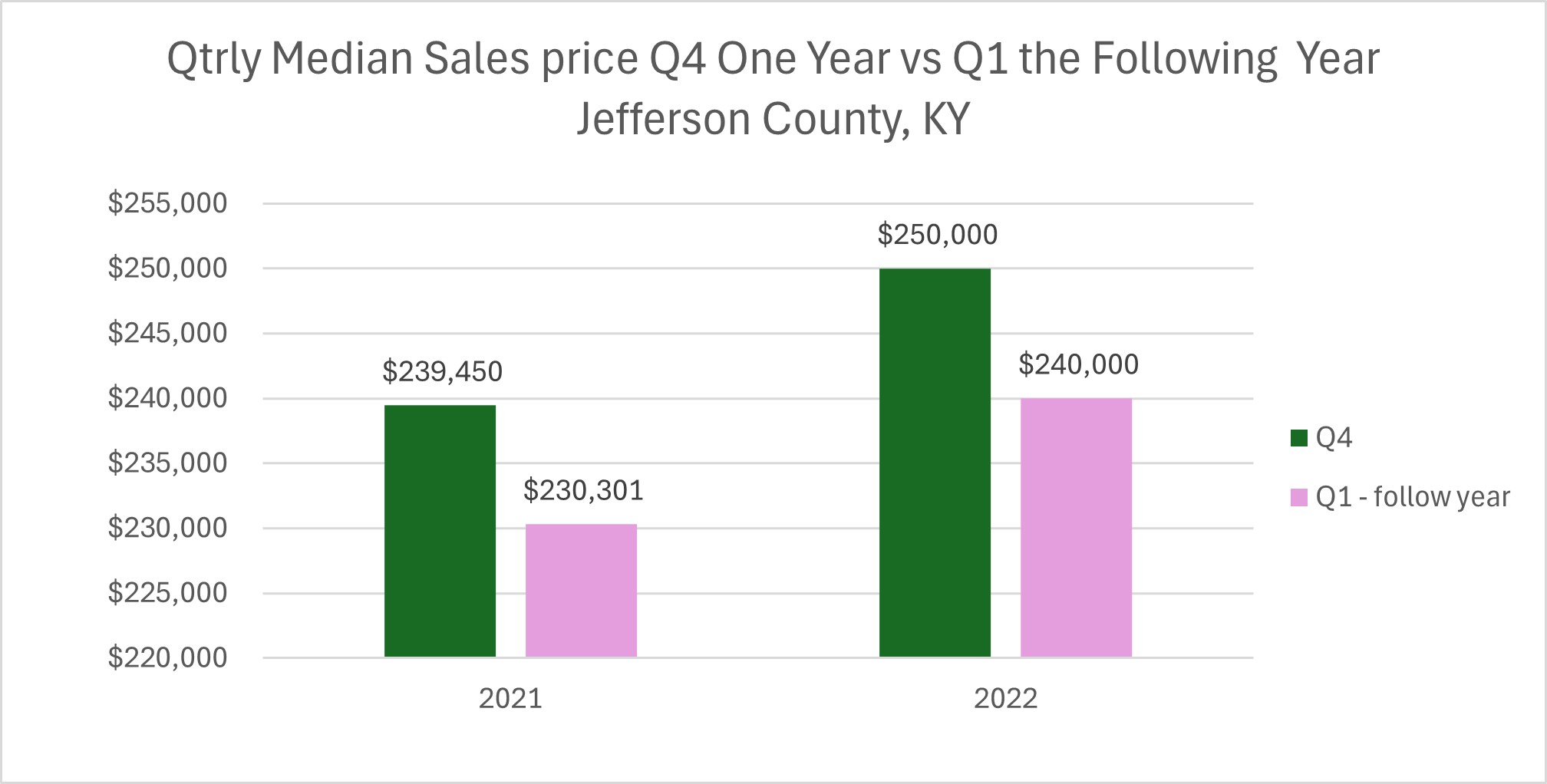

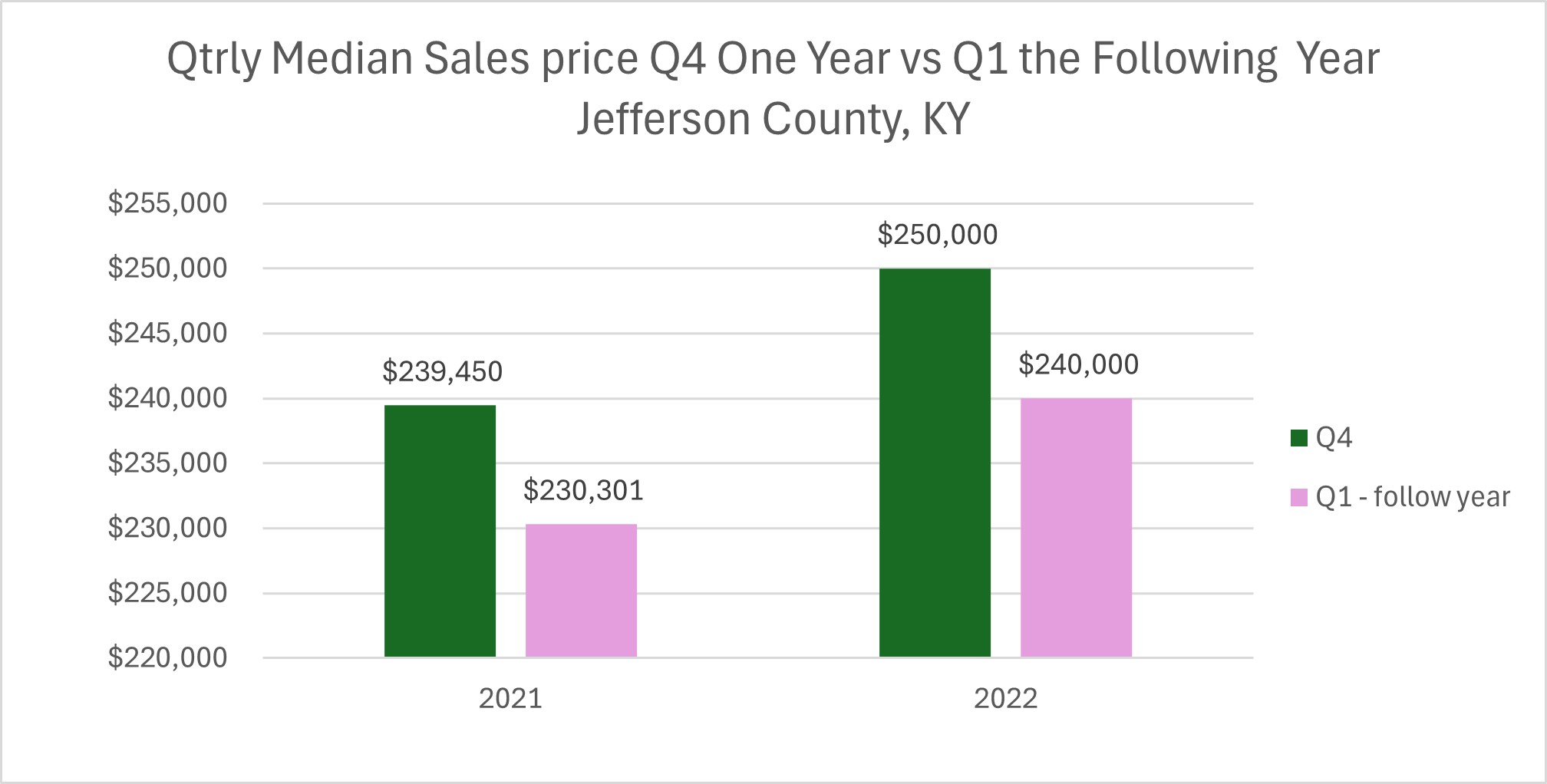

As we turn the calendar page each year, we see a recurring theme in the housing market. The beginning of the year often starts with a modest reset in home prices from their previous year-end highs.

This dip, however, is just a small chapter in an overall success story, as the trend line since 2021 is pointing upwards. This pattern means that while home values might momentarily soften as the New Year chimes in, they generally pick up steam as the months roll by, pushing the market value higher as the year progresses.

This trend is crucial for both buyers and sellers to keep in mind. If you’re considering selling your home and you’ve recently seen a property similar to yours sell at a peak price, it’s important to temper expectations.

A home appraisal report may well contain a valuation adjustment in line with the current market phase, particularly if there’s been a recent cooling. It’s a reminder to always be attuned to the rhythm of the market and to set your strategies accordingly.

Why Pay Attention to These Trends?

In the spirit of Stephen Covey’s second habit, “Begin with the End in Mind,” we turned our focus to the critical importance of market trends in the real estate landscape.

It’s not just a matter of peering through the data; it’s about understanding the narrative behind the numbers. This is where the essence of strategic foresight in real estate comes to life.

Paying close attention to the highs and lows of the market allows us to navigate with precision and purpose, ensuring that each step taken is a deliberate stride towards our ultimate objectives.

Maximizing Returns:

Just as a captain charts a course by the stars, real estate market trends serve as our celestial guides, helping us navigate towards maximum profitability.

Just as a captain charts a course by the stars, real estate market trends serve as our celestial guides, helping us navigate towards maximum profitability.

Recognizing the right time to list or purchase can make all the difference in the financial outcome of a real estate transaction. In Louisville, KY, for example, the upward trend in home prices, even amidst seasonal fluctuations, indicates a potential for sellers to maximize returns by timing the market judiciously.

Identifying Growth Opportunities:

By observing the shifts and preferences in the housing market, we identify not just current demands but forecast emerging trends that signal growth opportunities.

Understanding Market Shifts:

The real estate market is as dynamic as the seasons, changing in response to a multitude of economic and societal factors.

The real estate market is as dynamic as the seasons, changing in response to a multitude of economic and societal factors.

Having a keen eye on these changes allows us to predict and prepare for the natural cycles of the market. It’s about reading the signs and knowing when to act. This understanding empowers us to make informed decisions that resonate with confidence and clarity, much like the principles Covey advocates.

Conclusion

In conclusion, the philosophy of ‘Begin with the End in Mind’ encourages us to thoughtfully consider how our current actions will shape our future outcomes. It’s not merely about staying informed but about being strategically equipped to make decisions that align with our ultimate aspirations.

Whether we’re buying, selling, providing guidance, or appraising, the insights we glean from a diligent analysis of market trends are priceless. They lay down a framework for informed action, grounded in deep understanding, which empowers us to navigate the real estate landscape with both foresight and the flexibility to adapt to ever-changing conditions.

By Conrad Meertins Jr

by Conrad Meertins | Jan 1, 2024 | Valuation

In the world of home appraisals, the clash between emotional value and market reality often emerges, a theme vividly illustrated in a recent case I encountered.

About five months ago, a soft-spoken man sought my expertise for an unbiased appraisal of his father’s home. Caught in a $50,000 valuation disagreement with his brother, they turned to me to settle their differences.

This case unravels not just the complexities of property appraisal but also the emotional ties we associate with our homes. As we delve into this intriguing case study, we’ll explore how market data often challenges our expectations, teaching us valuable lessons in property valuation.

Background of the Property

Nestled in a neighborhood in Louisville, where property values are between $278,000 and $550,000, with a median sale price at $375,000, the subject property presented a unique appraisal challenge. This home, larger than most in its neighborhood at over 1800 square feet, had features both appealing and dated.

The basement, equipped with one kitchen, could be seen as a versatile addition, offering potential for rental income or extended family living. A second part of the property, transformed into a modern accessory unit, added a contemporary touch.

However, the main level told a different story. Despite being well-maintained, it was a time capsule of the 1970s, with its disco-era wallpaper and outdated fixtures. This blend of the old and the new, where the majority of the living space still echoed the past, demanded careful consideration in its valuation.

Appraisal Process and Challenges

As an appraiser, my process involved a meticulous valuation of the property’s attributes: its prime location, the large living area, and the modern updates on the second level.

However, the challenges were evident. The dated condition of the main level, representing 70% of the living space, significantly impacted the overall valuation.

Despite the modern renovations and unique features like an additional kitchen, the property’s true market value couldn’t solely hinge on its updates. It required a holistic view, considering both its strengths and weaknesses.

This comprehensive analysis led to a valuation of $325,000, a figure grounded in market realities yet distant from the clients’ expectations.

Client Reaction and Market Reality

When the appraisal valued the home at $325,000, the clients were in disbelief, struggling to reconcile this figure with their higher expectations of $400,000 to $500,000. Their emotional attachment to the home clouded their acceptance of the market-based valuation, particularly the impact of its outdated main living area.

Despite a detailed explanation during a follow-up meeting, their conviction in the home’s higher worth remained unshaken. Boldly, they listed the property for $405,000, but the market’s response was unequivocal.

After languishing for 100 days without interest, they had to reduce the price by over $30,000. But, there was still no interest. This stark contrast between expectation and reality highlighted a crucial lesson: emotional value doesn’t always align with market value.

Conclusion

In conclusion, the case of the “High Hopes Appraisal” serves as a powerful reminder of the complex interplay between emotional value and market reality in property valuation.

It underscores that while sentimental attachment can significantly inflate a homeowner’s valuation expectations, the true worth of a property is ultimately determined by the open market, influenced by current trends and objective data.

This case study highlights the importance of approaching property appraisals with an open mind, valuing the expertise of professionals, and understanding that market data often tells a story different from our personal narratives. It’s a testament to the fact that in real estate, numbers and market dynamics hold the final say, not our emotional connections to the property.

If you’re navigating the intricate process of property valuation and seeking an unbiased, market-informed perspective, reach out for professional appraisal services.

Let’s ensure your property decisions are grounded in reality and informed by expert insights. Remember, in the real estate market, it’s the hard data that ultimately shapes our success.

– Conrad Meertins, Jr.