by Conrad Meertins | Jul 16, 2024 | Valuation

Curious why your 2-4 family property’s appraisal seems so complex? You’re not alone. Many Louisville homeowners and realtors are surprised to discover that multi-family appraisals are a whole different ballgame compared to single-family homes.

But don’t worry – we’re about to unveil the mystery behind 2-4 family home appraisals in the Derby City.

Imagine you’ve just inherited a charming duplex in the Highlands. You’re excited about the potential, but when you mention getting it appraised, your realtor friend looks at you with a mix of sympathy and amusement. “Oh honey,” she says, “you’re in for a wild ride.”

That’s the moment you realize: multi-family appraisals are not just about counting bedrooms and measuring square footage. They’re about unlocking the true potential of your property in Louisville’s dynamic real estate market.

The Multi-Family Appraisal Maze: A Louisville, KY Perspective

In the world of Louisville residential appraisers, 2-4 family properties are the ultimate puzzle. Unlike single-family homes, where appraisers mainly focus on adjusted sales prices of comparable properties, multi-family appraisals dive deeper.

They’re like peeling an onion – layer upon layer of analysis.

Here’s what makes multi-family home appraisals in Louisville unique:

Price per Bedroom: In a city where college students and young professionals are always hunting for rentals, this metric is gold. It helps compare properties with different bedroom counts, crucial in areas near the University of Louisville or Bellarmine University.

Price per Unit: Essential for investors eyeing properties in up-and-coming neighborhoods like Butchertown or NuLu. This metric helps normalize values across duplexes, triplexes, and fourplexes.

Price per Room: Crucial when comparing properties in diverse areas, from Old Louisville to the East End. It accounts for differences in layout and living spaces, which can vary widely in Louisville’s eclectic housing stock.

Price per Gross Building Area (GBA): Vital in a market where historic properties often compete with new developments. This metric helps level the playing field between a renovated Victorian in Crescent Hill and a modern fourplex in the Highlands.

But why does this matter to you? Because understanding these metrics can be the difference between a good investment and a great one in Louisville’s competitive market.

Cracking the Code: How Louisville Appraisers Use These Metrics

Louisville’s top residential appraisers don’t just crunch numbers; they tell the story of your property’s potential. They use these metrics to:

Select the most relevant comparable sales in your neighborhood. In a city as diverse as Louisville, this means finding properties that truly match yours, whether it’s a historic conversion in Old Louisville or a purpose-built multi-family in St. Matthews.

Make precise adjustments that reflect Louisville’s unique market conditions. Our city’s mix of urban, suburban, and historic districts means each area has its own nuances that impact property values.

Provide a rock-solid final valuation that stands up to scrutiny. In Louisville’s fast-moving market, accuracy is key for both buyers and sellers.

For homeowners and realtors in Louisville, this means:

Homeowners: You need to see your 2-4 family property through an investor’s eyes. Keep detailed records of your property’s specifications and rental history. In Louisville’s seasonal rental market, tracking occupancy rates and rental income throughout the year can provide valuable insights.

Realtors: Prepare to become a multi-family property detective. Your ability to analyze and present these metrics can set you apart in Louisville’s competitive real estate scene. Understanding how these metrics vary across different neighborhoods – from the Parklands to Portland – can make you an invaluable resource to your clients.

The Income Approach: A Crucial Component in Louisville’s Multi-Family Appraisals

When it comes to 2-4 family properties in Louisville, the income approach takes center stage. This method looks at your property’s potential to generate rental income – a key factor for investors in our growing city.

Here’s why it matters:

Gross Rent Multiplier (GRM): This quick calculation helps investors compare properties across different Louisville neighborhoods. A lower GRM in an up-and-coming area like Germantown might signal a good investment opportunity.

Capitalization Rate (Cap Rate): This metric is crucial for understanding the potential return on investment. In Louisville’s diverse market, cap rates can vary significantly between established areas like the Highlands and emerging neighborhoods like Schnitzelburg.

Net Operating Income (NOI): This figure accounts for Louisville-specific expenses like property taxes, insurance, and maintenance costs, which can vary widely across the city.

Understanding these income-based metrics can help you make informed decisions in Louisville’s multi-family market, whether you’re looking at a duplex in Clifton or a fourplex in Fern Creek.

Utility Considerations: A Hidden Factor in Louisville Multi-Family Appraisals

In Louisville’s varied housing stock, utility setups can significantly impact a multi-family property’s value. Here’s what you need to know:

Separate vs. Common Utilities: Properties with separate utilities for each unit often command higher valuations in Louisville. They’re particularly attractive in areas with a high concentration of young professionals, like the Highlands or NuLu.

Energy Efficiency: With Louisville’s hot summers and cold winters, energy-efficient properties can command premium rents. Upgrades like new windows or HVAC systems can significantly boost your property’s appeal and value.

Local Regulations: Be aware of Louisville Metro’s regulations regarding utility billing in multi-family properties. Compliance with local laws is crucial for maintaining your property’s value and avoiding legal issues.

Your Next Move in Louisville’s Multi-Family Market

Now that you’re armed with this insider knowledge, what’s your next step? Whether you’re considering buying a duplex in Germantown or selling a fourplex in Clifton, understanding these appraisal secrets gives you an edge.

Here are some actionable steps:

Research Your Neighborhood: Louisville’s neighborhoods each have their own character and market dynamics. Understand how your property fits into the local context.

Keep Detailed Records: Track your property’s rental history, occupancy rates, and any improvements you’ve made. This information is gold for appraisers and potential buyers.

Stay Informed: Louisville’s real estate market is always evolving. Keep an eye on local development plans and market trends that could impact your property’s value.

Consider Professional Management: In a competitive market like Louisville, professional property management can help maximize your property’s potential and value.

Plan for the Future: Whether it’s energy-efficient upgrades or unit reconfigurations, strategic improvements can significantly boost your property’s appraisal value.

Ready to navigate the exciting world of multi-family properties in Louisville? Don’t go it alone. Partner with a Louisville residential appraiser who specializes in 2-4 family home appraisals. They’ll help you unlock the true potential of your property and make informed decisions in our vibrant Louisville market.

Remember, in the world of multi-family properties, knowledge isn’t just power – it’s profit. Are you ready to see your Louisville property in a whole new light? The key to unlocking your property’s true potential is just an appraisal away.

Don’t let the complexity of multi-family appraisals hold you back from making smart investment decisions in the Derby City’s dynamic real estate market.

by Conrad Meertins | Jul 1, 2024 | Valuation

Ever wondered why some luxury homes don’t appraise for what they’re truly worth? In the high-stakes world of luxury real estate, an accurate appraisal can make or break a deal. In the Louisville area, I’ve personally seen differences in value for the same property of over 1 million dollars!

That being said, appraisals for high-end properties come with unique challenges that can impact the final valuation significantly. From custom amenities and unique features to the scarcity of comparable sales, luxury homes require a meticulous and knowledgeable approach.

This article will guide you through the critical steps to ensure that your luxury property is appraised accurately and fairly. We’ll cover everything from selecting the right appraiser to understanding the importance of accurate sketches and cost approaches (the latter two points are especially important when it comes to the appraisal of new or proposed-construction luxury homes.

By following these tips, you can avoid common pitfalls and ensure a smooth home appraisal process that reflects the true value of your luxury home.

Understanding the Unique Challenges of Luxury Appraisals

High Value and Unique Features

Appraising high-value properties presents a unique set of challenges. Luxury homes often come with custom amenities and unique features that significantly impact their value.

These might include state-of-the-art home theaters, expansive wine cellars, private gyms, and elaborate landscaping, among others (I shouldn’t forget the elevator from the basement to the second floor in some homes!). Each of these features needs to be evaluated not just for its cost but also for how it contributes to the overall appeal and functionality of the property.

The challenge lies in the subjective nature of these features. What one buyer might consider an invaluable addition, another might see as unnecessary.

Therefore, it’s crucial for the appraiser to have a deep understanding of the luxury market and the specific value that these custom amenities add. They must assess how these features compare to other high-end homes, both in terms of functionality and desirability.

Limited Comparables

Finding comparable sales, or “comps,” is another significant hurdle in the appraisal of luxury properties. For example, here in Louisville, KY only 13 homes have sold over $2,000,000 this year.

The uniqueness of high-end homes often means there are fewer similar properties recently sold in the area. This lack of comparable sales can make it difficult to establish a market value based on recent transactions.

Luxury homes are often distinct in style, design, and amenities, which makes direct comparisons challenging. For instance, a Mediterranean-style villa with a view of the Ohio River, and a modern mansion with a private golf course may both be luxury properties, but their features and appeal can differ dramatically.

Additionally, market trends can have a pronounced effect on luxury property values. Economic shifts, changes in buyer preferences, and fluctuations in the high-end real estate market can all influence how comparable properties are valued.

A home appraiser needs to be well-versed in these trends and able to adjust their valuations accordingly.

In summary, the unique challenges of luxury appraisals stem from the high value and distinctive features of these properties, along with the difficulty in finding comparable sales.

Appraisers must navigate these challenges with a deep understanding of the luxury market, ensuring that each unique feature is accurately valued and that the lack of direct comparables is effectively managed. This nuanced approach helps in arriving at a fair and accurate appraisal, reflecting the true worth of the luxury property.

Preparing Your Property for Appraisal

So what information should you gather to provide to the appraiser? Proper preparation can significantly influence the appraiser’s perception and the final valuation of your luxury property.

Documentation and Information

Providing comprehensive and detailed documentation is crucial for a thorough appraisal. Here’s what you need to gather:

- Property’s History: Include any pertinent information about the property’s past, such as previous sales, historical significance, or unique events.

- Renovations and Upgrades: Document all renovations and upgrades made to the property. This should include dates, costs, and detailed descriptions of the work done. Highlight high-end materials and custom features.

- Unique Features: Outline any unique features that set the property apart from others. This could include custom-designed elements, smart home technology, eco-friendly installations, or rare architectural details.

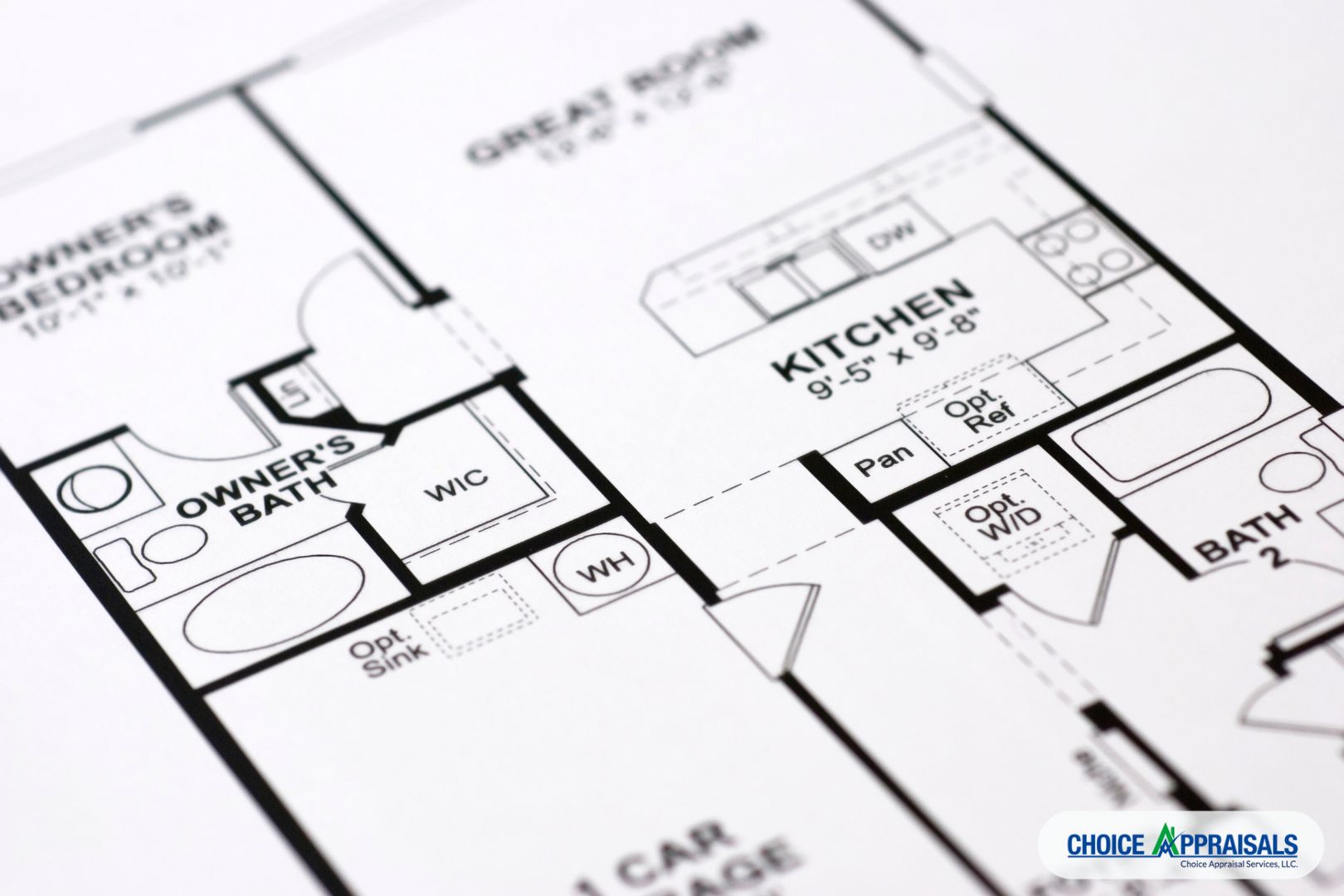

- Blueprints and Floor Plans: Offer original blueprints and updated floor plans to assist in verifying the accuracy of the property’s layout and dimensions.

- Legal Documents: Include any relevant legal documents, such as title deeds, zoning information, and homeowners association (HOA) regulations.

Selecting the Right Appraiser

Ensuring that your luxury property is accurately valued also depends significantly on selecting the right appraiser. An appraiser with the right experience, expertise, and local market knowledge can provide a more accurate appraisal.

Experience and Expertise

Hiring an appraiser who has specific experience in luxury properties is crucial. Luxury homes have unique features and characteristics that require a specialized understanding to appraise correctly.

-

- Importance of Experience: An experienced appraiser will be familiar with the intricacies and nuances of high-end properties, such as custom-built features, high-quality materials, and unique architectural elements. They understand how these aspects contribute to the overall value of the property.

-

- Credentials to Look For: When selecting an appraiser, it’s essential to consider their credentials. Look for professionals who are certified and have affiliations with reputable industry organizations.

Local Market Knowledge

In addition to experience and credentials, it’s vital to choose an appraiser who has in-depth knowledge of the local luxury market. Local expertise can significantly impact the accuracy of the appraisal.

-

- Familiarity with Local Market: An appraiser who is well-acquainted with the local luxury real estate market in Louisville will have a better understanding of the factors that influence property values in the area. This includes current market trends, buyer preferences, and the economic landscape.

-

- Benefits of Local Expertise: Appraisers with local market knowledge can more accurately assess how specific features and amenities of your property compare to other high-end homes in the area. They can also provide a more precise valuation by considering local comparables and recent sales data, which are critical in the appraisal process.

Selecting an appraiser with the right blend of experience, expertise, and local market knowledge ensures a thorough and accurate appraisal of your luxury property. By focusing on these qualifications, you can have greater confidence in the appraised value, facilitating a smoother transaction process and helping to achieve a fair market valuation.

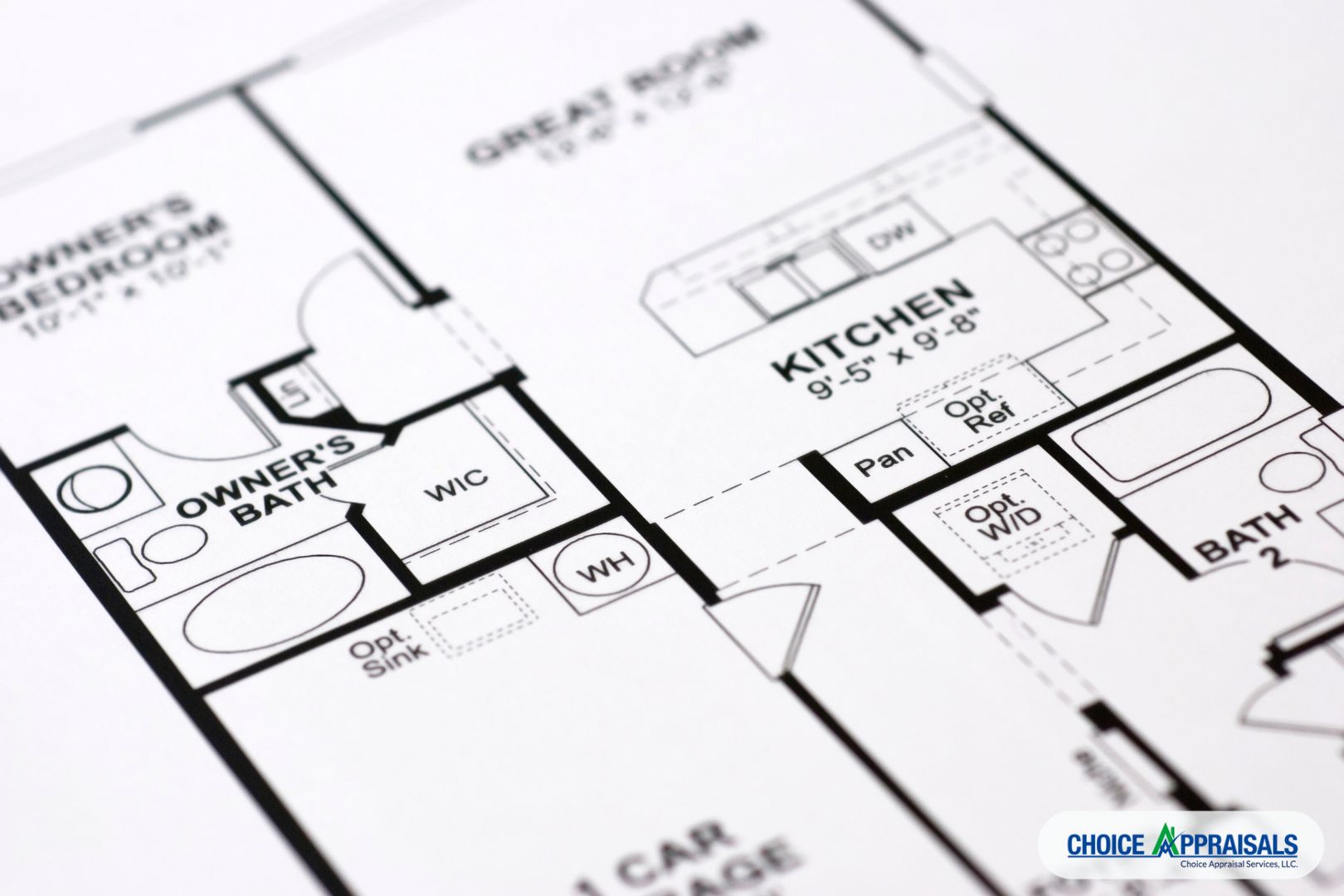

Ensuring Accurate Property Sketches

A critical step in the appraisal process is ensuring accurate property sketches. This step is vital as it directly impacts the Gross Living Area (GLA), which is a fundamental metric in determining a property’s value. Your appraiser cannot afford to drop the ball in this area!

Creating the Appraiser’s Own Sketch

In the case proposed construction, the builder will often provide detailed drawings and specifications of a property, However, it is essential for the appraiser to create their own sketch.

The builder’s drawings can be an excellent starting point, but they might not always adhere to appraisal standards or may include spaces that shouldn’t be counted as living areas. By creating an independent sketch, the appraiser can ensure that all measurements are accurate and meet the standards set forth by appraisal guidelines.

Ensuring the Gross Living Area (GLA) Excludes Non-Living Spaces

One of the most critical aspects of an accurate property sketch is correctly calculating the Gross Living Area (GLA). The GLA should only include spaces that are actually livable.

This means excluding areas such as attics, garages, and porches, which do not conform to the American National Standards Institute (ANSI) guidelines for living spaces. Including these areas can lead to an inflated GLA, which can subsequently result in an inaccurate property valuation.

Real-life Example

Consider a real-life example where a luxury home’s garage was included in the builder’s reported living area. In this case, the initial appraisal based on the builder’s drawings overestimated the property’s value because the garage space was mistakenly counted as part of the living area.

The appraiser, by creating their own sketch and excluding the non-living spaces, corrected this discrepancy. This not only provided a more accurate valuation but also prevented potential disputes or issues during the sale process.

Catching such discrepancies is crucial for several reasons:

-

- Accurate Valuation: Ensures that the property’s value is based on its actual livable space, leading to a fair and precise appraisal.

-

- Client Trust: Builds trust with clients who rely on the appraiser’s expertise and thoroughness.

-

- Market Consistency: Helps maintain consistency in the real estate market by adhering to standard valuation practices.

By creating their own sketches and meticulously ensuring that the GLA excludes non-living spaces, appraisers can provide more reliable and accurate property valuations. This practice not only upholds professional standards but also supports the integrity of the appraisal process, ultimately benefiting all parties involved in the transaction.

Getting the Cost Approach Right

After ensuring the GLA is accurate, a next crucial step is getting the cost approach right. This method involves estimating the current cost to replace the property with a similar one, adjusting for depreciation, and adding the land value. For luxury properties, this approach can be particularly complex due to the high-quality materials and custom features involved.

Reliable Cost Estimator

Using a reliable cost estimator is essential in the cost approach to ensure accuracy. Luxury homes often include bespoke elements and premium materials that require precise valuation. A reliable cost estimator will consider all these factors, providing a detailed breakdown of costs.

It’s important to enter the correct components when using a cost estimator. This includes everything from the type of flooring and countertops to the quality of fixtures and appliances.

Each component must be accurately recorded to reflect the true cost of replicating the property’s unique features. Indicating the appropriate quality for each element ensures that the final estimation is not just a sum of average costs but a true representation of the property’s value.

Avoiding Common Pitfalls

One of the most common mistakes in the cost approach, especially in the case of new or proposed construction, is simply taking the owner’s word on what it cost to build or the appraiser making the cost approach match what the builder said it costs. This can lead to inaccurate appraisals if the reported costs are not thoroughly vetted and verified.

-

- Verify Builder’s Costs: The appraiser should use the materials, finishes, and quality indicated by the builder to develop an accurate cost approach using recognized and accurate cost manuals. This involves a detailed analysis of each element to ensure it meets the high standards of luxury properties.

-

- Discuss Discrepancies with the Builder: Where there are differences in costs, the appraiser can talk with the builder to see if anything was overlooked. This conversation can help identify any discrepancies or additional costs that may not have been initially considered.

-

- Beware of Inflated Costs: In some rare cases, it may be that the builder’s costs are inflated. The appraiser must be vigilant and ensure that the cost approach reflects the true market cost of materials and labor. Relying solely on the builder’s reported costs without independent verification can lead to an overvaluation of the property.

Ensuring that the cost approach is comprehensive and accurate involves avoiding these pitfalls and using a methodical, detailed approach to valuation. By using a reliable cost estimator, verifying builder’s costs, and addressing any discrepancies, appraisers can provide a precise and fair valuation of luxury properties. This diligence helps in achieving a realistic appraisal, benefiting all parties involved in the real estate transaction.

Final Inspection and Verification

When dealing with a luxury property that was initially appraised as proposed construction and has now been completed, conducting a final inspection and verification is crucial. This step ensures that the completed property aligns with the initial plans and meets the standards set during the initial appraisal.

Measuring the Property

One of the primary tasks during the final inspection is to measure the property accurately.

-

- Importance of Measuring: Accurate measurements are essential to confirm that the dimensions of the completed property match those recorded in the initial appraisal. Any discrepancies can impact the appraised value and must be addressed to ensure a fair and accurate valuation.

-

- Ensuring Dimensions Match the Original Sketch: During the final inspection, the appraiser should measure all areas of the property to verify that they conform to the original sketch provided during the initial appraisal.This includes checking the Gross Living Area (GLA) and ensuring that all measurements are consistent with what was originally reported. Any significant variations should be noted and adjusted in the final appraisal report.

Checking Finished Areas

Another critical aspect of the final inspection is to verify that all areas of the property, especially those designated as finished in the initial appraisal, are indeed completed as specified.

-

- Verifying Finished Basements and Other Areas: The appraiser should inspect areas like basements, attics, and additional rooms to confirm they are finished as described.For example, if the initial appraisal included a finished basement, the appraiser must check that the basement is fully completed, with all necessary features and finishes in place.

-

- Impact on Appraised Value: Ensuring that all areas are finished as initially appraised is vital for an accurate final valuation. If any areas are not completed as expected, this can lead to adjustments in the appraised value.For instance, an unfinished basement that was supposed to be finished will lower the overall value of the property compared to the initial appraisal.

Conducting a thorough final inspection and verification ensures that the completed luxury property meets the standards set during the initial appraisal. This step is essential for confirming that all measurements and finished areas align with the initial plans, leading to an accurate and fair final appraisal.

This diligence helps avoid potential disputes and ensures a smoother transaction process, reflecting the true value of the luxury property.

Common Pitfalls and How to Avoid Them

Even with the best intentions and efforts, there are common pitfalls that can undermine the accuracy of a luxury property appraisal. Recognizing these pitfalls and knowing how to avoid them is crucial for ensuring a fair and precise valuation.

Overestimating Value

One of the most frequent issues is overestimating the value of a property.

-

- Avoiding Unrealistic Expectations: It’s easy for owners and appraisers to fall into the trap of overestimating the value based on emotional attachment or personal opinions about the property.Luxury properties often have sentimental value and unique features that owners believe should significantly increase the property’s worth. However, these subjective views can lead to inflated valuations.

-

- Relying on Objective Market Data: To avoid this pitfall, appraisers must rely on objective market data rather than personal opinions. This includes analyzing recent sales of comparable properties, understanding the market trends, and considering the actual demand for similar luxury homes.An unbiased approach helps in arriving at a realistic value that reflects true market conditions.

Ignoring Market Conditions

Another major pitfall is ignoring or not fully understanding current market conditions.

-

- Understanding Market Trends: The luxury real estate market can be highly volatile, influenced by economic factors, buyer preferences, and local market dynamics. Ignoring these trends can lead to inaccurate valuations.Appraisers need to stay informed about the latest developments in the luxury market and adjust their assessments accordingly.

Lack of Preparation

Insufficient preparation is another common issue that can adversely affect the appraisal process.

-

- Consequences of Insufficient Preparation: Lack of thorough preparation can lead to missed details, overlooked features, and ultimately, an inaccurate valuation. For luxury properties, where every detail can significantly impact the overall value, this can be particularly detrimental.

-

- Steps to Ensure Thorough Preparation: To avoid this pitfall, appraisers should take several preparatory steps:

- Gather Detailed Information: Collect all necessary documents, including blueprints, tax records, renovation histories, and unique feature descriptions.

- Conduct a Preliminary Analysis: Before the on-site visit, perform a preliminary analysis of the property and the market to identify key areas of focus.

-

- Thorough Property Inspection: During the inspection, meticulously document all features, take accurate measurements, and verify that all aspects of the property match the initial information provided.

-

- Engage with the Property Owner: Communicate with the property owner/builder to clarify any uncertainties and gather additional insights that may not be immediately apparent.

By recognizing and addressing these common pitfalls, appraisers can ensure a more accurate and fair valuation of luxury properties. Avoiding overestimation, understanding market conditions, and preparing thoroughly for the appraisal process are critical steps in achieving a precise and reliable appraisal outcome.

Conclusion

In summary, accurately appraising luxury residential properties requires a thorough and meticulous approach. Here are the key points we’ve covered:

Understanding the Unique Challenges of Luxury Appraisals:

-

- High-value properties have unique features that significantly impact their value.

- Finding comparable sales is challenging due to the distinctiveness of luxury homes.

- Market trends can heavily influence the valuation of luxury properties

Preparing Your Property for Appraisal:

-

- Gather comprehensive documentation, including property history, renovations, unique features, blueprints, and legal documents.

- Ensure the property’s presentation highlights it’s luxury features.

Selecting the Right Appraiser:

-

- Choose an appraiser with specific experience in luxury properties and relevant credentials.

- Ensure the appraiser has in-depth knowledge of the local luxury market for an accurate valuation.

Ensuring Accurate Property Sketches:

-

- Appraisers should create their own sketches to ensure accuracy and adherence to appraisal standards.

- Exclude non-living spaces from the Gross Living Area (GLA) to avoid inflated valuations.

Getting the Cost Approach Right:

-

- Use a reliable cost estimator and verify the builder’s reported costs.

- Ensure the cost approach reflects true market costs by avoiding inflated or unverified figures.

Final Inspection and Verification:

-

- Measure the property accurately and ensure dimensions match the original sketch.

- Verify that all designated finished areas are completed as specified in the initial appraisal.

Common Pitfalls and How to Avoid Them:

-

- Avoid overestimating value by relying on objective market data and understanding current market conditions.

- Prepare thoroughly for the appraisal by gathering detailed information, conducting preliminary analysis, and engaging with the property owner.

By implementing these tips, you can ensure a successful appraisal experience that accurately reflects the true value of your luxury property. This diligence not only supports fair and precise valuations but also fosters trust and smooth transactions.

Remember, a meticulous approach to appraisals is crucial in the high-stakes world of luxury real estate, and adhering to these best practices will help you achieve the most accurate and fair outcomes. If you’ve found value from this article, please share it with a colleague or anyone you think would benefit. Thanks for reading!

by Conrad Meertins | Jan 1, 2024 | Valuation

In the world of home appraisals, the clash between emotional value and market reality often emerges, a theme vividly illustrated in a recent case I encountered.

About five months ago, a soft-spoken man sought my expertise for an unbiased appraisal of his father’s home. Caught in a $50,000 valuation disagreement with his brother, they turned to me to settle their differences.

This case unravels not just the complexities of property appraisal but also the emotional ties we associate with our homes. As we delve into this intriguing case study, we’ll explore how market data often challenges our expectations, teaching us valuable lessons in property valuation.

Background of the Property

Nestled in a neighborhood in Louisville, where property values are between $278,000 and $550,000, with a median sale price at $375,000, the subject property presented a unique appraisal challenge. This home, larger than most in its neighborhood at over 1800 square feet, had features both appealing and dated.

The basement, equipped with one kitchen, could be seen as a versatile addition, offering potential for rental income or extended family living. A second part of the property, transformed into a modern accessory unit, added a contemporary touch.

However, the main level told a different story. Despite being well-maintained, it was a time capsule of the 1970s, with its disco-era wallpaper and outdated fixtures. This blend of the old and the new, where the majority of the living space still echoed the past, demanded careful consideration in its valuation.

Appraisal Process and Challenges

As an appraiser, my process involved a meticulous valuation of the property’s attributes: its prime location, the large living area, and the modern updates on the second level.

However, the challenges were evident. The dated condition of the main level, representing 70% of the living space, significantly impacted the overall valuation.

Despite the modern renovations and unique features like an additional kitchen, the property’s true market value couldn’t solely hinge on its updates. It required a holistic view, considering both its strengths and weaknesses.

This comprehensive analysis led to a valuation of $325,000, a figure grounded in market realities yet distant from the clients’ expectations.

Client Reaction and Market Reality

When the appraisal valued the home at $325,000, the clients were in disbelief, struggling to reconcile this figure with their higher expectations of $400,000 to $500,000. Their emotional attachment to the home clouded their acceptance of the market-based valuation, particularly the impact of its outdated main living area.

Despite a detailed explanation during a follow-up meeting, their conviction in the home’s higher worth remained unshaken. Boldly, they listed the property for $405,000, but the market’s response was unequivocal.

After languishing for 100 days without interest, they had to reduce the price by over $30,000. But, there was still no interest. This stark contrast between expectation and reality highlighted a crucial lesson: emotional value doesn’t always align with market value.

Conclusion

In conclusion, the case of the “High Hopes Appraisal” serves as a powerful reminder of the complex interplay between emotional value and market reality in property valuation.

It underscores that while sentimental attachment can significantly inflate a homeowner’s valuation expectations, the true worth of a property is ultimately determined by the open market, influenced by current trends and objective data.

This case study highlights the importance of approaching property appraisals with an open mind, valuing the expertise of professionals, and understanding that market data often tells a story different from our personal narratives. It’s a testament to the fact that in real estate, numbers and market dynamics hold the final say, not our emotional connections to the property.

If you’re navigating the intricate process of property valuation and seeking an unbiased, market-informed perspective, reach out for professional appraisal services.

Let’s ensure your property decisions are grounded in reality and informed by expert insights. Remember, in the real estate market, it’s the hard data that ultimately shapes our success.

– Conrad Meertins, Jr.