by Conrad Meertins | Jan 20, 2025 | Valuation

My first experience with an ADU was about a decade ago in Old Louisville. It was a four-story single-family residence (a beautiful brownstone). Just as I thought I had finished the appraisal, the owner asked, “Would you like to see the carriage house?”

I didn’t know there was more to see, but I confidently said, “Of course!” I was looking forward to it, not realizing at the time how ADUs would eventually become a significant trend in real estate.

As a Louisville appraiser, I’ve witnessed firsthand how Accessory Dwelling Units (ADUs) are reshaping our local real estate market. From the historic carriage houses in Old Louisville to newly constructed garden suites in St. Matthews, these versatile spaces are becoming increasingly valuable additions to Kentucky properties.

Let’s explore how ADUs impact market value, both positively and negatively, and what homeowners and buyers need to know about Fannie Mae’s guidelines.

The Upside: Positive Impacts of ADUs on Market Value

1. Increased Property Value in Our Market

Here in Louisville, where housing demand continues to grow, particularly in areas like the Highlands and Crescent Hill, ADUs often significantly increase a property’s value. The charm of our historic neighborhoods makes these additions especially appealing when they complement the architectural character of the main residence.

2. Rental Income Potential in Derby City

With the Kentucky Derby, Louisville’s growing tourism industry, and our expanding medical district, ADUs offer unique rental opportunities. From short-term rentals during major events to long-term leases for medical residents and students, ADUs can provide substantial income streams that help offset mortgage costs or generate additional cash flow.

3. Enhanced Market Appeal in Our Community

Louisville’s multi-generational families and young professionals are increasingly seeking properties with ADUs. Whether it’s housing aging parents in Cherokee Gardens or creating a home office in Clifton, these spaces offer the flexibility and versatility that our local market demands.

4. Flexibility in Use

ADUs can adapt to the changing needs of homeowners. Today, they might serve as a rental unit or guest house; tomorrow, they could be a home office, a space for aging relatives, or even a short-term rental during Derby week.

Challenges to Consider: The Downsides of ADUs

While ADUs offer incredible benefits, there are challenges to keep in mind:

1. High Construction Costs

Building an ADU can be a significant upfront investment, ranging from $100,000 to over $400,000 depending on size, design, and location.

2. Zoning and Regulatory Hurdles

Local zoning laws and permitting requirements can be complicated. Noncompliant or illegal ADUs may impact insurance claims, property marketability, or financing options.

3. Increased Property Taxes

Adding an ADU typically increases a property’s assessed value, which means higher property taxes.

4. Maintenance and Management

For those renting out their ADU, property management and maintenance become ongoing responsibilities.

5. Type of ADU Impacts Value Differently

- Detached ADUs generally add the most value.

- Attached ADUs come next.

- Internal ADUs (like basement apartments) add the least value but can still be significant depending on the market.

What Does Fannie Mae Say About ADUs?

As a key player in the mortgage market, Fannie Mae provides specific guidelines for properties with ADUs:

- Appraisal Requirements: Appraisers must evaluate how the ADU contributes to market value by analyzing comparable sales or, if none are available, using a cost-based approach.

- Gross Living Area (GLA): ADUs are appraised separately from the main dwelling unless they are within it and have interior access.

- Legal Compliance: ADUs must meet local zoning laws and regulations to be included in the property’s valuation.

- Financing and Underwriting: Lenders must follow specific loan-to-value (LTV) and debt-to-income (DTI) guidelines while factoring in potential rental income from the ADU.

Real-Life Insights: ADUs in Louisville

My most recent experience with an ADU involved a proposed construction project—a $1.3 million build featuring a 3,500-square-foot main residence with an attached garage and a 1,500-square-foot ADU on the other side of the garage.

The design was not only stunning but also supported by the local market, demonstrating a positive correlation between construction costs and property value in this case.

Looking Forward: What ADUs Mean for Louisville

As Louisville continues to grow and evolve, ADUs represent a significant opportunity for property owners. Whether you’re in the Highlands, Butchertown, or the expanding East End, understanding how these units impact property values is crucial for making informed real estate decisions.

Adding an ADU can increase property value, generate income, and provide flexibility, but it also requires careful planning, compliance with local regulations, and a clear understanding of market trends.

Fannie Mae’s guidelines play a vital role in shaping how ADUs are appraised and financed, so it’s important to factor these into your decision-making process.

If you’re considering adding an ADU to your property—or buying a home with one—consulting with a professional appraiser who understands the local market can make all the difference.

Need professional guidance on ADU appraisal in Louisville? Contact me for a thorough valuation of your property’s potential!

by Conrad Meertins | Feb 27, 2024 | Market Trends, Valuation

In the realm of real estate, the synergy between homeowners, realtors, and appraisers is not just beneficial; it’s essential.

Drawing from Stephen Covey’s 6th habit, “Synergize”, we see the immense value in collaborative efforts, especially when it comes to the precise task of home valuation. This principle underscores the strength found in teaming up, highlighting how collective inputs lead to superior outcomes.

The Unique Roles in Real Estate Transactions

Realtors are the navigators of the real estate transaction process, masters at brokering deals to ensure fairness and optimal outcomes for their clients. With an in-depth knowledge of market areas honed over years, they are pivotal in guiding homeowners through the complexities of selling or buying a home.

Appraisers, on the other hand, bring a different set of skills to the table. As valuation experts, they delve into the nitty-gritty details of property value, armed with data and trends to pinpoint the most accurate market value.

Their expertise becomes particularly crucial in fluctuating markets, where accurate valuations can make or break a deal.

The Synergy in Action: A Real-World Scenario

Consider a homeowner eager to sell their property. They believe their home is worth $350,000, while their realtor, considering current market dynamics, suggests a starting point of $300,000.

Here, the realtor could either acquiesce to the homeowner’s wishes or provide detailed market insights to align expectations. This is where an appraiser’s expertise becomes invaluable.

Data and Evidence: Understanding Louisville’s Market

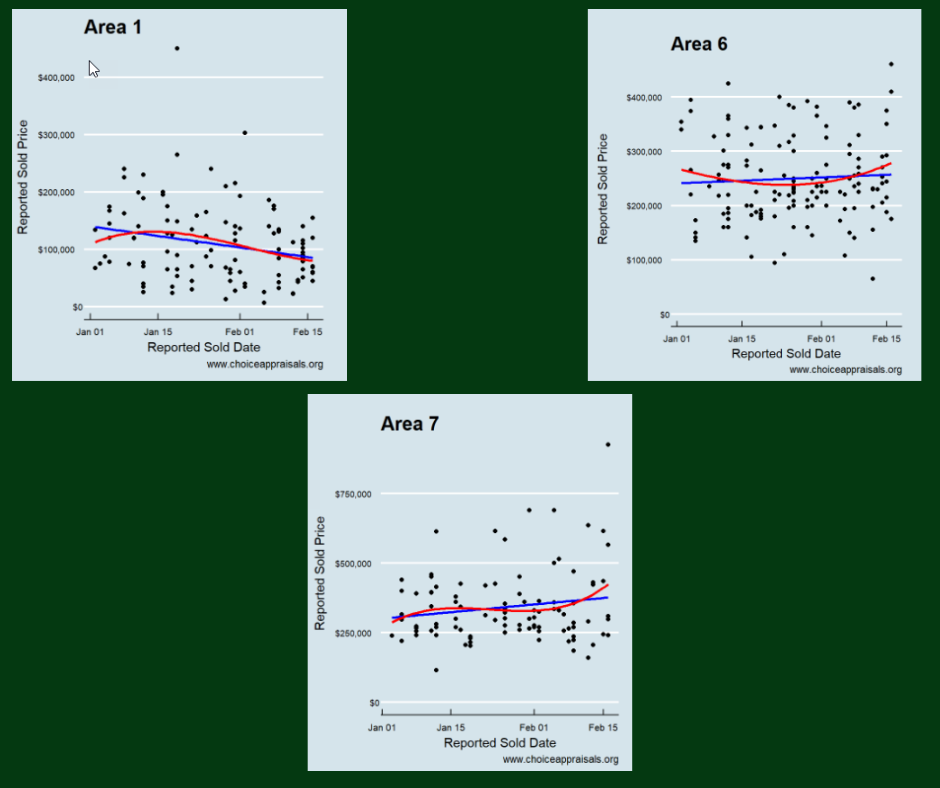

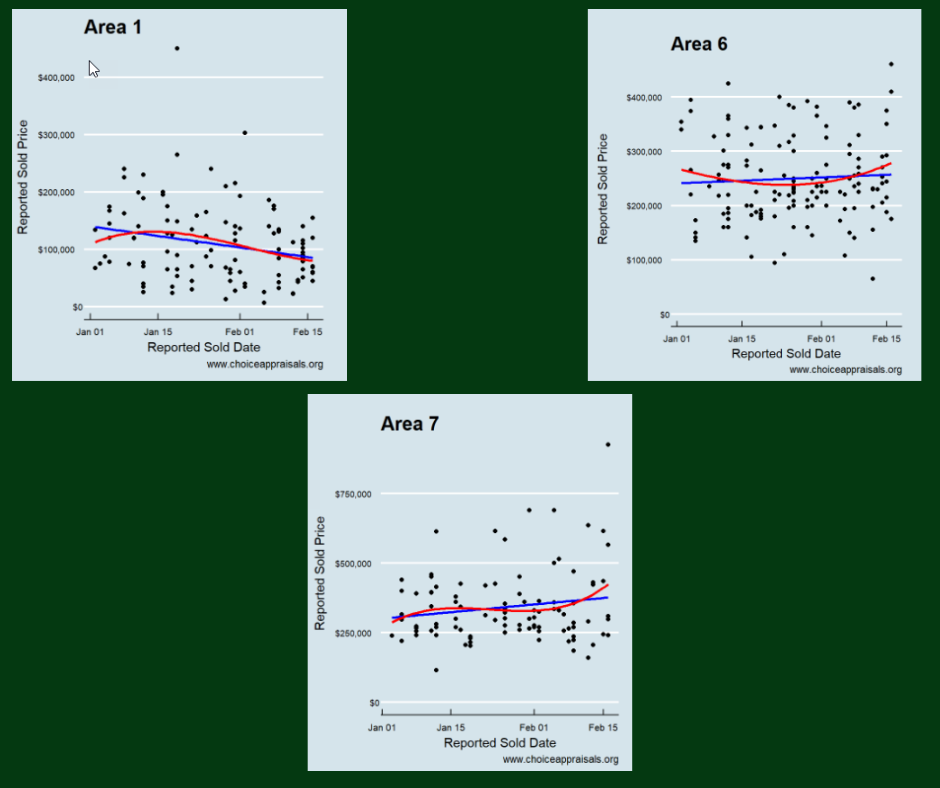

The above graph highlights the trend for homes that sold in MLS Area 1, Area 6, and Area 7. While Area 1 experienced a decline in sales prices with 114 sales, Areas 6 and 7 showed an uptick, boasting 145 and 96 sales, respectively.

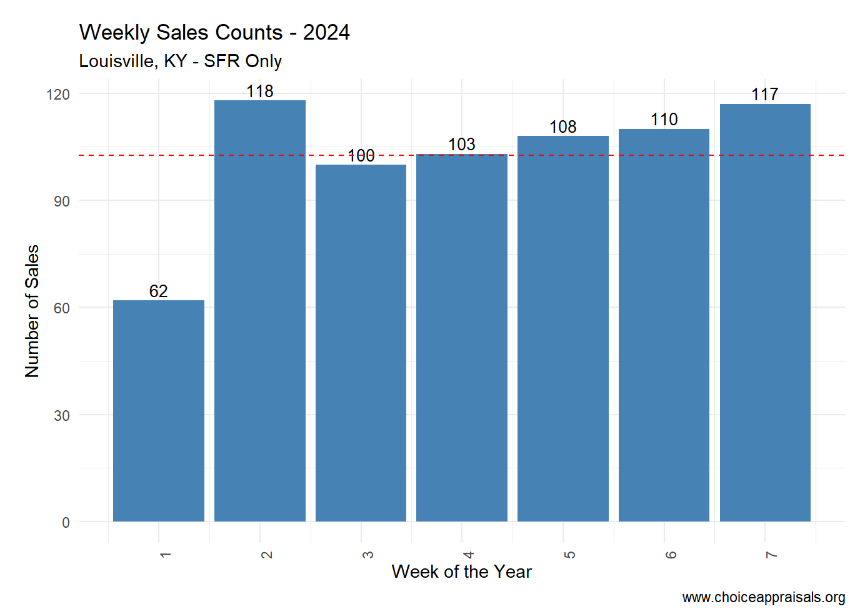

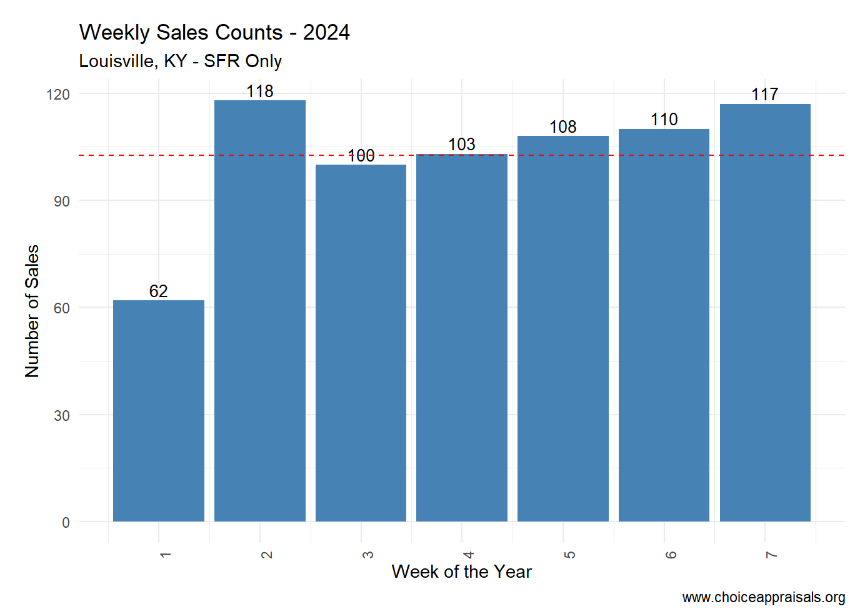

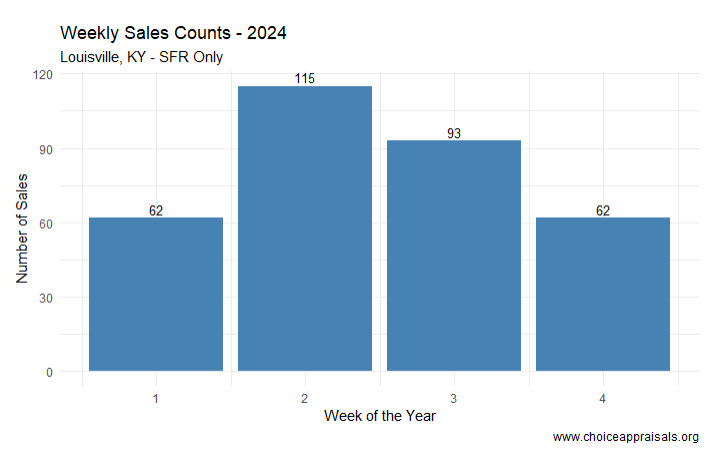

The above graph highlights the weekly volume of sales in Louisville, KY. since week one of 2024

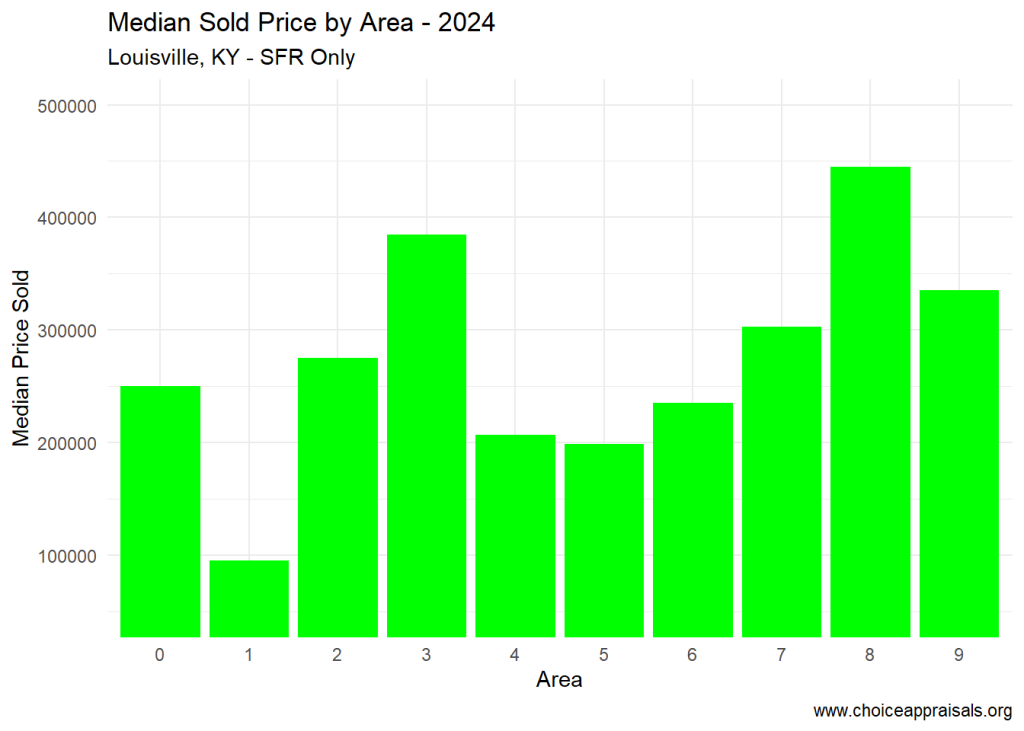

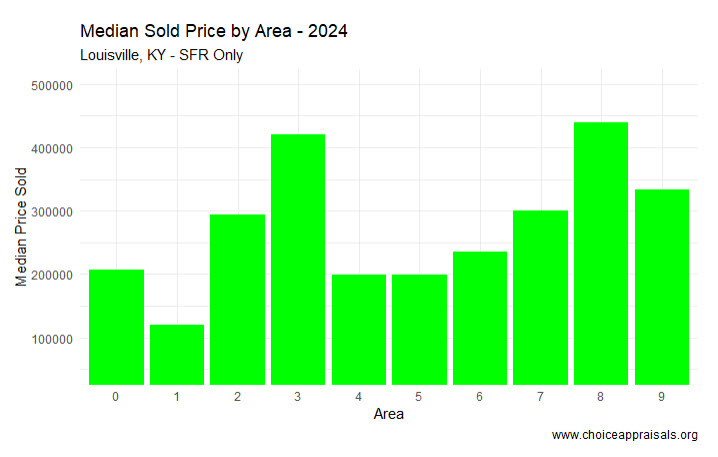

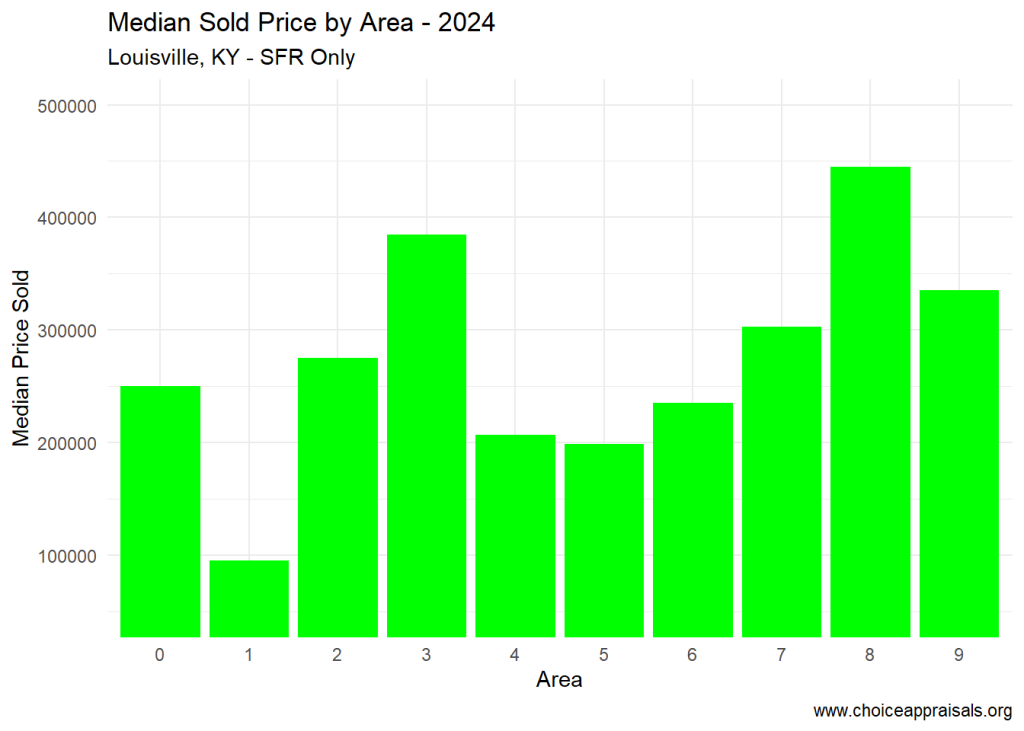

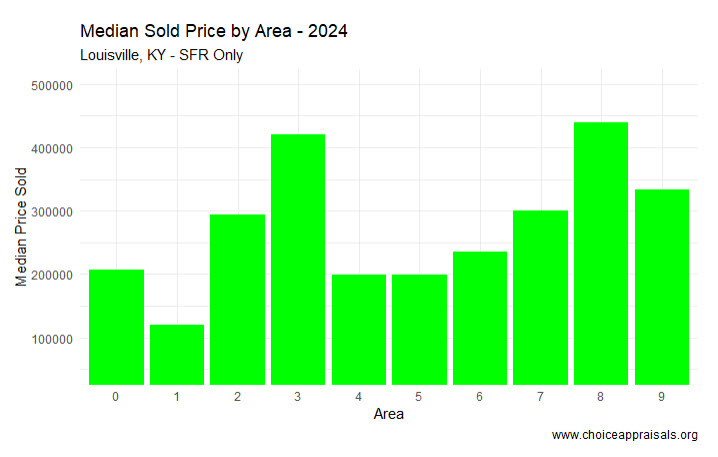

The above graph illustrates the median sale price for each MLS area in Louisville, KY over the first 7 weeks of 2024. As can be seen from the above charts, in week 7 of 2024, Louisville’s real estate market presented varied trends across its MLS areas.

The average days on market hovered between 20 and 25, with an overall median sales price of $249,000 across Louisville.

However, disparities exist, with Area 3 approaching a median of $400K and Area 8 nearing $450K. Such granular data is crucial for appraisers and realtors alike to provide homeowners with accurate, realistic valuations.

Leveraging Synergy for Success

When realtors and appraisers collaborate, sharing insights and data, they ensure homeowners receive the most accurate valuation, tailored to the nuanced dynamics of their specific MLS area.

This synergy not only enhances trust among all parties but also secures a smoother transaction process, grounded in realism and mutual understanding.

Embrace Collaboration

For homeowners, understanding the value of your home is more nuanced than it might appear. Engage both your realtor and a local Louisville appraiser in the conversation.

Realtors, don’t hesitate to bolster your market knowledge with insights from appraisers. Appraisers, your expertise is more critical than ever in today’s data-rich age—collaborate with realtors to demystify market trends for homeowners.

The Winning Formula

Synergy, as Stephen Covey highlighted, is about producing a collective outcome that surpasses what individuals could achieve alone.

In Louisville’s diverse real estate landscape, embracing this collaborative spirit ensures that homeowners, realtors, and appraisers alike can navigate the valuation process with confidence, accuracy, and success.

Let’s work together, leveraging our unique strengths for the common goal of transparent, fair, and effective real estate transactions. Go Louisville, where synergy is indeed where it’s at!

by Conrad Meertins | Jan 30, 2024 | Market Trends

In the heart of Louisville, real estate embodies a simple truth: everyone can indeed win. As an appraiser and an optimist who always looks for the silver lining, I see the essence of ‘Win-Win’ deeply ingrained in the process of buying and selling properties.

Just think of the definition of market value—a probable price struck when buyers and sellers, each acting in their own best interest without pressure, reach a harmonious agreement. This is the epitome of ‘Win-Win’ in our world.

But let’s get practical—how does this philosophy translate into the nuts and bolts of property valuation and deciding how to list your home?

It all begins with facts. A quote that I love is as follows: True victory is not in the acquisition alone but in the integrity of the transaction. Misrepresentation benefits no one.

That’s why due diligence is a cornerstone. And for us real estate professionals, our role is crucial—we must anchor our valuations in reality, not fancy. In this context, thinking ‘Win-Win’ is built on understanding the facts of our current real estate landscape in Louisville.

Let’s lay out these facts, not with complexity but with the clarity that empowers. With a clear view of how the market has fared in the first month of 2024, we pave the way for decisions that benefit all.

Active Listings: Climbing Towards More Opportunities

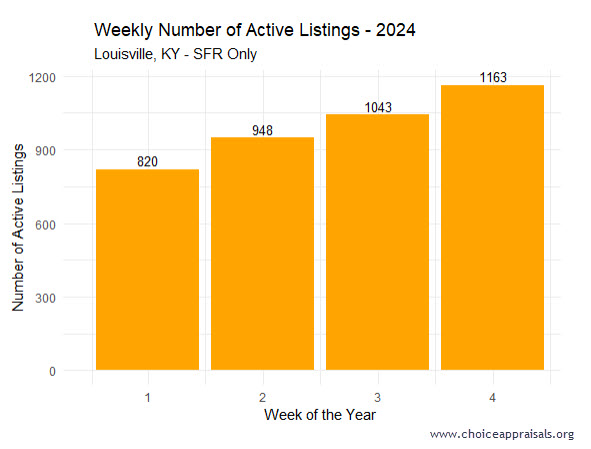

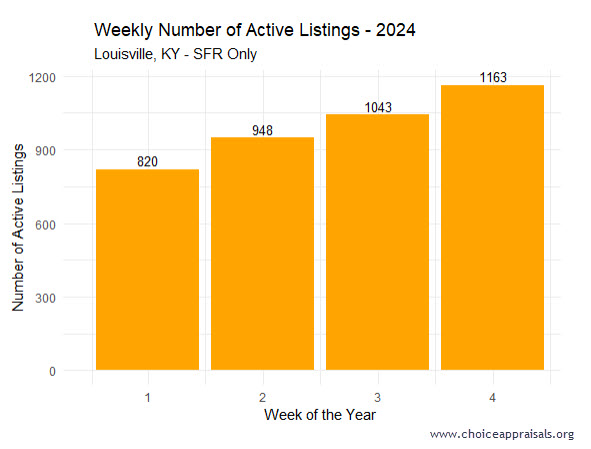

The bar graph illustrates an upward trend in the number of active listings from 820 in the first week to 1163 by the fourth week.

A growing inventory could be indicative of two trends: either sellers are entering the market to take advantage of favorable conditions, or it could suggest a slowdown where listings are staying on the market longer than in previous periods.

It’s important for agents and homeowners to watch this trend closely, as a high inventory level could lead to a more competitive market for sellers, possibly affecting prices and selling strategies.

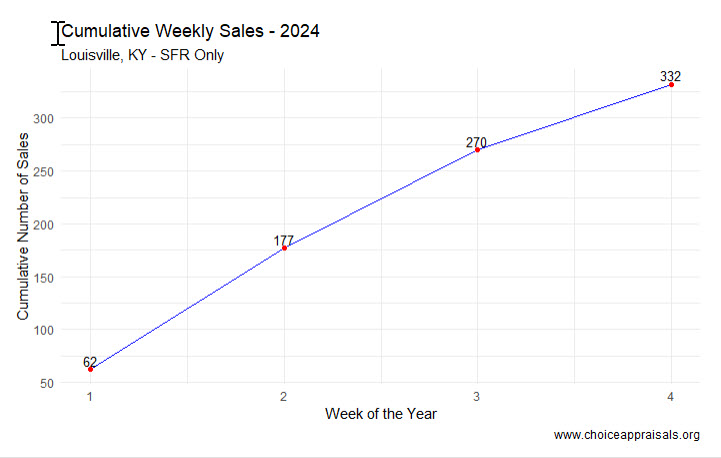

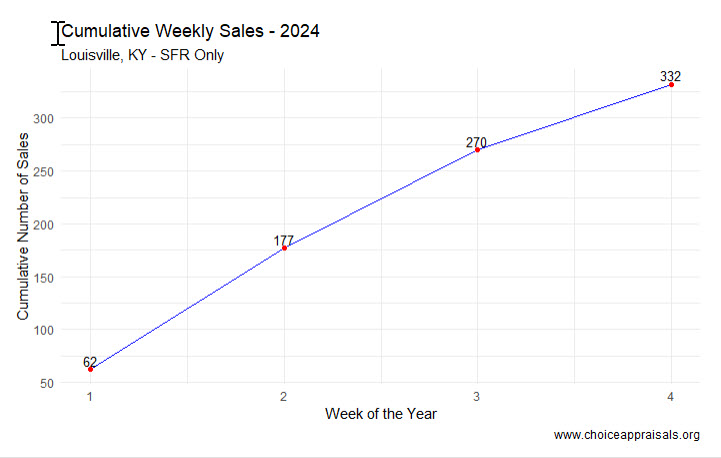

Cumulative Sales: Assessing the Market’s Lift-Off

The “Cumulative Weekly Sales – 2024” graph for Louisville, KY, depicts an upward trend in property sales over the first month, with sales rising from 62 to 332. While at first glance this seems to indicate a thriving market, we have to be careful.

The trend does not necessarily signify robust growth without a benchmark. Seasonal influences also play a crucial role in real estate activity. So, it’s important to question whether this early-year sales uptick means.

Time will tell but for the sake of home buyers, realtors and appraisers, we hope it’s a sign of greater sales volume than last year.

In this context, a Win-Win scenario materializes when everyone leverages this data coupled with the information about active listings to make decisions that reflect both the present moment and the potential of the market’s future.

MLS Areas: Decoding the Sales Price Variance

The graph showcasing the “Median Sold Price by Area – 2024” in Louisville, KY, for single-family residences reveals varied median prices across nine different areas.

This variance highlights the diverse nature of the housing market within the city, suggesting that certain areas are more in demand or possess attributes that command higher prices—factors such as school districts, proximity to amenities, and neighborhood desirability might be influencing these figures.

Notably, Area 8 stands out with a median price significantly higher than the others, which could indicate a premium neighborhood or area with larger or more luxurious homes. Conversely, Areas 1 exhibits a notably lower median sold price, which could reflect a variety of factors such as older homes, or more modest housing options.

Interesting Fact: Area 1 had the second highest amount of sales volume for the first four weeks of January 2024 with 47 sales. I personally have done more Louisville appraisals in this part of town in the past 30 days. Area 8 came in at #5 with 35 sales. It’s funny how the winner changes when we change the lens that we look through.

Weekly Sales: Unpacking the Market’s Pulse

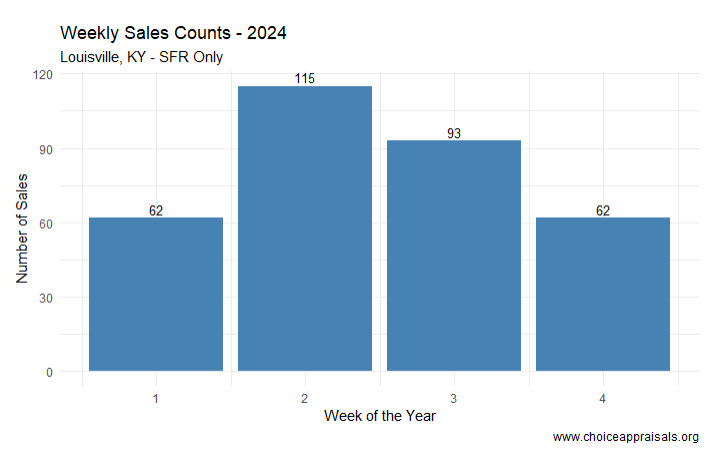

The “Weekly Sales Counts – 2024” graph for Louisville, KY, presents a roller coaster like sales pattern within the first month of the year. We begin with 62 sales in week one, surge to 115 sales in the second week, then experience a decrease to 93 in week three, before returning to the starting point of 62 sales in week four.

This ebb and flow could reflect a number of underlying market dynamics. The initial rise in sales might indicate a wave of activity often seen at the beginning of a new year, as buyers and sellers enter the market with fresh goals.

Then, week three seems to whisper, “Let’s just slow down and think about this,” possibly due to buyer hesitancy or sellers holding out for better offers. By week four, we’re back to where we started, which could be a sign of market stabilization—or maybe it’s just taking a nap after the excitement of the year end – I think/hope it’s the latter!

The subsequent fall could suggest that this initial enthusiasm is tempered by external factors, such as economic news or interest rate adjustments, which may cause market participants to act more cautiously.

Overall, this data underscores the importance of monitoring weekly market movements closely, as they can provide early indications of shifts in buyer and seller behavior that could impact strategy and decision-making.

Valuations: Crafting a Win-Win Strategy

When it comes to valuations, ‘Think Win-Win’ is about fairness and balance. For realtors and clients in Louisville, here’s how you can put this into practice:

Stay Informed and Educate: The real estate market is dynamic, and being well-informed is key. An educated homeowner is more likely to price their home accurately, and an educated buyer can make a fair offer.

Regular Market Analysis: Keep an eye on how homes are priced in different areas. Realtors should provide homeowners with a regular analysis of how the market is moving, not just in terms of price but also in how long homes stay on the market.

Set Realistic Expectations: Help clients set realistic expectations based on market data. If the market is indicating a decrease in demand, homeowners should be prepared for potentially longer selling times.

Listen and Adapt: A Win-Win situation comes from understanding what the other party values. Listen to buyers and sellers carefully and adapt your strategy to align with their goals.

Prepare for Different Scenarios: The market can shift unexpectedly. Have a plan for different scenarios, whether it’s a sudden uptick in interest rates or a change in buyer sentiment.

Conclusion

In the Louisville market, adopting a ‘Think Win-Win’ approach in real estate isn’t just idealistic, it’s practical. It’s about creating transactions where buyers and sellers walk away satisfied, where the value is fair, and where the community thrives on the integrity of its dealings.

I invite you to reflect on this philosophy and how it has shaped your experiences in real estate. Have you encountered situations where the Win-Win approach turned a negotiation around or created a surprising opportunity? Share your stories and insights. Let’s continue the conversation and learn from each other, so we can all reap the rewards of a market that works for everyone.

by Conrad Meertins | Jan 8, 2024 | Market Trends

The Power of Proactivity in Real Estate

Have you ever watched a chess master at work? Each move is made not just for the present but for the unfolding game. If she is going to win, one key will be mastering the habit of proactivity.

It’s little wonder that this habit is the first one mentioned of Stephen Covey’s Seven Habits of Highly Effective People. Will Real Estate professionals need this quality for 2024? Absolutely.

As Covey mentioned, exemplifying this habit means that we give ourselves space between stimulus and response and claim our control. In this article I’ll be reviewing activity from the first week of January with the goal of helping you to be proactive in the real estate game.

Current Market Pulse: A Snapshot of Early January 1/1/24 – 1/7/24

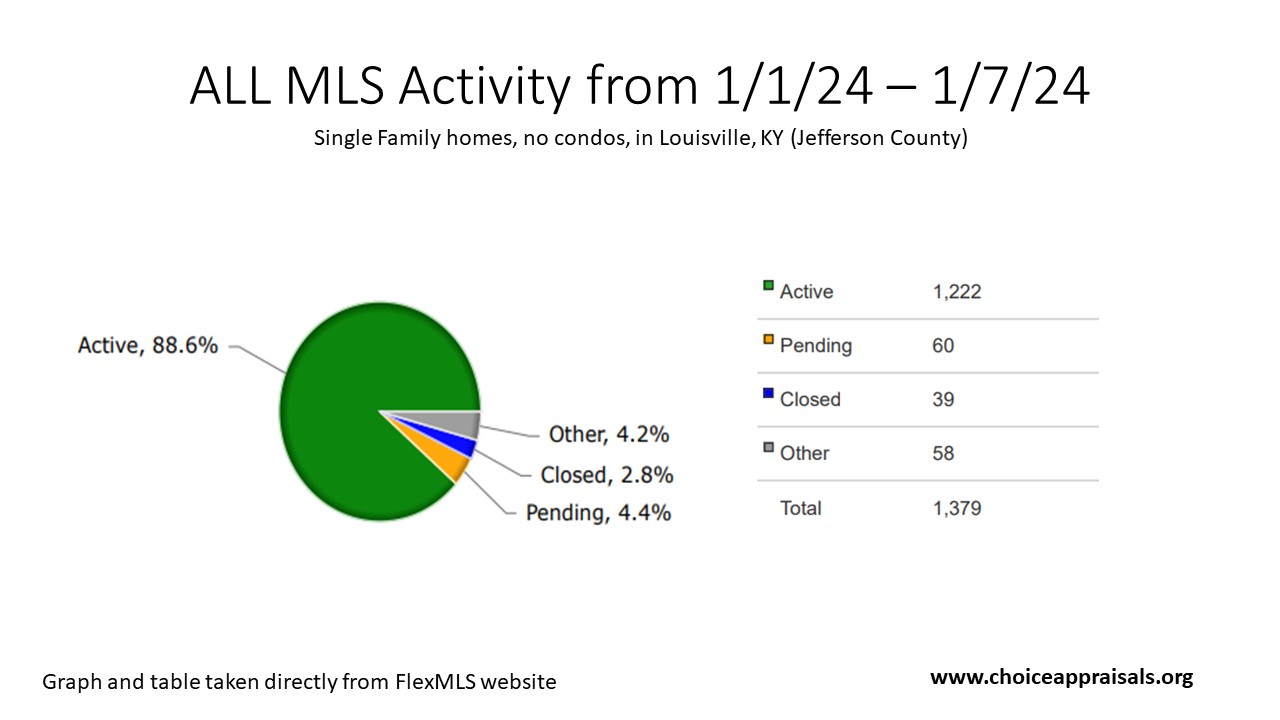

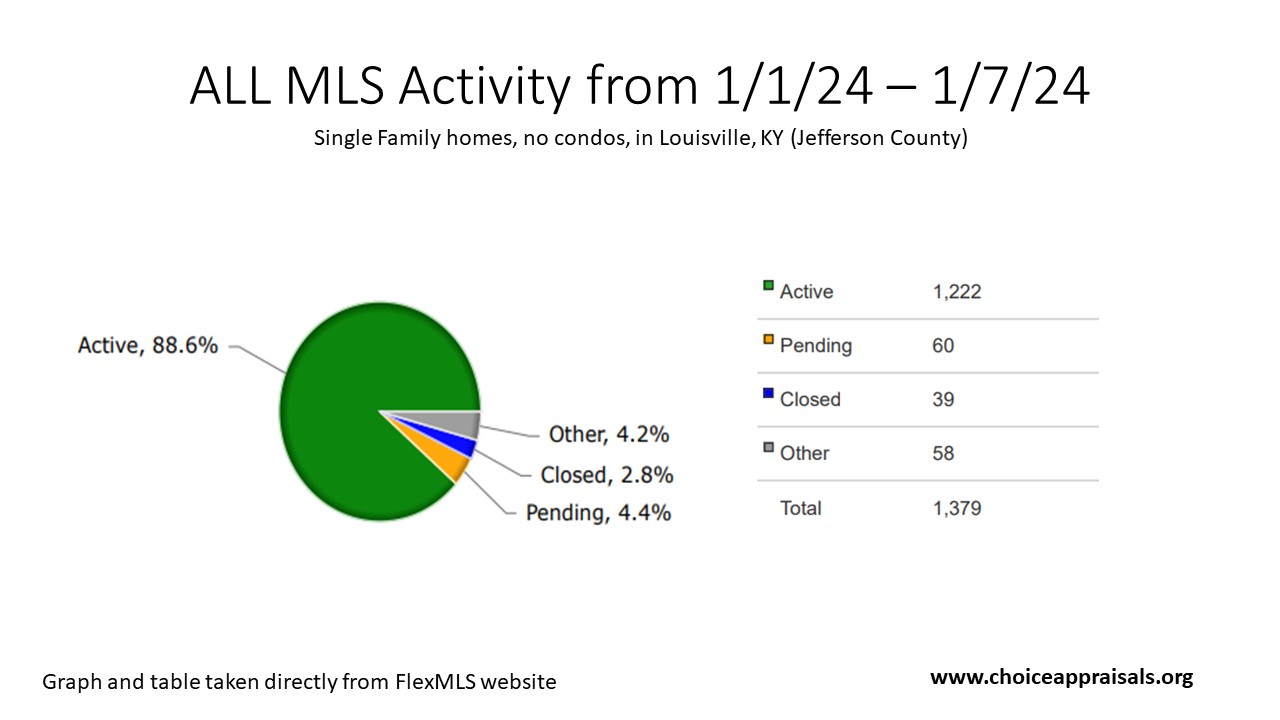

Is Our Market Bursting with Options?

As we stepped into January, we saw 1,222 homes for sale here in Louisville, KY. This could mean lots of choices for buyers. But proactive real estate professionals know there’s a need to look a bit closer.

Only a small slice of homes are actually getting offers (4.4%) and even fewer are being sold (2.8%). Could some homes be priced too high? Or is something else making buyers hesitate?

Something we can’t get away from is the fact that interest rates are between 6.62% and 7.20% for most home loans (depending on where you shop). Even though these rates have dipped a tiny bit, they’re still pretty high compared to the past, which could make buyers slow down and think twice as they contemplate that higher monthly payment.

Plus, let’s be real, moving when it’s cold and right after spending time off with family isn’t a fun idea for many people. That can definitely make for a slower market.

So what’s the real deal in Louisville, with our market (1222 active listings) in this chilly season?

We might have:

- a vibrant market with lots of options for buyers.

- a market that’s taking a breather with homes not selling as fast as expected. Or

- overpriced listings.

To really understand what’s happening, we’re going to take a closer look at the homes that did sell during the first seven days of January 2024 and check out the Cumulative Days on Market of homes that are still active.

What Week 1 -January 2024 Sales Reveal

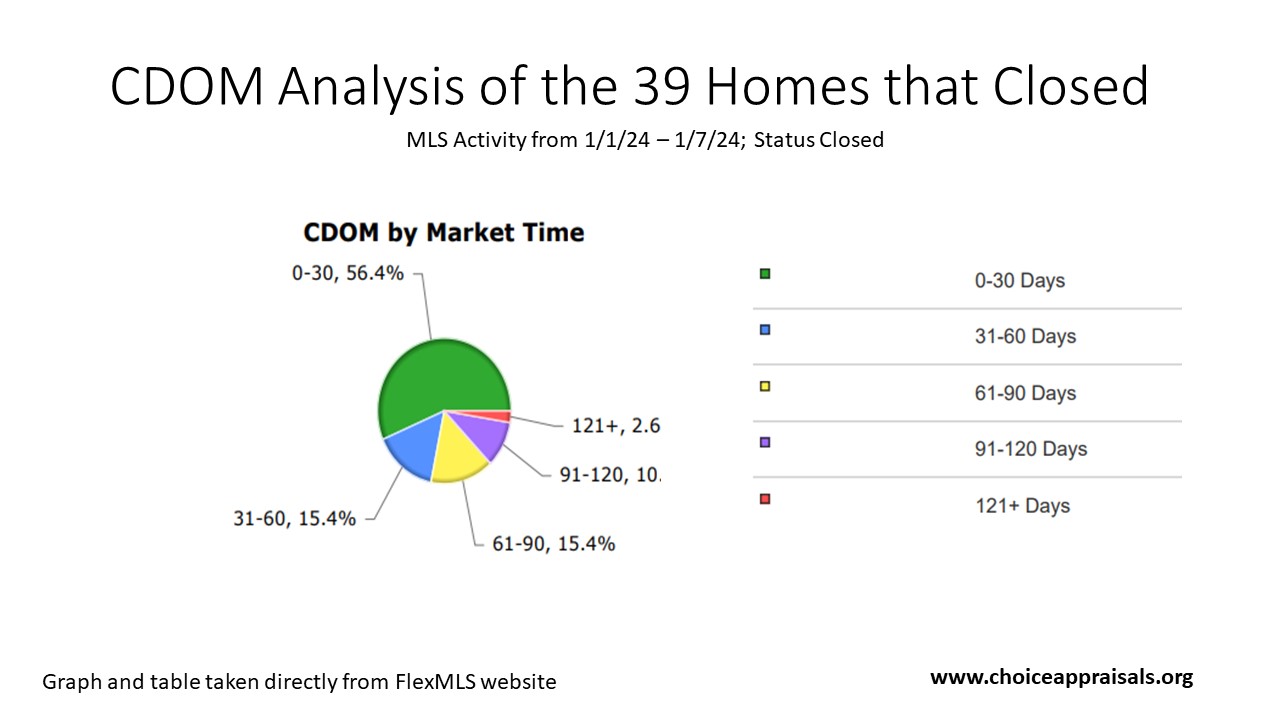

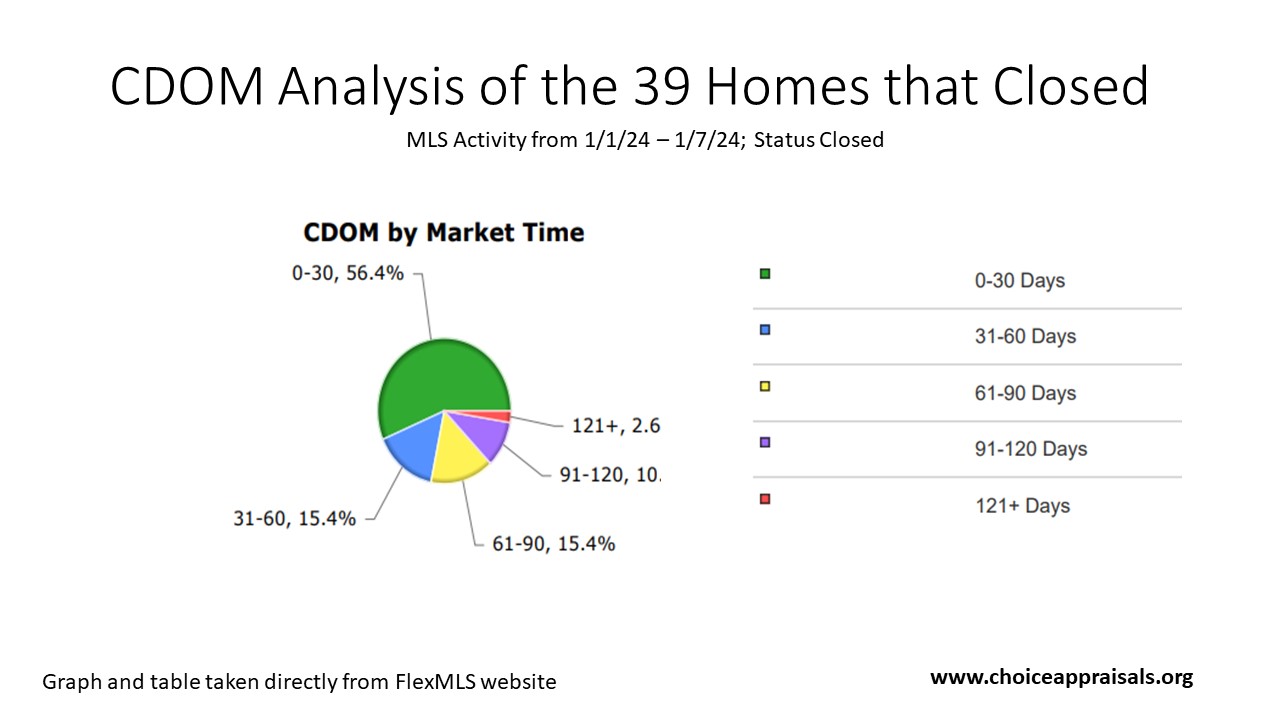

Peering into the recent sales gives us a clearer picture of our winter market. In January’s first week, out of 1,222 homes up for grabs, 39 made it across the finish line. But how fast?

The pie chart lays it out: Over half of the homes sold (56.4%) in 30 days or less. This brisk movement indicates a segment of our market is priced just right—homes that buyers are snatching up quickly, likely because they hit that sweet spot of value and appeal.

Then there’s the 15.4% that closed in 31-60 days and another 15.4% in 61-90 days.

These homes took their time, but not too much time. It suggests a balanced approach—perhaps a minor price negotiation here or a little patience there paid off.

The smaller slices—10% selling in 91-120 days and a sliver at 2.6% beyond 120 days—tell us some stories took longer to tell.

These could be homes where initial expectations needed adjusting, whether due to price, property quirks, or just finding the right buyer who sees a diamond where others didn’t.

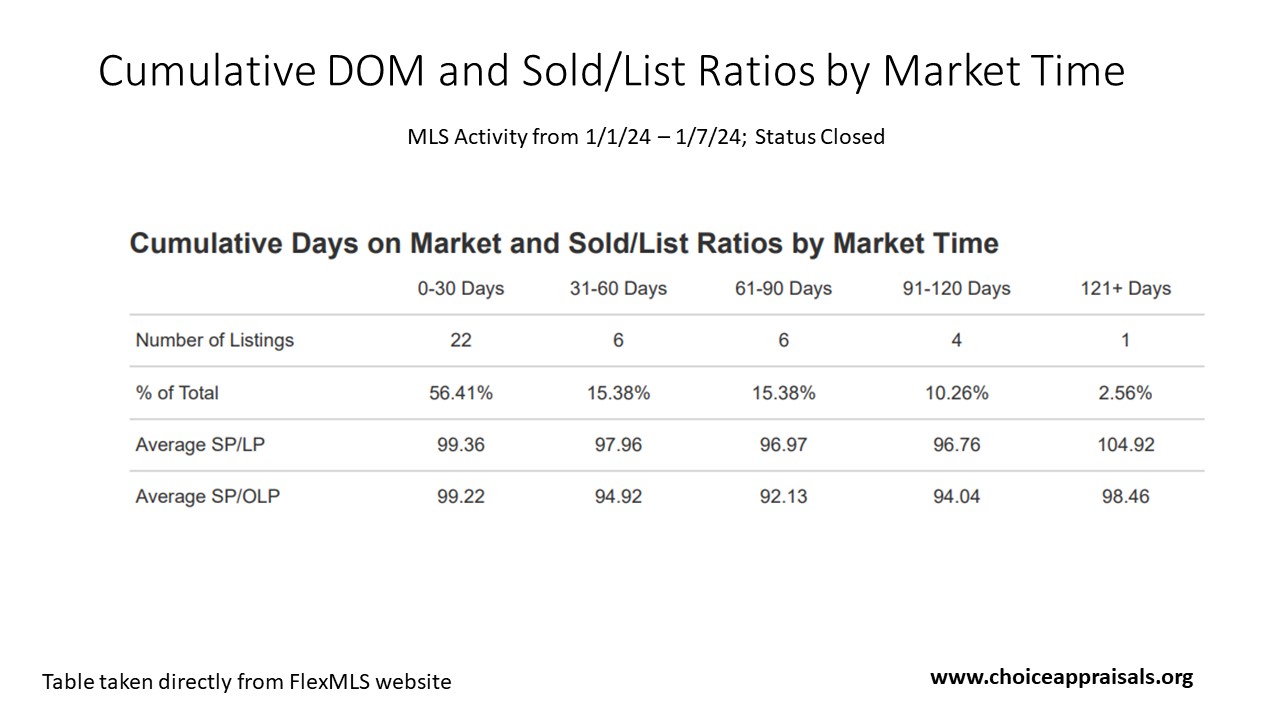

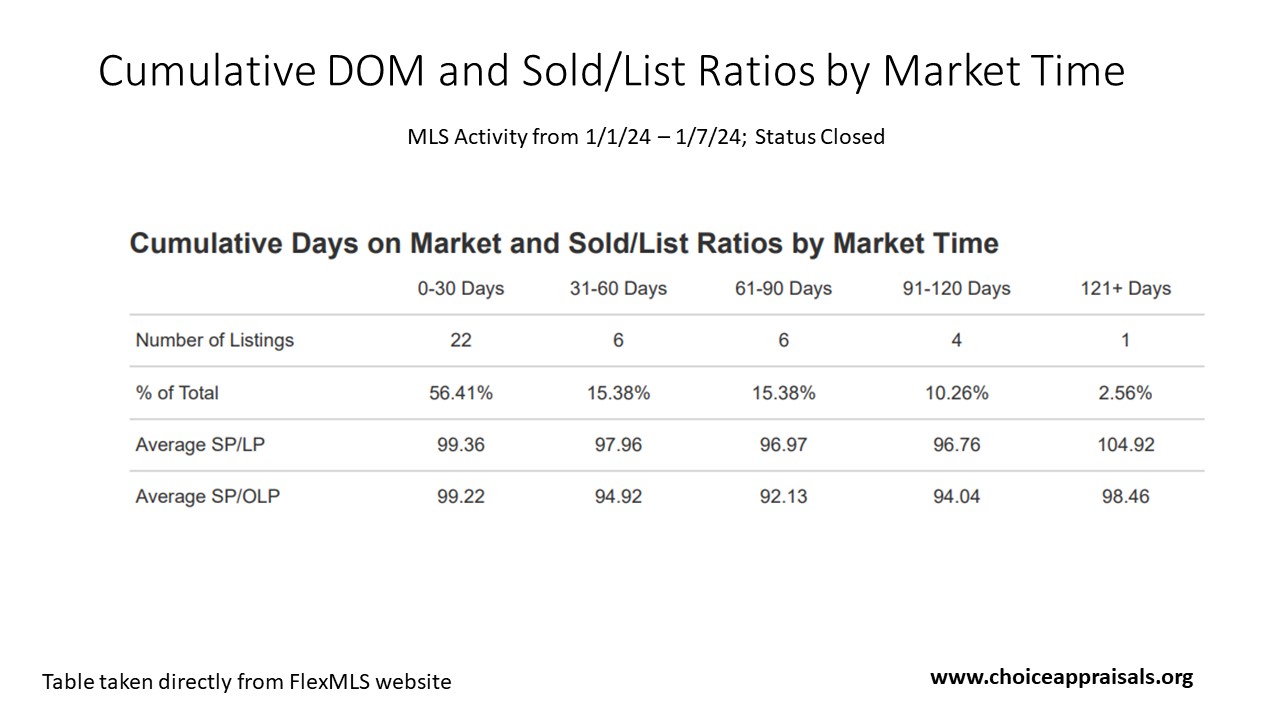

While this data strengthens our understanding of the Louisville market timings, a deeper layer awaits our attention – the interplay between the final Sale Price and the Original List Price (SP/OLP). This ratio sheds light about the art of pricing accurately from the onset.

January Sales with a focus on Sold Price/List Price Ratios

The Average Sold Price to Original List Price (SP/OLP) ratio tells us how the final sale price compares to the initial asking price.

0-30 Days: Homes in Louisville, KY that sold within a month almost met their asking price, with an SP/OLP of 99.22%, indicating they were likely priced right from the start.

31-60 Days: The drop to an SP/OLP of 94.92% for homes sold in one to two months hints at negotiations, perhaps due to ambitious initial pricing.

61-90 Days: A further dip in SP/OLP to 92.13% for sales in two to three months suggests either significant price drops or shifts in market trends.

Armed with stats like these you can advise clients on pricing their homes to sell within a desired timeframe, considering market dynamics.

But what about homes that are still on the market? How long have they been sitting, and what does their waiting time tell us?

To answer that question, let’s pivot to a Cumulative DOM analysis for active listings. In doing so, we’ll uncover another layer of the market’s story.

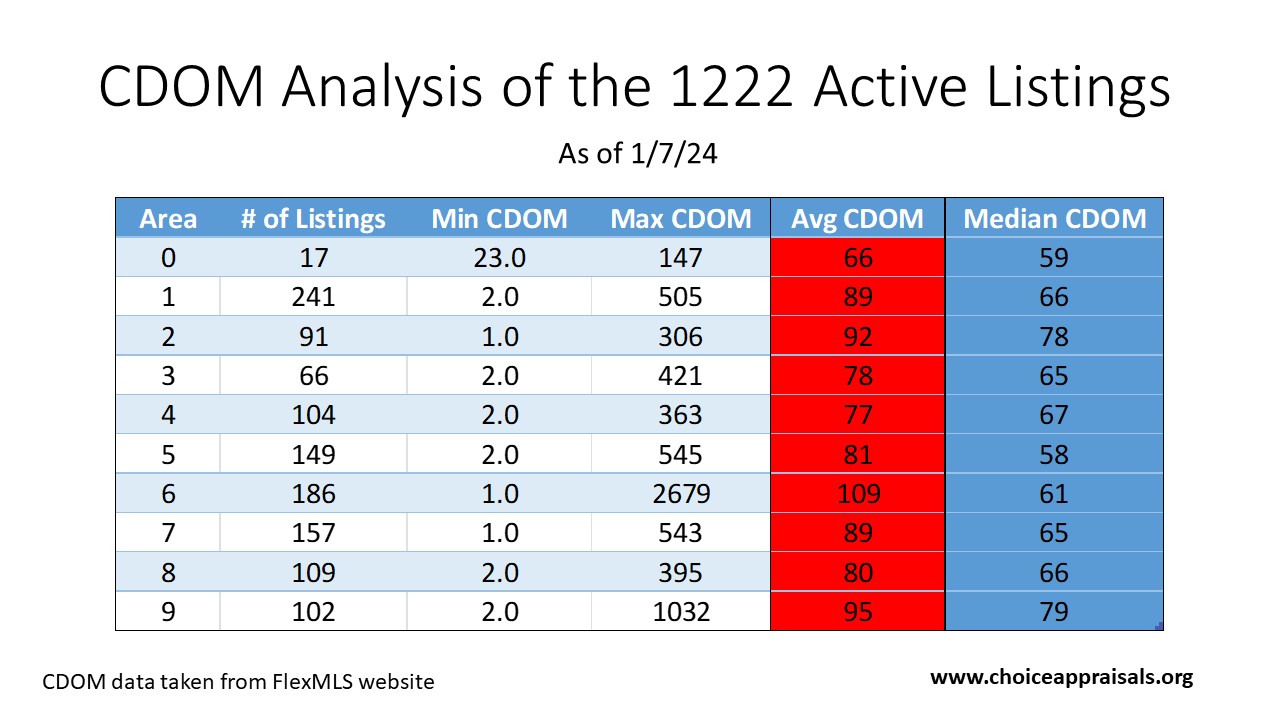

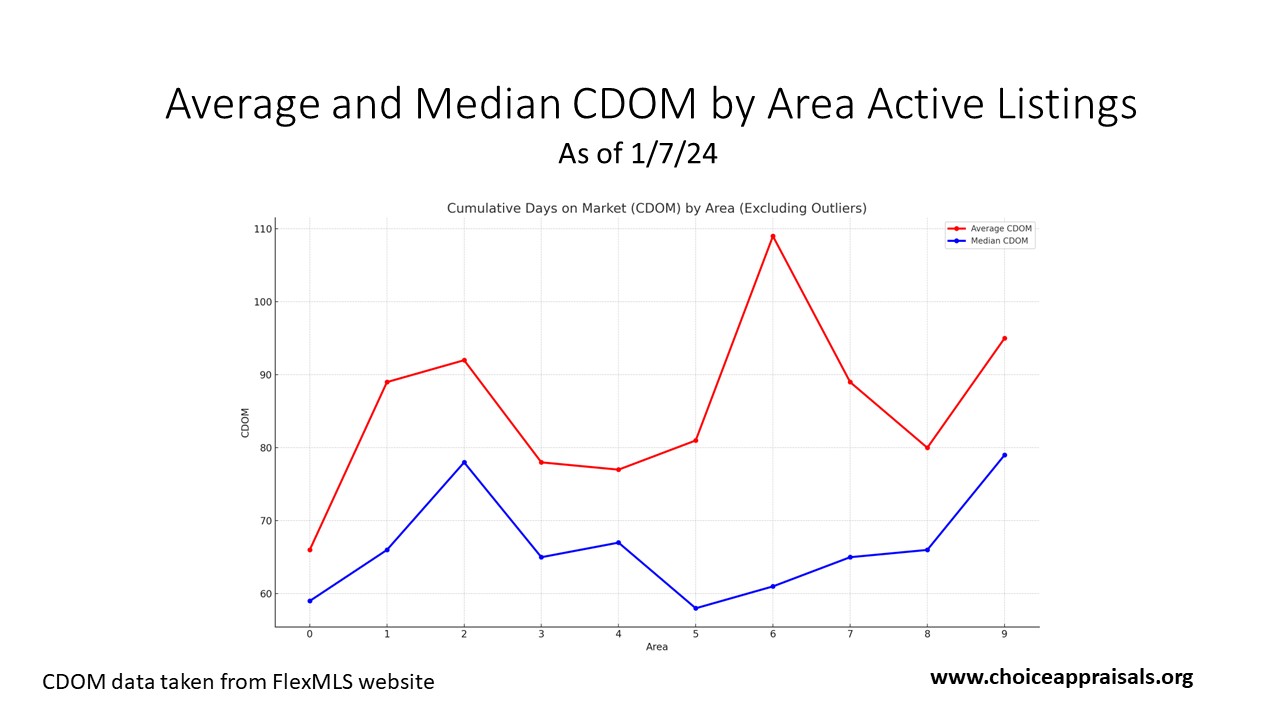

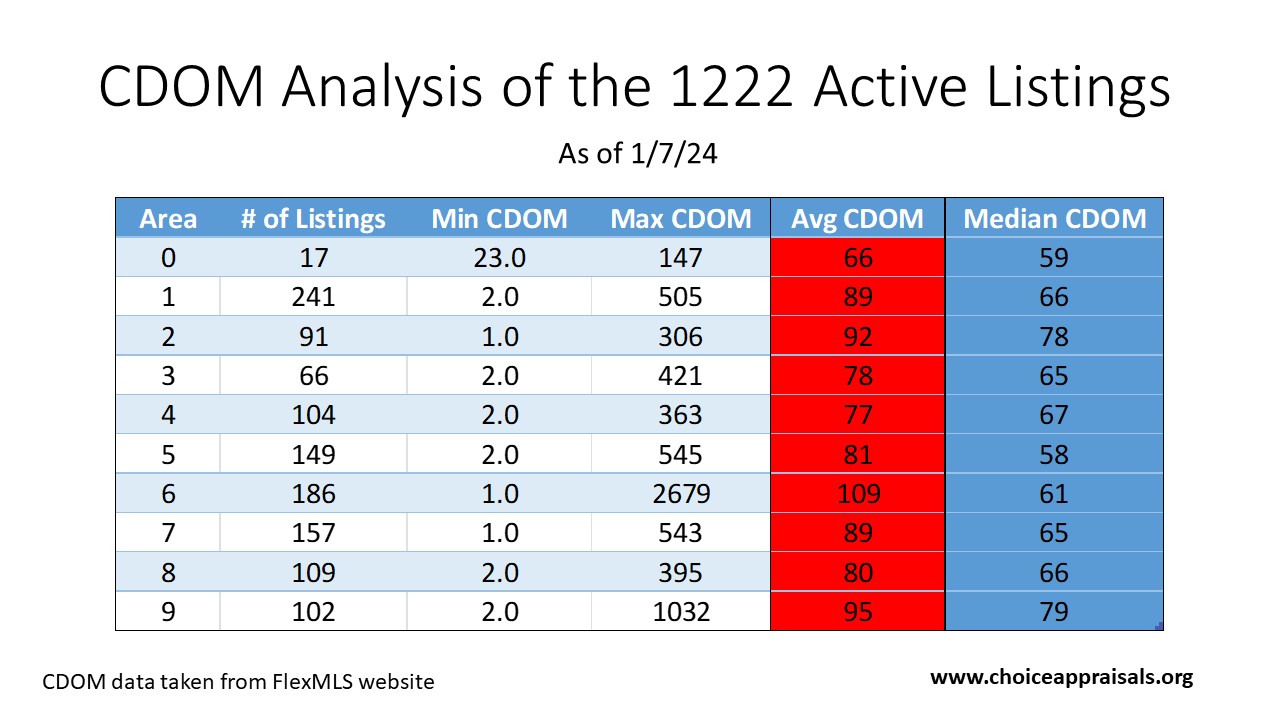

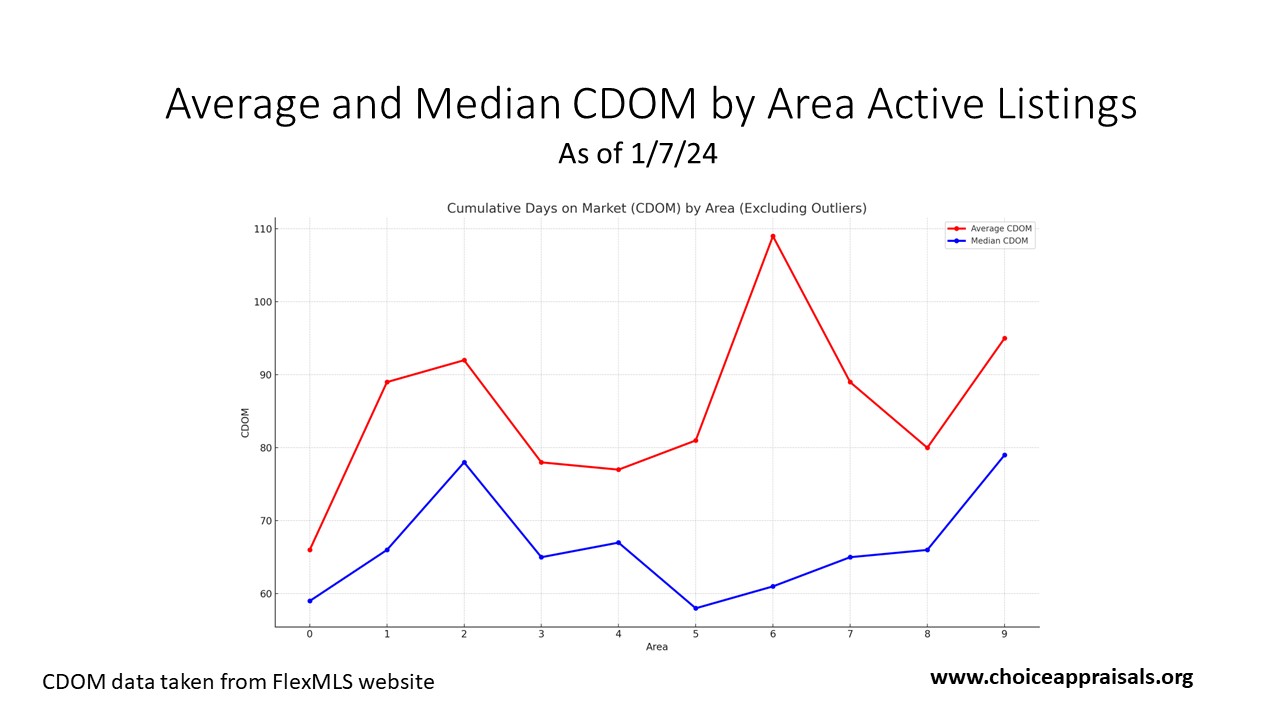

Average and Median Days on Market – for Homes that Have Not Sold

The canvas of our January market, with 1,222 active listings, is rich with detail when viewed through the lens of CDOM. The average CDOM across all MLS Areas is currently between 66 and 109 days.

The median CDOM, which ranges from 58 to 79 days across the areas, is a more balanced lens since the median is less affected by outliers. It indicates that over half of the homes have been listed for about two months or less. This is a more typical timeframe in a balanced market.

These insights are crucial for managing expectations on both ends—sellers can gauge how long it might take to sell their home, and buyers can spot opportunities for negotiating better prices on listings that have been on the market longer.

As we wrap up our review of January’s first week, remember that these statistics do more than just inform—they enable you to lead in the marketplace with authority and foresight.

But in order for that to happen you have to continue to pause after your exposure to data like this. Think about how it relates to a current or upcoming listing, and then take the appropriate response that indicates purposeful control – That’s being proactive!

Next week, we’ll delve into the second of Covey’s habits, ‘Begin with the End in Mind’, to further refine our strategic approach to real estate success.

Have a great week.

Conrad Meertins Jr.

by Conrad Meertins | Jan 1, 2024 | Valuation

In the world of home appraisals, the clash between emotional value and market reality often emerges, a theme vividly illustrated in a recent case I encountered.

About five months ago, a soft-spoken man sought my expertise for an unbiased appraisal of his father’s home. Caught in a $50,000 valuation disagreement with his brother, they turned to me to settle their differences.

This case unravels not just the complexities of property appraisal but also the emotional ties we associate with our homes. As we delve into this intriguing case study, we’ll explore how market data often challenges our expectations, teaching us valuable lessons in property valuation.

Background of the Property

Nestled in a neighborhood in Louisville, where property values are between $278,000 and $550,000, with a median sale price at $375,000, the subject property presented a unique appraisal challenge. This home, larger than most in its neighborhood at over 1800 square feet, had features both appealing and dated.

The basement, equipped with one kitchen, could be seen as a versatile addition, offering potential for rental income or extended family living. A second part of the property, transformed into a modern accessory unit, added a contemporary touch.

However, the main level told a different story. Despite being well-maintained, it was a time capsule of the 1970s, with its disco-era wallpaper and outdated fixtures. This blend of the old and the new, where the majority of the living space still echoed the past, demanded careful consideration in its valuation.

Appraisal Process and Challenges

As an appraiser, my process involved a meticulous valuation of the property’s attributes: its prime location, the large living area, and the modern updates on the second level.

However, the challenges were evident. The dated condition of the main level, representing 70% of the living space, significantly impacted the overall valuation.

Despite the modern renovations and unique features like an additional kitchen, the property’s true market value couldn’t solely hinge on its updates. It required a holistic view, considering both its strengths and weaknesses.

This comprehensive analysis led to a valuation of $325,000, a figure grounded in market realities yet distant from the clients’ expectations.

Client Reaction and Market Reality

When the appraisal valued the home at $325,000, the clients were in disbelief, struggling to reconcile this figure with their higher expectations of $400,000 to $500,000. Their emotional attachment to the home clouded their acceptance of the market-based valuation, particularly the impact of its outdated main living area.

Despite a detailed explanation during a follow-up meeting, their conviction in the home’s higher worth remained unshaken. Boldly, they listed the property for $405,000, but the market’s response was unequivocal.

After languishing for 100 days without interest, they had to reduce the price by over $30,000. But, there was still no interest. This stark contrast between expectation and reality highlighted a crucial lesson: emotional value doesn’t always align with market value.

Conclusion

In conclusion, the case of the “High Hopes Appraisal” serves as a powerful reminder of the complex interplay between emotional value and market reality in property valuation.

It underscores that while sentimental attachment can significantly inflate a homeowner’s valuation expectations, the true worth of a property is ultimately determined by the open market, influenced by current trends and objective data.

This case study highlights the importance of approaching property appraisals with an open mind, valuing the expertise of professionals, and understanding that market data often tells a story different from our personal narratives. It’s a testament to the fact that in real estate, numbers and market dynamics hold the final say, not our emotional connections to the property.

If you’re navigating the intricate process of property valuation and seeking an unbiased, market-informed perspective, reach out for professional appraisal services.

Let’s ensure your property decisions are grounded in reality and informed by expert insights. Remember, in the real estate market, it’s the hard data that ultimately shapes our success.

– Conrad Meertins, Jr.