by Conrad Meertins | Dec 9, 2024 | Uncategorized

Whether you’re selling your home or refinancing your mortgage, an appraisal is a critical step in the process. Appraisers evaluate your property to determine its market value. However, certain issues, or “appraisal red flags,” can lower your home’s value. Let’s explore these red flags and how you can avoid them.

Introduction

Picture this: You’re ready to make a big move. You’ve got a buyer lined up for your home or you’re all set to refinance your mortgage. But there’s one crucial step left – the home appraisal. Enter the appraiser, the person who gets to decide the market value of your home. This individual walks through your property, eyes sharp, jotting down notes, assessing every nook and cranny.

Now, let’s talk about something called “appraisal red flags.” Think of these as the little gremlins that could potentially lower your home’s value in the eyes of the appraiser. It could be something as significant as a crack in the foundation or as subtle as outdated electrical systems.

This article will guide you through these red flags, helping you understand what they are and why it’s so important to be aware of them. Because, let’s face it, no one wants a lower appraisal than expected, right? So, let’s dive in and demystify these appraisal red flags.

Understanding Appraisal Red Flags

You’ve done everything you can think of to get your home ready to sell. Fresh paint on the walls, new fixtures in the bathroom, even a few strategic landscaping improvements to enhance curb appeal.

But when the appraiser arrives, they point out several issues that you hadn’t even considered. Suddenly, your home’s market value takes a hit. This is the power of “appraisal red flags.”

So, what exactly are these red flags? In the simplest terms, appraisal red flags are issues or conditions that can negatively impact the value of your home in the eyes of an appraiser. These can range from obvious physical problems, like a cracked foundation or outdated systems, to more subtle issues, like unpermitted renovations or even factors outside your home, like the gas station next door..

Now, you might be wondering: why should I care about these red flags? Well, in the world of real estate, knowledge is power. Being aware of potential appraisal red flags can help you anticipate issues before they become a problem, allowing you to address them proactively. Whether you’re a homeowner preparing for an appraisal or a buyer trying to understand the value of a potential investment, understanding these red flags can be a game-changer.

Think of it this way: each red flag is a conversation between you and the appraiser. They’re saying, “Hey, this could be a problem,” and you have the opportunity to respond, either by fixing the issue or by adjusting your expectations about your home’s value. So, let’s dive into these conversations and learn how to navigate them effectively.

Top 5 Appraisal Red Flags

Let’s dive into the nitty-gritty, shall we? Here are the top five red flags appraisers are on the lookout for when they swing by your property.

First up, Structural Issues. Think of your home as a human body, the structure is the skeleton that holds everything together. If there are cracks in the foundation or the roof looks like it’s seen better days, it’s like a broken bone or a bad back. It’s a serious problem. These types of issues can significantly knock down your home’s value because they’re costly to repair and can lead to other problems down the line. The key here is that if its observable to the appraiser that it’s something that he will likely notate in his or her report.

Next, we have Outdated Systems. If your home’s electrical, plumbing, or HVAC systems are older than the cast of Friends, you’ve got a problem. Appraisers know that outdated systems can be a ticking time bomb of expensive repairs. Plus, they’re not as efficient or safe as their modern counterparts. The appraiser is not a home inspector, but its easy to see corrosion on pipes, exposed electrical wires or leaking water heaters.

Thirdly, Poor Maintenance. You know that peeling paint you’ve been meaning to address or that leaky roof you’ve been ignoring? Yeah, appraisers notice that too. Signs of neglect like these are red flags because they suggest there might be other, potentially more serious issues lurking beneath the surface.

The fourth red flag is Unpermitted Additions. That DIY sunroom might seem like a selling point to you, but if it was done without the proper permits, it could be a liability. Unpermitted additions can lead to serious legal and safety issues, and appraisers may mention them in his report.

Finally, Neighborhood Factors. You might have the nicest house on the block, but if your block happens to be right next to a noisy highway, it’s going to hurt your appraisal. Appraisers take into account the market’s reaction to such influences when determining a home’s value.

In essence, appraisers are like home detectives, looking for clues that tell the true story of a property’s value. These five red flags are key indicators they use in their investigation. So, if you’re preparing for an appraisal, it’s wise to address these issues head-on. Don’t try to hide them or hope they’ll go unnoticed. Trust me, they won’t.

Tips to Avoid Appraisal Red Flags

So, you’ve got a good handle on what appraisers are on the lookout for – those pesky red flags that could potentially lower your home’s value. But what can you do about it? How can you make sure your home passes the appraisal with flying colors? Don’t worry, I’ve got your back. Let’s roll up our sleeves and dive into some practical tips that can help you sidestep these common appraisal pitfalls.

Firstly, take a good, hard look at your home. And I mean really look. Put yourself in the shoes of an appraiser. Are there any glaring issues that jump out at you? Cracked walls? Peeling paint? Outdated electrical systems? These are all things you’ll want to address before the appraiser’s visit.

Next, get your hands on a home inspection checklist. This can be a real lifesaver. It’ll guide you through each part of your home, helping you identify and fix potential red flags. And trust me, it’s a lot easier to fix these issues before the appraiser points them out.

Now, let’s talk about those unpermitted additions. You know, that fancy new deck you built last summer? If you didn’t get the proper permits for it, it could be a real thorn in your side during the appraisal. So, make sure you’ve got all your paperwork in order. If you’re missing any permits, now’s the time to get them.

Finally, remember that factors outside your home can also impact your appraisal. You might not be able to control the noise from the nearby highway, but you can make your home more appealing in other ways. A well-maintained garden, a new coat of paint, or even some attractive outdoor lighting can all help to boost your home’s curb appeal.

As Tom Horn, a seasoned appraiser from the Birmingham Appraisal Blog, wisely points out, “The best defense is a good offense.” By taking a proactive approach and addressing potential red flags before the appraisal, you’ll be in a much stronger position. So, don’t wait for the appraiser to knock on your door. Get ahead of the game and make sure your home is in tip-top shape.

Conclusion

So, there you have it, folks. We’ve taken a journey down the less-traveled road of home appraisal, shedding light on the elusive ‘red flags’ that can potentially play spoilsport in your home’s valuation game. Structural issues, outdated systems, poor maintenance, unpermitted additions, and neighborhood factors – they all play a pivotal role in determining the value of your home in the eyes of an appraiser.

Now, you might be thinking, “This all sounds pretty daunting, doesn’t it?” But here’s the kicker – it doesn’t have to be. As a homeowner, you hold the power to ensure a successful appraisal. It’s all about staying proactive, keeping your home in good shape, and addressing potential issues before they escalate into full-blown red flags. Remember, a well-maintained home is not just a pleasure to live in; it’s also a goldmine when it comes to appraisal.

So, go ahead. Take a good look around your home. Is there a crack in the foundation you’ve been ignoring? An outdated electrical system that’s due for an upgrade? Or maybe an unpermitted addition that needs to be legitimized? Tackle these issues head-on, and you’ll be well on your way to acing that appraisal.

In the end, it’s not just about getting a good appraisal. It’s about maintaining your home to the best of your ability, and ensuring it reflects the true value it holds. Because, let’s face it, your home is more than just a property – it’s a reflection of you. And you, my friend, are priceless.

by Conrad Meertins | Dec 2, 2024 | Uncategorized

Getting your property appraised can be a daunting task, especially if you’re unsure about how to prepare for it. But fear not! This guide is here to help you get your home ready for the most accurate valuation possible.

Introduction

So, you’re about to dive into the world of home appraisals. It might feel like uncharted territory, like setting foot on the moon without an astronaut’s guide. But here’s the thing: you’re not alone in this journey. I’m here to navigate you through the twists and turns, the ups and downs, and the ins and outs of home appraisals. But first, let’s get our bearings.

A home appraisal, in its simplest form, is a professional evaluation of your property’s worth. It’s like a health check-up, but for your house. And just like your health, it’s crucial to get an accurate diagnosis. An incorrect appraisal could mean selling your home for less than it’s worth or, conversely, pricing it so high that it languishes on the market.

Now, I know what you’re thinking: “Great, another thing to stress about!” But hold your horses, because this guide is here to ease your worries and help you prepare for an accurate home appraisal. Think of it as your personal playbook, filled with insider tips, practical steps, and sage advice. So, strap in, and let’s get started on this journey to a successful home appraisal.

Understanding the Home Appraisal Process

Imagine you’re a detective. Your mission? To discover the true value of a property. That’s what the home appraisal process is all about. It’s an investigation of sorts, an exploration into the value of your property. Sounds thrilling, right? Let’s dive in.

First off, it’s important to understand that a home appraisal isn’t a one-size-fits-all process. It’s a personalized investigation, tailored to your property. It’s about assessing the unique features and characteristics of your home, from the age and condition of the property to its location and size.

Think about it. Would a vintage, Victorian-style home in a historic district be valued the same as a modern, minimalist apartment in the city center? Probably not. And that’s where the appraisal process comes in. It’s about understanding what makes your property unique and how these factors contribute to its value.

So, how does it work? Well, it starts with a professional appraiser visiting your property. They’ll inspect the home, taking note of its condition, size, design, and any unique features. They’ll also consider the property’s location and how it compares to similar properties in the neighborhood.

But it doesn’t stop there. The appraiser will also take into account market trends and recent sales data of comparable homes in your area. It’s a thorough process, combining both the physical attributes of your home and the larger real estate market context.

So, what’s the takeaway here? A home appraisal is a holistic process, one that considers a wide range of factors to determine the true value of your property. It’s not just about what your home looks like, but also where it’s located, how it compares to similar properties, and how it fits into the broader real estate market.

In the end, understanding the home appraisal process is like having a roadmap. It helps you navigate the journey, giving you a clearer idea of what to expect and how to prepare. So, ready to embark on this appraisal adventure? Let’s move on to some top tips to help you prepare.

Top Home Appraisal Tips

Picture this: you’re about to invite a professional appraiser into your home, and you’re hoping for the highest valuation possible. What can you do to tip the scales in your favor? Here are some insider tips to help you prepare for a home appraisal that reflects the true value of your property.

- Understand the Market: The value of your home is largely determined by the current real estate market conditions in your area. So, do your homework. Look at the recent sales prices of similar homes in your neighborhood. Having a sense of the market can help you set realistic expectations for your own home’s value.

- Highlight the Positives: Every home has its unique features. Maybe it’s a recently renovated kitchen, a large backyard, or a convenient location. Make sure these highlights are not overlooked. Point them out to the appraiser and explain why they add value to your home.

- Don’t Forget About the Small Improvements: While major renovations certainly increase a home’s value, don’t underestimate the power of small improvements. A fresh coat of paint, new hardware on cabinets, or updated lighting fixtures can make a big difference in the overall appeal of your home.

- Keep Up with Regular Maintenance: A well-maintained home is a valuable home. Regular maintenance tasks like cleaning gutters, servicing HVAC systems, and repairing leaky faucets show that you take good care of your property. This can positively influence an appraiser’s assessment of your home’s condition.

- Be Present During the Appraisal: It’s important to be home during the appraisal. You can answer any questions the appraiser might have and provide additional information about your home’s features and improvements. Plus, it gives you a chance to showcase your home in the best light.

Remember, an appraisal isn’t just about tallying up square footage and counting bathrooms. It’s about assessing the overall quality, condition, and appeal of a home. By understanding the process and taking these steps, you can help ensure your home is appraised at its true worth.

Practical Steps to Prepare for Home Appraisal

Before we dive into the meat of this section, let’s take a moment to imagine a scenario. Picture this: You’re about to host a dinner party for some very important guests. You’d naturally want your home to look its best, right? You’d clean, declutter, and maybe even do some minor repairs. Preparing for a home appraisal isn’t much different.

First things first, clean and declutter. Just like your dinner guests, appraisers are people too. And let’s be honest, no one likes to navigate through a maze of mess. A clean, organized home can make a positive impression.

Next, repair and maintain. Remember that leaky faucet you’ve been meaning to fix? Now’s the time. Appraisers look for signs of neglect or damage that could affect the home’s value. Addressing these issues beforehand can save you from potential valuation dings. It’s not just about major repairs either. As mentioned earlier, regular maintenance like servicing your HVAC system or cleaning your gutters can also make a difference.

Finally, document improvements. Have you renovated the kitchen or installed a new roof? Keep a record of these improvements. Appraisers aren’t just looking at your home’s current condition, they’re also interested in its history. Providing documentation of renovations and upgrades can help justify a higher valuation.

These practical steps aren’t just about impressing the appraiser. They’re about presenting your home in the best light possible. It’s about showing respect for your property and its value. So, don’t think of it as a chore. Consider it an opportunity to showcase your home’s true potential.

Common Mistakes to Avoid During Home Appraisal

When it comes to the home appraisal process, even the most well-intentioned homeowners can unwittingly sabotage their own efforts. Here are some common missteps you’ll want to sidestep for a smooth and successful appraisal:

- Ignoring Minor Repairs: I know I might sound like a broken record here, but small issues like leaky faucets, cracked windows, or chipped paint may seem inconsequential, if multiplied by 10, can suggest to an appraiser that the home hasn’t been well-maintained. Make these repairs before the appraiser visits to ensure your home is seen in the best light.

- Overestimating the Value of Renovations: Not all home improvements are created equal. While you may value your custom-made wine cellar, an appraiser might not see it as a significant value-add. Be realistic about the financial return of your renovations.

- Failing to Document Improvements: If you’ve made significant upgrades to your home, like a new roof or HVAC system, make sure you have the documentation to prove it. Without this, the appraiser might overlook these improvements.

- Being Absent During the Appraisal: While you don’t need to hover, being present allows you to answer any questions the appraiser might have. Plus, it gives you a chance to highlight the features you love about your home.

Avoiding these common mistakes can go a long way towards ensuring your home is appraised accurately. Remember, preparation is key. By understanding the appraisal process and taking the time to properly prepare, you’ll be setting your home – and yourself – up for success.

Utilizing Resources for a Successful Home Appraisal

So, you’ve done the hard yards. You’ve decluttered, fixed the wonky step, and even spruced up the garden. But, are you really ready for that home appraisal? There’s one more step that can help you ensure you’re not leaving any stone unturned – utilizing resources.

Imagine you’re about to bake a cake for the first time. You have all the ingredients, but do you just toss them into a bowl and hope for the best? Probably not. You’d likely follow a recipe, right? Think of resources like your recipe for a successful home appraisal.

One such resource is a home appraisal preparation checklist. Comprehensive checklists can guide you through the preparation process. They help you track your progress, ensure you’re covering all bases, and give you a sense of confidence that you’re on the right path. If you’d like to grab mine, visit the link below. I know what appraisers look for and what homeowners often overlook. By using these resources, you’re essentially getting insider tips on how to make your home shine in the eyes of an appraiser.

And it’s not just about getting a higher valuation. An accurate appraisal can save you from overpricing or underpricing your property, both of which can lead to financial losses or missed opportunities.

So, don’t just wing it. Use the resources available to you. They’re like your secret weapon for a successful, accurate home appraisal. After all, when it comes to something as important as your home’s value, wouldn’t you want to be as prepared as possible?

Conclusion

As I wrap up our guide, let’s revisit the key steps to ensure your property is well-prepared for an accurate home appraisal. It’s more than just a casual stroll through your property. It’s about presenting your home in its best light, making sure it’s clean, decluttered, and well-maintained. It’s about keeping a detailed record of all improvements and renovations.

Remember, it’s not about tricking the appraiser with superficial enhancements, but genuinely showcasing the value your property holds. Like a proud parent at a school open day, you want to highlight your home’s best features, but not hide its quirks. Every home has them, and they’re part of what makes your property unique.

Taking the time to prepare your property properly is not just about getting a higher appraisal value. It’s about understanding the true value of your home and being able to present it confidently. It’s about being an informed homeowner who knows their property inside out.

The benefits of an accurate property valuation extend beyond the appraisal day. It helps in setting a fair selling price, securing a mortgage, or even for insurance purposes. It’s a critical step in your homeownership journey, and we hope this guide has made the process a little less daunting.

Don’t forget to utilize resources like the home appraisal preparation checklist from our website. These tools are designed to guide you through the process and ensure nothing slips through the cracks.

In the end, the goal is to make the home appraisal process as smooth and successful as possible. And remember, preparation is the key to success. So take a deep breath, roll up your sleeves, and let’s get your property ready for its big day. You’ve got this!

by Conrad Meertins | Nov 11, 2024 | Valuation

Here is a shocking truth – When it comes to appraising a property, not all homes are created equal.

This article aims to shed light on the specific factors that differ when appraising a condo versus a single-family home, and why it’s crucial for real estate agents, buyers, and sellers to understand these nuances.

How the Type of Property Affects the Appraisal Process and Final Valuation

On the surface, the difference between a condo and a single-family home might seem like a matter of maintenance. However, from an appraisal standpoint, various factors affect the process and final valuation. Let’s delve into what goes into appraising each type of property.

What Goes Into Appraising a Single-Family Home?

The general process for a single-family home appraisal includes collecting property data, such as land, square footage, home condition, and improvements. Then comes the all-important market analysis and comparable sales analysis.

These factors help the appraiser to have a comprehensive view of the property’s worth, setting the stage for its market value.

What Goes Into Appraising a Condo?

In contrast, condo appraisals focus on different aspects. Here, property data collection includes common areas and amenities, Homeowners Association (HOA) fees, the percentage of owner-occupied units, and information about the subject project. Comparable sales within the same building or complex are always preferred if possible.

For instance, I once appraised a stand-alone condo that looked like a single-family home with land. However, the owner only owned the interior of the unit, not the land, making comps from typical single-family homes not suitable. Understanding these subtleties is vital for an accurate appraisal.

Key Differences Between Condo and Single-Family Home Appraisals

Ownership Elements: Single-family homes include land, while condos focus on common areas.

Comparative Sales: Condos require comps from other condo units (in the same building or complex whenever possible)

Appreciation Rate: Condos typically appreciate at a slower rate compared to single-family homes.

How Realtors Can Help

Real estate agents play a pivotal role in guiding their clients through the appraisal process. It’s not uncommon for people to look at the percentage increase in home values and assume their condo is appreciating at the same rate.

However, this is usually not the case. Moreover, choosing an appraiser experienced with the specific type of property is crucial for an accurate valuation.

The Importance of Expertise in Appraisals

Expertise comes into play when gathering information about a condo project. An unaware appraiser may state that certain info is unavailable, but an expert knows where to look.

For example, the county clerk’s office can provide a wealth of information about the condo project, from the legal description to the number of units in the project. Mastery of this small learning curve can make a significant difference in the appraisal process.

In summary, understanding the nuances between condo and single-family home appraisals can make all the difference in a successful real estate transaction. Choose your appraiser wisely and arm yourself with the right information for a seamless appraisal experience.

Contact us today for a free consultation and learn how our appraisal services can help you achieve your real estate goals.

by Conrad Meertins | Jan 21, 2024 | Valuation

Are you striving to master the art of perfecting listing prices in today’s dynamic real estate market?

Understanding the home appraisal process in Louisville, KY is a crucial step in this journey. Imagine being the realtor or homeowner who always knows the property’s true worth, navigating the valuation landscape with ease.

It’s not just about the numbers; it’s about interpreting them in the context of a constantly evolving market.

This blog delves into the subtleties of real estate valuation, examining the critical aspects that influence it, from an appraiser’s local market knowledge to the unique features of properties, and adapting to rapid market changes.

By aligning these insights with Stephen Covey’s “First Things First” principle, my goal is to help you to navigate these complexities effectively, ensuring more informed decision-making and successful client outcomes.

Common Valuation Challenges

A critical aspect often encountered in real estate transactions in Louisville, and in most areas, is the difference between the appraised value and market value of properties.

This difference, even as appraisers strive to provide the current market value, can largely be attributed to the appraiser’s expertise and understanding of the local market.

Appraiser’s Expertise and Local Market Knowledge

Appraisers strive to estimate a property’s value based on a set of standardized criteria, including the analysis of comparable sales, property condition, and market trends.

However, the depth of an appraiser’s local market knowledge can significantly influence the accuracy of the appraisal. A home appraiser with extensive experience and familiarity with a specific area of Louisville is more likely to provide a valuation that closely reflects the current market conditions.

They can better understand and interpret nuances like local demand trends, and even subtle influences like school districts or future development plans.

In contrast, an appraiser who may not be as deeply versed in the specifics of a locale might miss these subtleties. This gap in local insight can lead to variances between the appraised value and the market value as perceived by buyers and sellers in that specific market.

Navigating the Valuation Landscape

For realtors, understanding this aspect is crucial. Recognizing the importance of an appraiser’s local expertise can help in setting realistic expectations for both buyers and sellers.

It also underscores the value of engaging appraisers who are well acquainted with the property’s area, ensuring a more accurate reflection of the current market value.

Encourage your sellers to ask questions that will indicate that the appraiser knows the area. What if his answers sound fishy? Request another appraiser from the bank.

In line with Stephen Covey’s “First Things First” principle, prioritizing this understanding can greatly aid in navigating the valuation landscape, allowing for more informed decision-making and effective client guidance in real estate transactions.

Recognizing and Communicating Unique Property Features

In the context of home appraisals, understanding how unique property features are evaluated is another crucial part of the valuation puzzle. This knowledge is especially significant when bridging the gap between an appraiser’s valuation and a buyer’s perception of value.

How Appraisers View Unique Property Features

Appraisers approach property evaluation methodically, assessing a spectrum of features from basic structural elements to unique attributes.

These unique features might include custom interior designs, recent renovations, or exceptional architectural styles. Each of these is scrutinized for its impact on the property’s overall value.

However, the value that appraisers assign to these features might not always align with a potential buyer’s perceived value.

A feature that significantly enhances the aesthetic or functional appeal of a property, like a professionally landscaped garden, may be highly attractive to certain buyers.

Yet, in terms of appraised value, this feature might not lead to a proportional increase. This discrepancy arises because while appraisers acknowledge these features, their assessment is grounded in quantifiable impact more than subjective appeal.

The Realtor’s Role in Highlighting Unique Features

For realtors, this underscores the importance of effectively recognizing and communicating these features during transactions. Understanding the appraiser’s perspective on unique property features allows realtors to better manage client expectations regarding valuation.

Moreover, it empowers realtors to highlight these features in ways that resonate with potential buyers, showcasing the added value these unique aspects bring to the property.

By aligning appraisal insights with strategic communication, realtors can navigate the valuation landscape more effectively, ensuring a smoother transaction process and potentially enhancing property appeal in the competitive real estate market.

Adapting to Market Changes and Informing Appraisers

Understanding the appraisal of unique property features is just one facet; equally important is adapting to and proactively addressing rapid market changes. These fluctuations can significantly influence property valuations, and understanding how to communicate these shifts to appraisers is critical.

The Impact of Rapid Market Changes on Valuations

The real estate market in Louisville, KY and across the country is inherently dynamic, often influenced by factors like economic shifts, interest rates, and local developments.

These changes can swiftly alter property values, sometimes quicker than can be reflected in an appraisal based on historical data. For instance, a sudden surge in demand in a particular area might significantly increase property values, a change that recent sales data may not fully capture.

Proactive Communication with Appraisers

In these scenarios, the role of a realtor extends beyond just understanding market dynamics. It involves actively communicating these shifts to appraisers early in the valuation process.

While appraisers are experts in their field, they might not always be immediately aware of very recent market changes. By providing appraisers with the latest market insights, realtors can ensure that these factors are considered in the home appraisal analysis.

This proactive approach aligns with Stephen Covey’s “First Things First” strategy. Prioritizing the sharing of up-to-date market information with appraisers helps ensure that the valuation accurately reflects current market conditions.

This not only aids in creating more accurate appraisals but also helps in setting realistic expectations for both buyers and sellers.

Staying Informed and Adaptable

For realtors, staying informed about the latest market trends and developments is imperative. This means regularly reviewing market reports, engaging with local real estate networks, and maintaining a pulse on any sudden changes.

By being well-informed and adaptable, realtors can effectively guide their clients through the complexities of real estate transactions in a rapidly changing market.

Mastering the Art of Real Estate Valuation

The journey through the landscape of real estate valuation is both challenging and rewarding.

Understanding the depth of an appraiser’s local market knowledge, recognizing the impact of unique property features, and staying agile in the face of market dynamics are not just tasks – they are essential skills for today’s realtors.

By proactively communicating with appraisers, aligning with the latest market trends, and effectively highlighting the unique aspects of properties, realtors can significantly enhance their service to clients.

This approach, rooted in the wisdom of “First Things First,” is not just about adapting strategies; it’s about foreseeing opportunities and navigating the real estate market with confidence and expertise.

As we embrace these principles, we not only succeed in individual transactions but also contribute to the broader narrative of real estate professionalism and homeowner satisfaction.

by Conrad Meertins | Jan 15, 2024 | Market Trends

Imagine uncovering a secret blueprint that could transform your approach to real estate. This blueprint merges Stephen Covey’s timeless wisdom from “Seven Habits of Highly Effective People” with the dynamic realm of real estate transactions. The focus here is on the second habit, “Begin with the End in Mind,” a principle I believe is key to navigating the ever-evolving real estate market.

In the following sections, we’ll explore recent Louisville, KY real estate trends and uncover often-overlooked insights.

As we do, we can apply the ‘Begin With the End in Mind’ approach to our 2024 Real Estate Strategy. This isn’t just about goal setting—it’s about using market analytics to guide our decisions in real estate.

Let’s dive into how this forward-thinking principle can sharpen our competitive edge.

Q1 Insights: Setting the Stage for Annual Market Trends

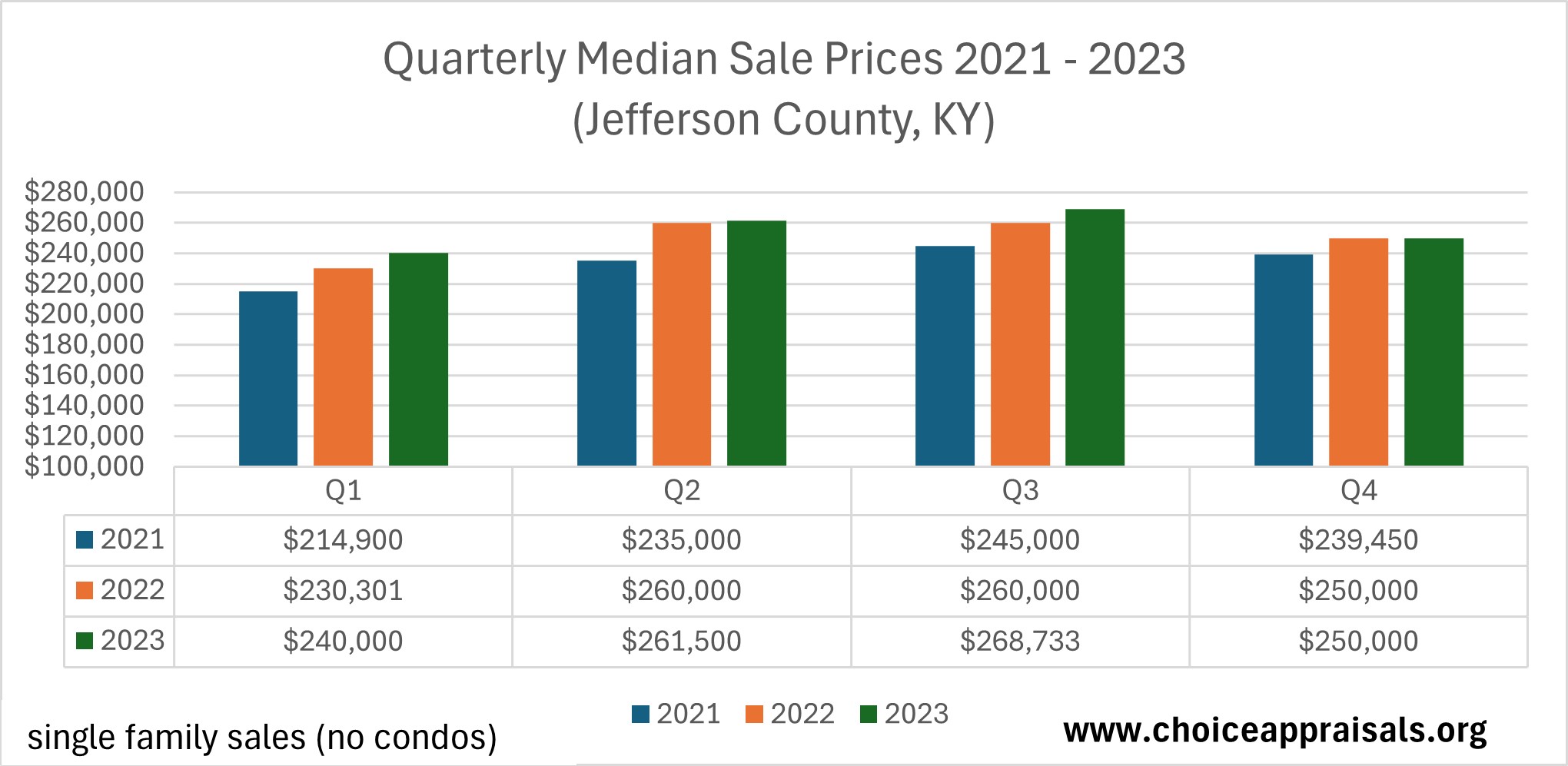

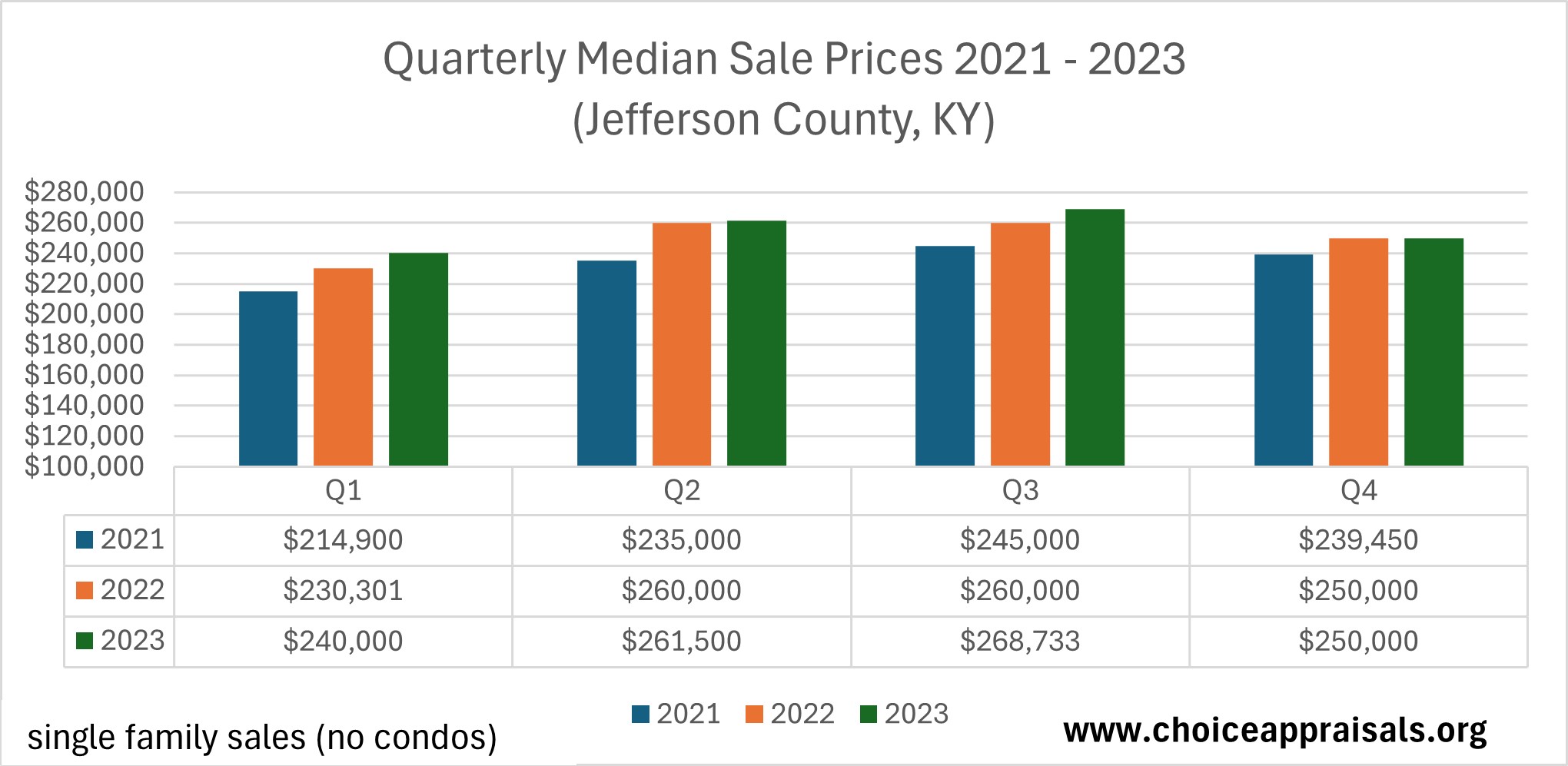

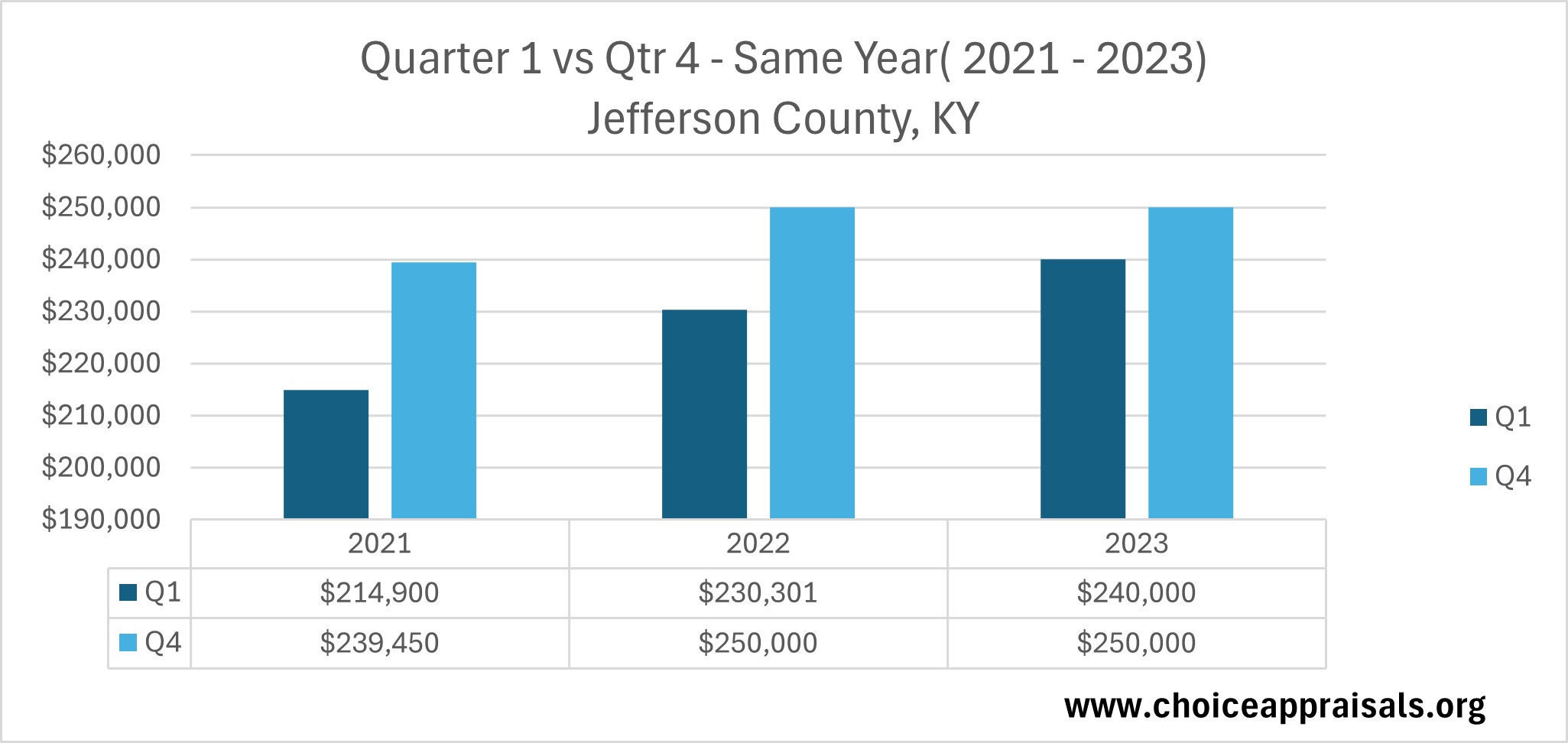

Let’s examine the market trends reflected in the quarterly median sale prices from 2021 to 2023 in Louisville, KY. Despite a reduction in the number of homes sold, which isn’t shown on this graph, there’s a clear upward trend in the prices that buyers have been willing to pay.

Starting each year with a glance at Q1, we can observe that 2023 opened with home prices that were higher than at the beginning of 2022, which also had surpassed 2021’s figures. This consistent rise in initial prices year over year is a positive indicator of growing market strength.

However, looking at the year’s end, we notice a slight deviation from this trend. While the closing prices of 2022 improved upon 2021, the same cannot be said for the transition from 2022 to 2023.

Although the prices didn’t climb higher at the end of 2023, they didn’t fall either, maintaining the gains from earlier in the year. This stability, rather than a decline, suggests that the market is holding its value well, which is reassuring for both current and prospective homeowners.

The Closing Quarter: Reflecting on Market Resilience

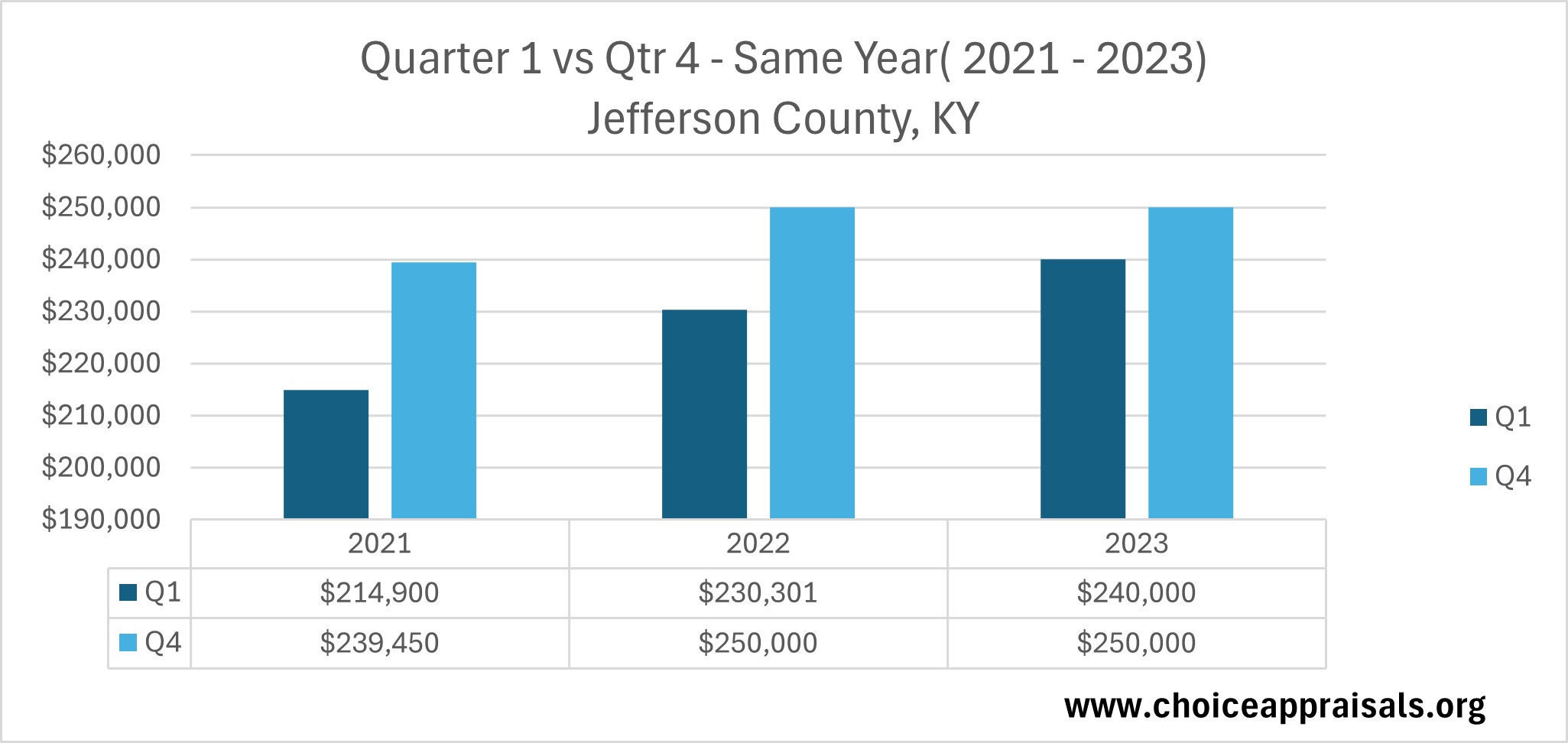

Consistency is key in the real estate market, and the trends in Jefferson County, KY, reaffirm this saying. If we take a closer look at how property prices have behaved at the start and end of each year from 2021 to 2023, we find an encouraging pattern.

Despite the expected seasonal dip towards the end of the year, the big picture is one of growth. Specifically, the comparison between Q1 and Q4 within the same year shows us that regardless of the short-term fluctuations, the overall value of homes has been on an upward trajectory.

For instance, in Louisville, KY as a whole, the opening quarter’s median sale prices have consistently been lower than those at the year’s close. This tells us that homeowners who hold onto their properties throughout the year could see a natural increase in their homes’ market value.

It’s a reassuring sign for long-term investors and a helpful metric for potential sellers planning the right time to enter the market. This trend highlights the resilience of the local real estate market.

It also demonstrates that even with the anticipated year-end slowdown, property values in Louisville, have maintained a positive momentum.

New Year’s Market Outlook: Beyond the Initial Dip

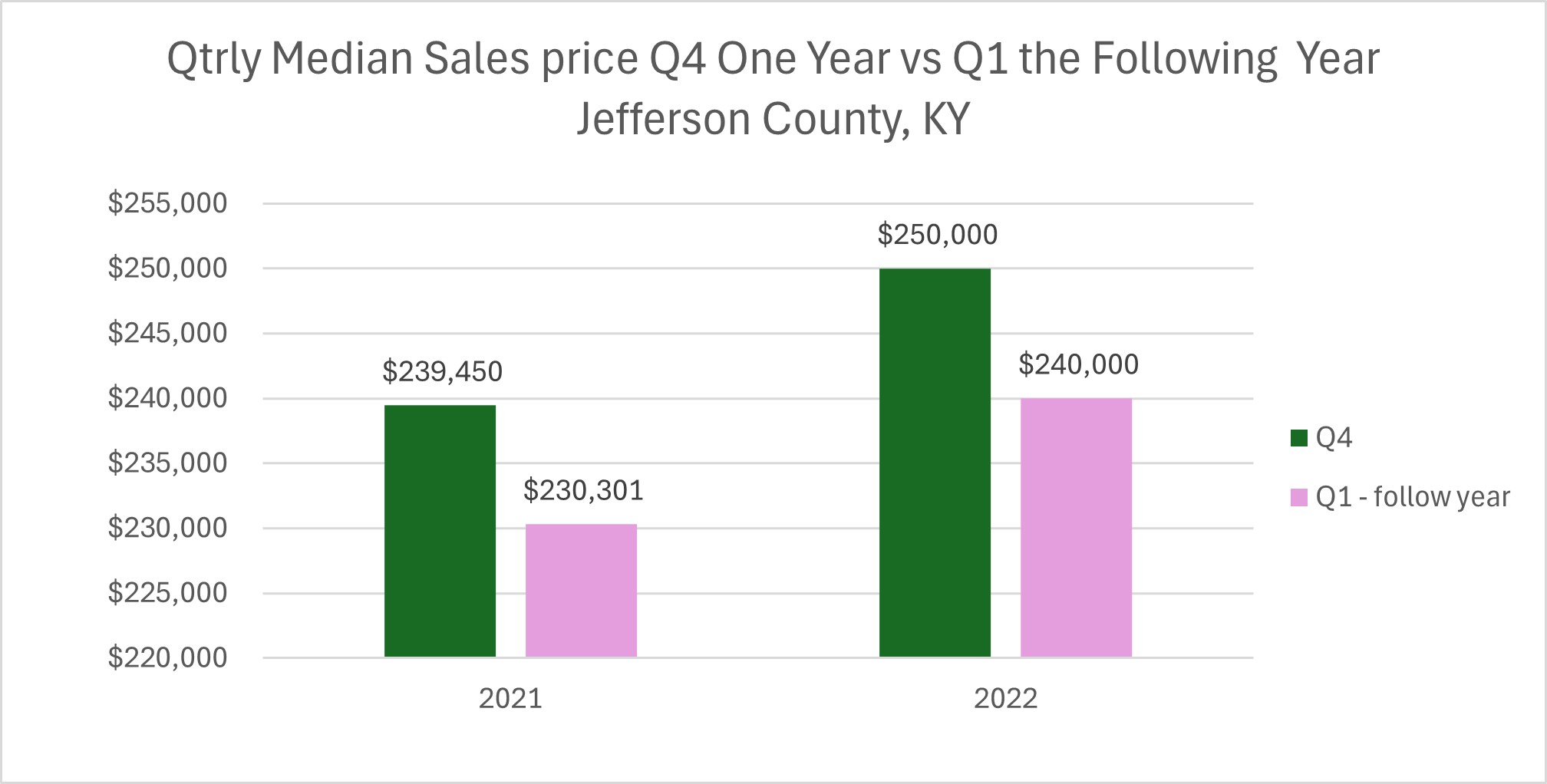

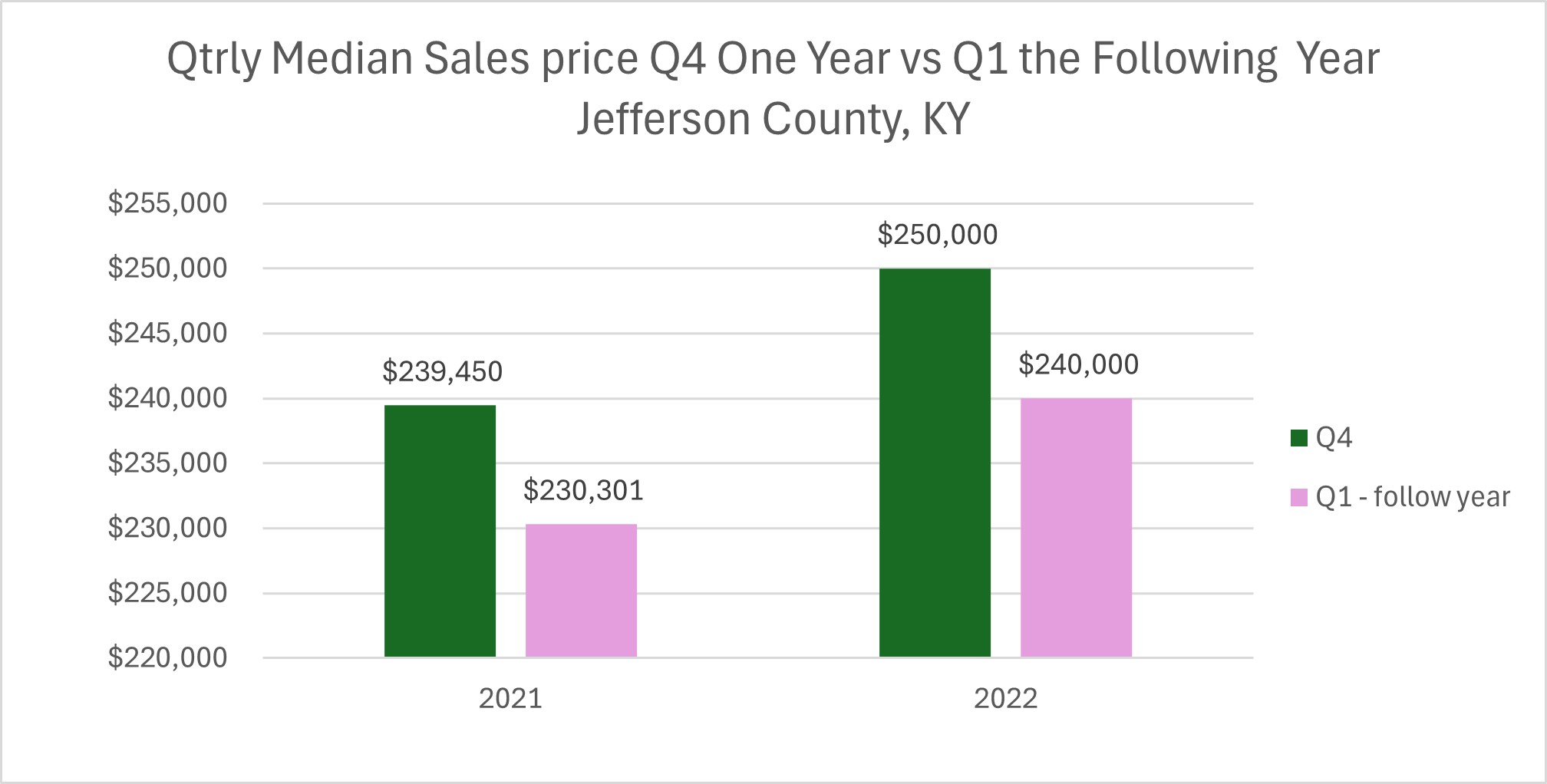

As we turn the calendar page each year, we see a recurring theme in the housing market. The beginning of the year often starts with a modest reset in home prices from their previous year-end highs.

This dip, however, is just a small chapter in an overall success story, as the trend line since 2021 is pointing upwards. This pattern means that while home values might momentarily soften as the New Year chimes in, they generally pick up steam as the months roll by, pushing the market value higher as the year progresses.

This trend is crucial for both buyers and sellers to keep in mind. If you’re considering selling your home and you’ve recently seen a property similar to yours sell at a peak price, it’s important to temper expectations.

A home appraisal report may well contain a valuation adjustment in line with the current market phase, particularly if there’s been a recent cooling. It’s a reminder to always be attuned to the rhythm of the market and to set your strategies accordingly.

Why Pay Attention to These Trends?

In the spirit of Stephen Covey’s second habit, “Begin with the End in Mind,” we turned our focus to the critical importance of market trends in the real estate landscape.

It’s not just a matter of peering through the data; it’s about understanding the narrative behind the numbers. This is where the essence of strategic foresight in real estate comes to life.

Paying close attention to the highs and lows of the market allows us to navigate with precision and purpose, ensuring that each step taken is a deliberate stride towards our ultimate objectives.

Maximizing Returns:

Just as a captain charts a course by the stars, real estate market trends serve as our celestial guides, helping us navigate towards maximum profitability.

Just as a captain charts a course by the stars, real estate market trends serve as our celestial guides, helping us navigate towards maximum profitability.

Recognizing the right time to list or purchase can make all the difference in the financial outcome of a real estate transaction. In Louisville, KY, for example, the upward trend in home prices, even amidst seasonal fluctuations, indicates a potential for sellers to maximize returns by timing the market judiciously.

Identifying Growth Opportunities:

By observing the shifts and preferences in the housing market, we identify not just current demands but forecast emerging trends that signal growth opportunities.

Understanding Market Shifts:

The real estate market is as dynamic as the seasons, changing in response to a multitude of economic and societal factors.

The real estate market is as dynamic as the seasons, changing in response to a multitude of economic and societal factors.

Having a keen eye on these changes allows us to predict and prepare for the natural cycles of the market. It’s about reading the signs and knowing when to act. This understanding empowers us to make informed decisions that resonate with confidence and clarity, much like the principles Covey advocates.

Conclusion

In conclusion, the philosophy of ‘Begin with the End in Mind’ encourages us to thoughtfully consider how our current actions will shape our future outcomes. It’s not merely about staying informed but about being strategically equipped to make decisions that align with our ultimate aspirations.

Whether we’re buying, selling, providing guidance, or appraising, the insights we glean from a diligent analysis of market trends are priceless. They lay down a framework for informed action, grounded in deep understanding, which empowers us to navigate the real estate landscape with both foresight and the flexibility to adapt to ever-changing conditions.

By Conrad Meertins Jr